Transcription of Local Tax Overview - sfpayroll.org

1 Local Tax Overview Pennsylvania i Revised 4/11/2012 Table of Contents Pennsylvania s Earned income Tax .. 1 Tax Rates .. 1 Tax Collection Districts (TCDs) .. 1 A Map of the Tax Collection Districts .. 2 Residency Certification Form .. 3 Withholding and Reporting .. 4 Political Subdivision (PSD) Codes .. 5 Pennsylvania Municipality Website .. 6 Philadelphia Rules .. 9 Pittsburgh Payroll Expense Tax .. 10 Local Services Tax (LST) .. 11 Census Bureau Website .. 13 Local Tax Quick Reference .. 15 APA Meeting, May 17, 2012 Pennsylvania Local Tax Overview 1 Pennsylvania s Earned income Tax The Earned income Taxes (EIT) in Pennsylvania are Local income taxes imposed by the employee s resident municipality.

2 In 2012, new legislation called Act 32 provides for a restructuring of the Earned income Tax Collection System for Pennsylvania Local governments and school districts. Legislation requires all taxing authorities that implement an Earned income Tax to comply with all applicable regulations for January 1, 2012. This new collection system will greatly reduce the number of tax collectors. Employers will be required to withhold from all employees working in a collection district and send the deposit and filing to that central collector who will then be responsible for forwarding the tax to the employees respective resident jurisdictions.

3 Tax Rates If the tax rate for the employee s resident municipality is different than the rate for their worked-in municipality, employers will be required to withhold the higher of the two rates. Tax Collection Districts (TCDs) Under Act 32, the current earned income tax collection process will be restructured to create county-wide Tax Collection Districts. These new districts will have boundaries that are congruent geographically with current county lines, unless there is a school district that overlaps county boundaries. If a school district crosses a county line, the school district and its component municipalities will be kept whole and be included in the county where the affected municipalities have the greatest population.

4 There will no longer be the possibility of different collectors for a school district and municipality (previously referred to as a split collector) and there will no longer be the possibility of a resident-only collector or courtesy withholding. Act 32 provides for one EIT tax office (collector) for each county, other than Philadelphia. It will result in a reduction of Local EIT collectors from 560 to 21. APA Meeting, May 17, 2012 Pennsylvania Local Tax Overview 2 A Map of the Tax Collection Districts The map above shows the 69 counties or Tax Collection Districts in Pennsylvania. Berks County, also known as the Berks Tax Collection District, has been highlighted.

5 Below is Berks County. Within this county are several townships and boroughs, also known as Political Subdivisions (PSD). Among them is Tilden Township, highlighted below. APA Meeting, May 17, 2012 Pennsylvania Local Tax Overview 3 Residency Certification Form Employers will be required to obtain a completed Residency Certification form from each of their employees. This form is provided by the Pennsylvania Department of Community and Economic Development. This form can be downloaded from: APA Meeting, May 17, 2012 Pennsylvania Local Tax Overview 4 Withholding and Reporting Once it s been determined where employees are working and living, the withholding and remitting is based upon the higher of those two rates.

6 The table below displays how withholding and remitting might look, along with the Political Subdivision (PSD) codes for three employees who work in Tilden Township While John, Mary, and Joe all work in Tilden Township, Mary and Joe live in different municipalities and Mary s resident rate is higher than Tilden Township s nonresident rate. Therefore, the employer would be required to withhold from Mary and remit it to the collector for Tilden Township. Employee Work PSD Work Rates Resident PSD Resident Rates Withholding Rate Remitted to: John Tilden Twp 060905 Res NonRes Tilden Twp 060905 Tilden Twp (Berks) Mary Tilden Twp 060905 Res NonRes East Union Twp 400513 Tilden Twp (Berks) Joe Tilden Twp 060905 Res NonRes Bern Twp 061401 Tilden Twp (Berks) APA Meeting, May 17, 2012 Pennsylvania Local Tax Overview 5 Political Subdivision (PSD) Codes These six-digit numeric codes have been formulated to designate each of the 69 tax collection districts, along with the school districts and municipalities therein.

7 Act 32 requires that employers and tax officers utilize PSD codes prescribed by the Department of Community and Economic Development (DCED). PSD Codes have been designed to identify the municipalities and school districts for each tax collection district and aid in ensuring that employee Earned income Tax withholdings are remitted and distributed to the proper taxing authority. The first two digits of these six-digit codes represent the tax collection district, the next two digits represent the school district and the last two digits represent the political subdivision. For example, the PSD code for the example we ll be looking at in the Pennsylvania website for Tilden Township is 060905.

8 06 09 05 Berks County Hamburg Tilden Township When quarterly filings are remitted to the worked-in tax collector, employee wage detail will be included which should provide the PSD code of the work location and the PSD code for each employee s home location. A list of these codes is available on and that link is: These can also be found on the Pennsylvania Municipal Statistics Website APA Meeting, May 17, 2012 Pennsylvania Local Tax Overview 6 Pennsylvania Municipality Website To determine which political subdivision a business is located in and to verify the employee s resident and nonresident withholding rates, the Pennsylvania Website can be very helpful.

9 This site can be accessed at: From the home page of this website, click the link near the top left which states Find Your Withholding Rates by Address. APA Meeting, May 17, 2012 Pennsylvania Local Tax Overview 7 From the screen below, type the employee s home address in the top section and their work location address in the bottom section. Click View Report. APA Meeting, May 17, 2012 Pennsylvania Local Tax Overview 8 The window below will open, displaying the employee s resident earned income tax rate, their work location nonresident rate, and the PSD codes for each. Also displayed at the bottom are the collectors for the Earned income Tax and the Local Services Tax.

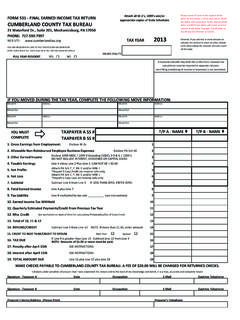

10 In this example, the employee lives in Bern Township and has a resident earned income tax rate of They work in Tilden Township which has a nonresident earned income tax rate of The employer in this situation would be required to withhold from this employee and remit it to the tax collector for Tilden Township, which in this case is Berks Earned income Tax Bureau. The Local Services Tax will be reviewed later in this guide. APA Meeting, May 17, 2012 Pennsylvania Local Tax Overview 9 Philadelphia Rules The city of Philadelphia imposes a tax on all those working in the city. Employers are required to withhold the full rate for residents and a reduced rate for nonresidents.