Internal Revenue Service memorandum - IRS tax forms

debt is secured and the adjusted purchase price of the qualified residence at the end of the taxable year, reduced by the average balance of each debt that was previously secured by the qualified residence. If the average balance of the debt does not exceed the limitation for that debt, all the interest on that debt is qualified residence interest.

Download Internal Revenue Service memorandum - IRS tax forms

Information

Domain:

Source:

Link to this page:

Please notify us if you found a problem with this document:

Documents from same domain

2017 ANNUAL REPORT - Internal Revenue Service

www.irs.govI am excited to share the FY 2017 IRS Criminal Investigation Annual Report. The report gives us an opportunity to reflect on the many successes we have had as

Services, Annual, Report, Annual report, Internal revenue service, Internal, Revenue

Form Tip Income and Allocated Tips - irs.gov

www.irs.govForm 8027 Department of the Treasury Internal Revenue Service Employer’s Annual Information Return of Tip Income and Allocated Tips See the separate instructions.

SCHEDULE M Transactions Between Foreign …

www.irs.govSCHEDULE M (Form 8858) (Rev. December 2012) Department of the Treasury Internal Revenue Service . Transactions Between Foreign Disregarded Entity of a

Services, Internal revenue service, Internal, Revenue, Schedule m, Schedule, Schedule m transactions between foreign, Transactions, Between, Foreign, Transactions between foreign disregarded entity, Disregarded, Entity

2017 Instructions for Schedule M-3 (Form 1120)

www.irs.govPage 2 of 28 Fileid: … 1120SCHM-3/2017/A/XML/Cycle05/source 9:58 - 17-Oct-2017 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before prin

for Education Page 1 of 87 10:40 - 31-Jan-2018 Tax …

www.irs.govPage 3 of 87 Fileid: … tions/P970/2017/A/XML/Cycle03/source 10:40 - 31-Jan-2018 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before print

SS-4 Application for Employer Identification Number

www.irs.govForm SS-4 (Rev. December 2017) Department of the Treasury Internal Revenue Service . Application for Employer Identification Number (For use by employers, corporations, partnerships, trusts, estates, churches,

Services, Applications, Internal revenue service, Internal, Revenue, Identification, Employers, Application for employer identification number, Number

1041-T Allocation of Estimated Tax Payments to …

www.irs.govForm 1041-T Department of the Treasury Internal Revenue Service Allocation of Estimated Tax Payments to Beneficiaries (Under Code section 643(g))

Services, Internal, Revenue, Payments, Allocation of estimated tax payments to, Allocation, Estimated, Internal revenue service allocation of estimated tax payments to beneficiaries, Beneficiaries

2017 Form 4868

www.irs.govForm 4868 (2017) (Rev. 11-2017) Page 3 Specific Instructions How To Complete Form 4868 Part I—Identification Enter your name(s) and address. If you plan to file a joint return,

THIS BOOKLET DOES NOT CONTAIN …

www.irs.govPage 3 of 107 Fileid: … ions/I1040/2017/A/XML/Cycle16/source 16:24 - 22-Feb-2018 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printi

UNITED STATES-THE PEOPLE'S REPUBLIC OF …

www.irs.govmessage from the president of the united states transmitting the agreement between the government of the united states of america and the government of the people's republic of china for the avoidance of double

Related documents

HOMEOWNER ASSISTANCE FUND GUIDANCE U.S.

home.treasury.govallocation of HAF funding for eligible entities. PURPOSE OF THE HAF . According to the ARP, the HAF was established to mitigate financial hardships associated with ... to the HAF participant’s disbursement of HAF funds for qualified expenses, in an aggregate amount not to exceed 15% of the funding from the HAF received by the HAF participant; and

Guidance, Allocation, Fund, Assistance, Qualified, Homeowner, Homeowner assistance fund guidance

This is an advance draft copy of a California tax form. It is …

www.ftb.ca.govMultiply the amounts on form FTB 3895 by the allocation percentages entered by policy. Add all allocated policy amounts and non-allocated policy amounts from forms FTB 3895, if any, to compute a combined total for each month. ... qualified health plan through the California health insurance marketplace (Marketplace). The term “Marketplace ...

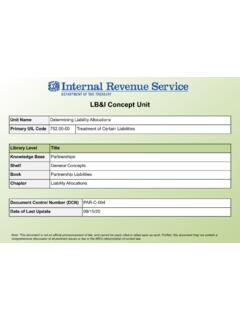

LB&I Concept Unit - IRS tax forms

www.irs.govPublication 541 and Treas. Reg 1.752- 2 discuss the allocation rules for recourse liabilities. A partnership liability is a recourse liability to the extent that any partner or a related person has an economic risk of loss for that liability. A partner's share of a recourse liability equals his economic risk of loss for that liability.

RISK MANAGEMENT & CORPORATE GOVERNANCE - OECD

www.oecd.org6 in ensuring that there are effective ^detective _ controls (in other words, controls that help to identify shortcomings and failures) and overall monitoring of corporate activities.

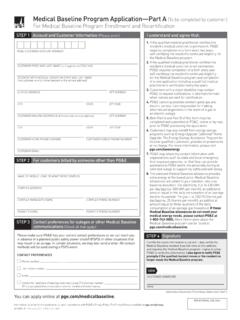

Medical Baseline Program Application

www.pge.combaseline allocation. For electricity, it is 16.438 kWh per day (approx. 500 kWh per month), an additional amount equal to the daily consumption of an average electric household. For gas, it is 0.82192 therms per day (approx. 25 therms per month), an additional amount equal to three-quarters of the daily consumption of an average gas household.

California Tax Credit Allocation Committee

www.treasurer.ca.govCalifornia Tax Credit Allocation Committee . California Tax Credit Allocation Committee (CTCAC) 915 Capitol Mall, Room 485 Sacramento, CA 95814 (916) 654-6340 Main Office ... Part 3.8 Qualified Allocation Plan 40 Part 3.9 Statutory Set Asides (State) 41 A. Qualified Nonprofit Organization 41 Part 3.10 Adopted State Regulations 41 ...

CALIFORNIA TAX CREDIT ALLOCATION COMMITTEE

www.treasurer.ca.gova project’s requested “qualified basis” to determine the amount of annual federal credits CTCAC will award the project. The amount of 9% federal credits is limited and calculated at $2.70 per person (returning to $2.35 per person in 2022), making California’s limit for 2018 $106.7 million in annual credits. Because