An S Corporation Should

Found 10 free book(s)Buyers and Sellers of an S Corporation Should Consider the ...

www.willamette.comwww.willamette.com INSIGHTS • SPRING 2012 21 Buyers and Sellers of an S Corporation . Should Consider the Section 338 Election. Robert P. Schweihs

Valuation Issues in the C Corporation to S Corporation ...

www.willamette.coming S corporation status must meet the following eligibility requirements: 1. The company must be a domestic corporation.

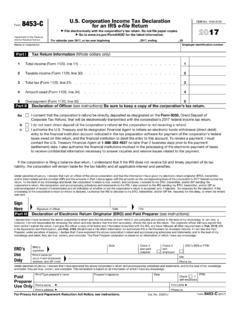

8453-C U.S. Corporation Income Tax Declaration

www.irs.govForm 8453-C Department of the Treasury Internal Revenue Service U.S. Corporation Income Tax Declaration for an IRS e-file Return File electronically with the corporation's tax return.

Choice of Entity for a New Subsidiary of an S Corporation

staleylaw.comBUSINESS LAW U P D A T E 3 sidiaries: the existing corporation and a new subsidiary. The existing corporation would transfer its valu-able asset to the new subsidiary.

CBT-2553 New Jersey S Corporation or New Jersey QSSS …

www.state.nj.usCBT-2553 - Cert Mail to: (8-05) PO Box 252 Trenton, NJ 08646-0252 (609) 292-9292 State of New Jersey Division of Taxation New Jersey S Corporation Certification

1120S, S Corporation Tax Return Checklist, Mini Form

www.albertcpa.comMINI-CHECKLIST S CORPORATION INCOME TAX RETURN 2013 – FORM 1120S Page 2 of 3 2013 AICPA, Inc. Page Completed Done N/A 8. Limit meals and entertainment to allowable percentage.

1120X Amended U.S. Corporation Income Tax Return

www.irs.govForm 1120X (Rev. November 2016) Department of the Treasury Internal Revenue Service . Amended U.S. Corporation Income Tax Return Information about Form 1120X and its instructions is at

So You Want Your LLC to Be An S Corporation…

edzollars.comSo You Want Your LLC to Be An S Corporation… February 4, 2008 Feed address for Podcast subscription: http://feeds.feedburner.com/EdZollarsTaxUpdate

Financial Reporting Manual - SEC.gov

www.sec.govDisclaimer: This Manual was originally prepared by the staff of the Division of Corporation Finance to serve as internal guidance. In 2008, in an effort to increase transparency of informal staff interpretations,

Medical Expenses and the S Corporation - Ed Zollars

edzollars.comExtra, Extra, Read All About Medical Plans Podcast of June 10, 2006 Feed address for Podcast subscription: http://feeds.feedburner.com/EdZollarsTaxUpdate

Similar queries

An S Corporation Should Consider, An S Corporation . Should Consider the Section, Issues in the C Corporation, S CORPORATION, Corporation, Corporation Income Tax Declaration, Internal Revenue Service, Entity for a New Subsidiary of an S Corporation, 2553 New Jersey S Corporation or New Jersey, New Jersey, New Jersey S Corporation, S Corporation Tax Return Checklist, Mini, You Want Your LLC to, An S Corporation, Financial Reporting Manual, Medical Expenses and the S Corporation