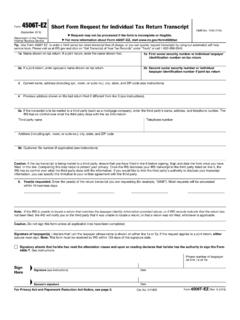

4506 T Ez

Found 8 free book(s)Form 4506-T-EZ (Rev. 11-2021) - IRS tax forms

www.irs.govreturn. Form 4506T-EZ cannot be used by taxpayers who file Form 1040 based on a tax year beginning in one calendar year and ending in the following year (fiscal tax year). Taxpayers using a fiscal tax year must file Form 4506-T, Request for Transcript of Tax Return, to request a return transcript. Use Form 4506-T to request tax return

Form 4506-T (Rev. 11-2021) - IRS tax forms

www.irs.govcorporation may submit a Form 4506-T but must provide documentation to support the requester's right to receive the information. Partnerships. Generally, Form 4506-T can be signed by any person who was a member of the partnership during any part of …

Amended and Prior Year Returns - IRS tax forms

apps.irs.govIRS2Go phone app or completing Form 4506T or Form 4506T-EZ, Request for Transcript of Tax Return. To get a copy of the original return, complete and mail Form 4506, Request for a Copy of Tax Return, to the appropriate IRS office listed on the form. There is a charge to receive a copy of the original return.

IRS Tax Return Transcript and IRS Record of Account ...

www.ccc.eduOnly one signature is required. Sign the IRS Form 4506-T exactly as your name appeared on the original tax return. If you changed your name after submitting your tax return, also sign your current name. • Mail or fax the completed IRS Form 4506-T to the appropriate address (or FAX number) provided on page 2 of IRS Form 4506-T.

IRS Tax Transcript Online Request

www.mcckc.eduPaper Request Form - IRS Form 4506T-EZ or IRS Form 4506-T In most cases, for electronic tax return filers, IRS income tax return information is available for the IRS data retrieval tool (DRT) or the IRS Tax Return Transcript within 2–3 weeks after the electronic IRS income tax return has been accepted by the IRS.

Income-Based Repayment Application/Request

www.ocap.orgAGI and other federal income tax return information to your loan holder. If required, your loan holder will include IRS Form 4506-T or 4506T-EZ with this IBR plan request or will provide instructions for obtaining the IRS forms. (b) Other documentation of your AGI, as …

Supplemental Checklist for COVID EIDL Intake Form

www.sba.govForm 4506-T, so that IRS will accept and provide the tax transcript data to SBA in a timely manner. The address listed here must be an exact match to the 2019 (or 2020 the Applicant did not operate in 2019) tax filings with the IRS. Field – Organization Type:

Shuttered Venue Operators Grant - sba.gov

www.sba.govOct 20, 2021 · o For applicants who filed Form 990 or 990 -EZ, call 877-829-5500, from 8 a.m. to 5 p.m. local time. Step 2: • If the IRS tells you that your tax return has been received and processed, please follow the instructions to fill out another 4506 -T and ensure that all information is …