Transcription of IMPORTANT: the attached explanatory notes …

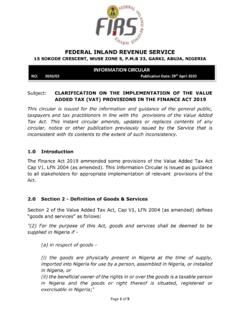

1 ORIGINAL. FORMS VAT 002. IMPORTANT: Please read the attached explanatory For Official Use Only notes before completing this return. If in doubt FEDERAL INLAND REVENUE SERVICE. contact your Tax Office. VALUE ADDED TAX RETURN. Taxpayer Identification number(Tin) 1 RETURN TO THE TAX OFFICE OF. FEDERAL INLAND REVENUE SERVICE. Name: Address: Return and Payment shall be made This return covers Start of Month Year End of Month Year Month within 21 days after the month of transaction THIS RETURN MUST BE COMPLETED AND SENT TO THE TAX OFFICE EVEN IF NO VATABLE SUPPLIES HAVE COOURRED. (Sales/income). Total supplies made for the period (including VAT) 2. Less: Exempted/Zero-rated VAT ON Supplies included in 2 3.

2 SUPPLIES above MADE Total Supplies subject to VAT 4. BY YOU. VAT charged by you 5. Add: VAT Adjustments 6. TOTAL OUT PUT TAX. 7. (Purchases/Expenses). VAT on Domestic Supplies/purchases for which invoicing requirement have been met. 8. Add: VAT Adjustment 9. DEDUCTION. OF VALUE. SUBTRACT. ADDED TAX. VAT on imports BOX 14. OF PURCHASES (Where applicable) 10 FROM. MADE BY BOX7. YOU Total VAT payable by you 11. Less: VAT on Purchases not wholly used in making vatable supplies 12. Less: VAT taken at source 13. TOTAL DEDUCTIONS (INPUT TAX) 14. Amount payable/refundable(delete as applicable). 15. NOTE: LATE PAYMENT SHALL BE PENALISED. DECLARATION: I declare that the particulars in this return are true and correct Full Name: Title/Position: Signature Date: For Official Use Only e-ticket checked by me Name of Tax Controller (TC).

3 Amount Paid: Bank Date of Payment: Signature of Tax Controller: VAT RETURN. explanatory notes . 1. Introduction. These explanatory notes are on how the attached VAT Return Form is to be completed and filled. The Form is to be completed in duplicate. The top copy is to be sent to the Relevant Tax Office together with the payment due, while the duplicate copy is retained for your record purpose. The return together with the relevant payment is due not later than 21 day after the last day of the tax period. A tax period is one calender month. 2 Block 1. Pre-printed details Taxpayer Identification Number 1. ABJ 010256102. RETURN TO THE TAX OFFICE OF. FEDERAL INLAND REVENUE SERVICE.

4 Name: ABC Bank Limited Plot 123 FIRS Stret ZONE 6. Zone 2 WUSE, ABUJA. Address: Wuse - Abuja. Return and Payment shall be made This return covers Start of Month Year End of Month Year Month within 21 days after the month of transaction THIS RETURN MUST BE COMPLETED AND SENT TO THE TAX OFFICE EVEN IF NO VATABLE SUPPLIES HAVE COOURRED. This portion of the form contains: Taxpayer Identification Number: Every registered person is given an identification number. The number in box 1 is your own and you must always quote it in all future correspondence with the FIRS. Name of the registered person: Contact Address: , the exact location where the registered person can be contacted.

5 Confirm this to be correct and notify any change in future. Tax period: This is usually one Calender Month Due date for furnishing the return and paying the tax due. This is within twenty one (21) days after the end of the tax period. The Address of the Relevant Tax Office of the FIRS where the return and payment are to be sent. 3. Block 2. Good and services Supplied. (Sale/Income). Total Supplies made for the 458, 2. period (including VAT). Less: Exempted/Zero-rated Supplies included in 2 16, 3. VAT ON. SUPPLIES above MADE Total Supplies subject to VAT 442, 4. BY YOU. VAT Receivable 21, 5. Add: Adjustments 6. TOTAL OUTPUT TAX. 21, 7. In this section enter in Box: 2 The total value of taxable supplies (goods) and Services) (including exempted, zero-rated supplied) made during the taxable period, including VAT.

6 Value of exempt items are not to be included. 3 Deduct the total Value of Exempted/ZEro-rated supplies included above Zero rated means that are not exempted from collection or payment of VAT on this class of sales, but also allowed to get refund or credit for any taxes paid on their inputs. Exemption means that you are not required to collect on the sales. You are however, not allowed credit for tax paid on the input for such sale 4 The total value of supplies subject to VAT is entered in this 5 The VAT charge at the standard rate of 5%. 6 The total tax adjustment for supplies of good and services made during the period. Use the tax adjustment box 6 to show the Vat on: Goods and services taken for private use.

7 Goods and services appropriated to non-taxable use other than private use: Barter transaction;. Fringe benefits provided to employees;. Bad dept recovered Insurance indemnity and payment received; and other relevant adjustment made 7 Total output tax, is enrered in this box. 4. Block 3. Deduction of VAT paid. (Purchases/Expenses). VAT on Domestic Supplies/purchases for which 12, 8. invoicing requirement have been met. Add: Adjustment 3, 9. DEDUCTION SUBSTRACT. OF VALUE BOX14. ADDED TAX VAT on Import 10 FROM. OF PURCHASES (Where applicable) BOX7. MADE BY 16, 11. YOU Total VAT payable by you Less: VAT on purchases not wholly used in 12. making vatable supplies Less: VAT Taken at Source 1, 13.

8 TOTAL DEDUCTIONS (INPUT TAX) 14, 14. In this section enter in the Box: 8 VAT on total value of domestic supplies received for the purpose of making taxable Supplies for which TAX INVOICES ARE HELD. You are to keep, for audit and inspection, records of: -What was purchased;. -When it was purchased;. -How much it cost; and -Tax invoices obtained 9 Add the total value of tax adjustment for supplies of goods and services received during thetaxable period These adjustment are in the nature of: -VAT on credit notes issued and debit notes received;. -Any other relevant adjustment;. -All adjustment will be verified during the Vat audit and inspection. 10 VAT on import. 11 Total VAT payable.

9 12 Less VAT on purchases not wholly used in making Vat able supplies, 13 Less VAT taken at source. This is the sum of the VAT paid on behalf of a contractor by ministry, parastatal and other agencies of government at the time when the contract price is paid, The contractor is expected to obtain and keep the FIRS receipts for verification as evidence of remittance of the sum to the Relevant Tax office before credit be obtained. 14 Total deductions (input tax). 5. Block 4. (1) Calculation and Payment of Tax Payable. Amount payable/refundable (delete as applicable) 7, 15. NOTE: LATE PAYMENT SHALL BE PENALISED. DECLARATION: I declare that the particulars in this return are true and correct Full Name: Title/Position: Signature Date: In this section, for box: Subtract the total VAT taken at source (box 14) from the total VAT payable (box13).

10 Where the 15 amount in box 14 is greater, than that in box 13, the balance is what the FIRS will refund to Where the amount in box 13 is greater than box 14, you are to attach to the return an e-ticket for the balance, evidencing payment to Federal Government of Nigeria - FIRS - VAT Account . In any of the Banks designated for the collection of Taxes. (ii) Declaration. You are to complete the form faithfully and correctly too. Thereafter, your name and position of authority as the person completing the form is to be inserted, Also you are to Date and sign the declaration portion. This declaration is to be completed by a responsible person: That is -For a Company, a Cooperate body Any Director, the or an incorporated Society: statutory officers or the Secretary.