Allocation Of Income And Loss

Found 9 free book(s)ALLOCATION OF INCOME AND LOSS - taxtaxtax.com

taxtaxtax.comALLOCATION OF INCOME AND LOSS 900 INTRODUCTION 900.1 A partnership is not subject to tax at the partnership level. The partnership’s items of income, gain,

Adjustments to Separate Limitation Income (Loss ...

www.irs.govSchedule J (Form 1118) (Rev. September 2016) Department of the Treasury Internal Revenue Service . Adjustments to Separate Limitation Income (Loss) Categories for

BTS BOND ASSET ALLOCATION FUND TO MERGE INTO …

btsfunds.comsolutions for mutual fund and variable annuity clients looking for income and/or total returns. BTS has multi-year track records in tactical fixed income and equity management dating as

FIXED INCOME - Research Affiliates

www.researchaffiliates.com2 | FIXED INCOME Time Horizon One of the major considerations when embarking on the journey to generate asset class return expectations is the issue of time horizon. Because the focus here is on generating capital market expectations for strategic asset allocation, and not tactical overlays, a significantly long time horizon of 10 years was selected.

8958 Allocation of Tax Amounts Between

www.irs.govForm 8958 (Rev. November 2014) Department of the Treasury Internal Revenue Service (99) Allocation of Tax Amounts Between Certain Individuals in Community Property States

1065 U.S. Return of Partnership Income 2016 - CSU DH

www2.csudh.eduForm 1065 (2016) Page 3 Schedule B Other Information (continued) Yes No 11 At any time during the tax year, did the partnership receive a distribution from, or was it the grantor of, or transferor to, a foreign trust? If 'Yes,' the partnership may have to file Form 3520, Annual Return To …

Income in retirement: Common investment strategies

vanguard.comVanguard research June 2010 Income in retirement: Common investment strategies Authors Maria A. Bruno, CFP® Yan Zilbering Executive summary. This paper describes several basic strategies for

Allocation of Capital in the Insurance Industry

www.huebnergeneva.org1 Allocation of Capital in the Insurance Industry∗ J. David CUMMINS The Wharton School 1. Introduction The purpose of this article is to provide an overview of the various techniques that have been

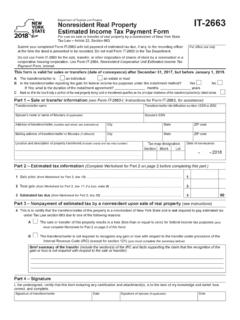

Form IT-2663:2018:Nonresident Real Property Estimated ...

www.tax.ny.gov0431180094 IT-2663 (2018) Page 3 of 3 This area is for county clerk use only. IT-2663-V Individual taxpayer’s full name or name of estate or trust Spouse’s name (if applicable) or name and title of fiduciary Spouse’s SSN Individual taxpayer’s street address or address of fiduciary or representative (see instructions) City, village, or post office State ZIP code

Similar queries

ALLOCATION OF INCOME AND LOSS, Of income, Income, Loss, Internal Revenue Service, BTS BOND ASSET ALLOCATION FUND TO MERGE, FIXED INCOME, Allocation, Allocation of Tax Amounts Between, Return of Partnership Income 2016, Income in retirement: Common investment strategies, Allocation of Capital in the Insurance, IT-2663