1041 Issues For Tax Return Preparers

Found 3 free book(s)Income – Schedules K-1 and Rental - IRS tax forms

apps.irs.govprofessional preparers. It is important to ensure that all income is accurately reported on the return. Ask taxpayers if they rented out their home during the tax year or if they received a Schedule K-1 (Form 1041, Form 1065, or Form 1120S) from an estate, trust, partnership, or S …

Instructions for Form SS-4 - IRS tax forms

www.irs.gov• Instructions for Form 1041 and Schedules A, B, D, G, I, J, Fax. Under the Fax-TIN program, you can receive your EIN and K-1, U.S. Income Tax Return for Estates and Trusts. by fax within 4 business days. Complete and fax Form SS-4 • Form 1042, …

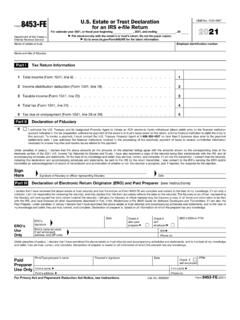

2021 Form 8453-FE - IRS tax forms

www.irs.govnecessary to answer inquiries and resolve issues related to the payment. Under penalties of perjury, I declare that the above amounts (or the amounts on the attached listing) agree with the amounts shown on the corresponding lines of the electronic portion of the 2021 U.S. Income Tax Return(s) for Estates and Trusts.