Florida Sales and Use Tax R. 06/21

If you file your return or pay tax late, a late penalty of 10% of the amount of tax owed, but not less than $50, may be charged. The $50 minimum penalty applies even if no tax is due. Penalty will also be charged if your return is incomplete. A floating rate of interest applies to underpayments and late payments of tax.

Tags:

Your, Seal, Florida, Return, Florida sales and use tax, Your return

Information

Domain:

Source:

Link to this page:

Please notify us if you found a problem with this document:

Documents from same domain

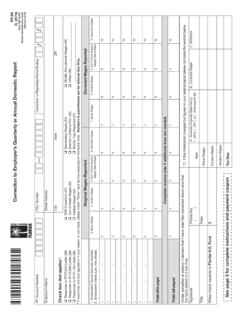

Correction to Employer’s Quarterly or Annual …

floridarevenue.comUnder penalties of perjury, I declare that I have read this corrected return and that the facts stated in it are true. 11. If this information changes the figures on your original report please complete the section below.

Information, Annual, Quarterly, Employers, Correction, Correction to employer s quarterly or annual

Florida Annual Resale Certificate for Sales Tax

floridarevenue.comFlorida Department of Revenue, Florida Annual Resale Certificate for Sales Tax, Page 1 . Florida Annual Resale Certificate for Sales Tax. GT-800060

Annual, Seal, Certificate, Florida, Resale, Florida annual resale certificate for sales

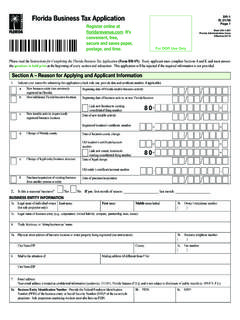

Florida Business Tax Application DR-1

floridarevenue.comFlorida Business Tax Application Please read the Instructions for Completing the Florida Business Tax Application (Form DR-1N).Every applicant must complete Sections A and K and must answer

Business, Applications, Florida, Florida business tax application

DR-1N Florida Business Tax Application (Form DR-1)

floridarevenue.comInstructions for Completing the Florida Business Tax Application, Page 2 of 10 Tax and Taxable Activity Descriptions DR-1N R. 01/18 You must complete and submit Form DR-1 to register to collect, accrue, report, and pay the taxes, surcharges, and fees listed

Business, Form, Applications, Florida, Florida business tax application

F-1065 Florida Partnership Information Return R. …

floridarevenue.comGeneral Instructions Who Must File Florida Form F-1065? Every Florida partnership having any partner subject to the Florida Corporate Income Tax Code must file Florida

Information, Florida, Partnership, Return, 1056, 1065 florida partnership information return r

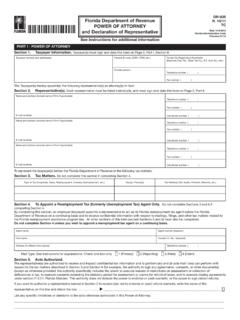

DR-5 R. 01-17 TC - Florida Dept. of Revenue - …

floridarevenue.comApplication for a Consumer's Certificate of Exemption Instructions DR-5 R. 01/17 TC Rule 12A-1.097 Florida Administrative Code Effective 01/17

Sales and Use Tax on Building Contractors

floridarevenue.comFlorida Department of Revenue, Sales and Use Tax on Building Contractors, Page 3 . How is Tax Calculated? Lump sum, cost plus or fixed fee, guaranteed price, or time and materials contracts –

Building, Florida, Contractor, Use tax on building contractors

Florida Department of Revenue R. 10/11 POWER …

floridarevenue.comPART I - POWER OF ATTORNEY Florida Department of Revenue POWER OF ATTORNEY and Declaration of Representative Section 1. Taxpayer Information. Taxpayer(s) must sign and date this form on Page 2, Part I, Section 8.

DR-46NT Nontaxable Medical Items and General …

floridarevenue.comNontaxable Medical Items and General Grocery List DR-46NT R. 01/18 Rule 12A-1.097 Florida Administrative Code Effective 01/18 Chemical Compounds and Test Kits

General, Medical, Time, Nontaxable, 46nt nontaxable medical items and general, 46nt, Nontaxable medical items and general

Registration Package for Motor Fuel and/or …

floridarevenue.comRegistration Package for Motor Fuel and/or Pollutants GT-400401 R. 01/18 GT-400401 is the item number assigned to the form package posted on our website for registration as a dealer for Florida fuel or pollutants tax with the Department.

Registration, Motor, Packages, Fuel, Registration package for motor fuel

Related documents

Form G-49, Annual General Excise/Use Tax Return ...

files.hawaii.govTransient Accommodations Rentals 15. I 16. V I Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg ... ANNUAL RETURN & RECONCILIATION (mm/dd/yy) ATTACH CHECK OR MONEY ORDER HERE G49_I 2017A 01. G49 ... Write the ling period and your Hawaii Tax I.D. No. on your check or money order. Mail to: HAWAII DEPARTMENT OF …

Your, Annual, Return, Transient, Accommodation, Hawaii, Tax return, Annual return, Transient accommodations, Your hawaii tax

Sales and Use Tax on Rental of Living or Sleeping ...

floridarevenue.comIndividual Florida counties may impose a local option tax on transient rental accommodations, such as the tourist development tax, convention development tax, tourist impact tax, or municipal resort tax. ... If you file your return or pay tax late, a late penalty of 10% of the amount of tax owed, but not less than $50, ... to complete your tax ...

Your, Complete, Return, Transient, Accommodation, Your return, Complete your tax

Form G-49, Annual General Excise/Use Tax Return ...

files.hawaii.gov1 Transient Accommodations Rentals 1 Interest and 1 Landed Value of Imports Form G-49 (Rev. 2019) 16 O 9 DO NO I IN I 16 (Rev. 2019) TAX YEAR ENDING HAWAII TAX I.D. NO. GE Last 4 digits of your FEIN or SSN NAME: _____ STATE OF HAWAII DEPARTMENT OF TAXATION N XI NN N ONIIION TTA O ON OD

Your, Annual, Return, Transient, Accommodation, Hawaii, Tax return, Transient accommodations, Hawaii tax

INSTRUCTIONS FOR SCDOR-111 (Rev. 10/23/20)

dor.sc.gov† Accommodations - The rental of transient accommodations is subject to a 2% Accommodations Tax in addition to the 5% Sales Tax, and any applicable Local Tax. - If you rent out rooms or spaces at hotels, campgrounds, boarding houses, mobile home parks, etc., you are required to obtain a retail license.

Transient, Accommodation, Transient accommodations, Accommodations tax

KANSAS BUSINESS TAX APPLICATION - Kansas Department …

ksrevenue.govwhich you are not charged a sales tax? Yes No. 6.Estimate your annual Kansas sales or compensating use tax liability: $400 and under (annual filer) $401 - $4,000 (quarterly filer) $4,001 - $40,000 (monthly filer) $40,001 and above (accelerated monthly filer) 7.If your business is seasonal, list the months you operate:

Business, Applications, Your, Annual, Business tax application, Your annual

DBPR HR-7027 DIVISION OF HOTELS AND RESTAURANTS ...

www.myfloridalicense.compublications/. Complete and submit the form with your application if your lodging establishment is three stories or higher. Please note there may be additional requirements from other governmental agencies such as sales tax, FEIN, social security or ITIN number, food license, alcoholic beverage license, etc. .

A GUIDE TO * ’,#’ - (- *() *,0

datcp.wi.gova municipal room tax may also apply, depending on the location of the lodging. For example, lodging furnished in Milwaukee County is subject to 5.6% sales tax (5% state, .5% county, and .1% stadium) plus a 2.5% basic room tax. If the sale occurs in the City of Milwaukee, an additional 7.0% room tax applies.