California tax credit allocation

Found 36 free book(s)STATE OF CALIFORNIA CALIFORNIA TAX CREDIT …

www.smgov.netThe California Tax Credit Allocation Committee (TCAC), in its role as administrator of the federal and California Low Income Housing Tax Credit programs (Tax Credit programs) established by Section 42 of the Internal Revenue Code of 1986, as amended, and Sections 12206, 17058 and 23610.5 of the California

0968 California Tax Credit Allocation Committee

www.ebudget.ca.gov0968 California Tax Credit Allocation Committee - Continued As of 2014, each state has an annual housing credit ceiling of $2.30 per state resident, and may qualify for a share of credits available annually in a national pool comprised of states' unused credits.

Recording requested by and Tax Credit Allocation Committee

www.nhlp.orgThis Regulatory Agreement (this "Agreement") is made between the California Tax Credit Allocation Committee ("TCAC"), established under Section 50199.8 of the Health and Safety Code of the State of California, and ("Owner") and is dated as of (the "Effective ... "Tax Credit" means the low-income housing tax credit under Section 42 of the Code.

BOARD RESOLUTION ADOPTING THE COMPLIANCE REVIEW …

spb1.spb.ca.govTHE CALIFORNIA TAX CREDIT ALLOCATION COMMITTEE WHEREAS, the State Personnel Board (SPB or Board) at its duly noticed meeting of March 3, 2014, carefully reviewed and considered the attached Compliance Review Report of the California Tax Credit Allocation Committee submitted by SPB's Compliance Review Unit. ...

PROPERTY TAX RULES - State of California

www.boe.ca.govPROPERTY TAX RULES . Division 1. State Board of Equalization-Property Tax . Chapter 2. Assessment . Article 3. Exemptions and Immunities ... Reservation Letter from the California Tax Credit Allocation Committee or California Debt Limit Allocation Committee Bond Cap Allocation Letter is acceptable. (b) QUALIFIED CLAIMANTS. ...

2016 3521 - Instructions for Form FTB 3521 - California

origin-www.ftb.ca.govCalifornia Tax Credit Allocation Committee authorization. The Committee must authorize the amount of the credit allocated to any low-income housing project. California requires that the credit be allocated based on a project’s need for the ... 2016 3521 - Instructions for Form FTB 3521 ...

0968 California Tax Credit Allocation Committee

govbud.dof.ca.gov0968 California Tax Credit Allocation Committee FUND CONDITION STATEMENTS LEGISLATIVE, JUDICIAL, AND EXECUTIVE LJE 1 * Dollars in thousands, except in Salary Range.

LOW-INCOME HOUSING TAX CREDIT PROGRAM WORKING …

wavartists.comWORKING ARTISTS VENTURA “WAV” RESIDENT SELECTION CRITERIA TDD # (415) 345-4470 or California Relay Service (711) ... annually by HUD and the California Tax Credit Allocation Committee (CaTCAC) and available to the public ... LOW-INCOME HOUSING TAX CREDIT PROGRAM WORKING ARTISTS VENTURA “WAV” ...

ASSEMBLY BILL No. 35 - California

www.leginfo.ca.govMar 02, 2015 · line 19 by the California Tax Credit Allocation Committee a credit for line 20 federal income tax purposes under Section 42 of the Internal line 21 Revenue Code , relating to low-income housing credit .

ASSEMBLY BILL No. 35 - California

www.leginfo.ca.govMay 20, 2015 · line 4 (2) (A) The California Tax Credit Allocation Committee shall line 5 certify to the housing sponsor the amount of tax credit under this line 6 section allocated to the housing sponsor for each credit period.

The ABC’s of Low Income Housing Tax Credits

www.frbsf.orgCalifornia Tax Credit Allocation Committee Low Income Housing Tax Credits . Lisa Vergolini . Deputy Director

Tax Credit Case Studies - arev.assembly.ca.gov

arev.assembly.ca.govThe California Tax Credit Allocation Committee (CTCAC), comprised of the State Treasurer, State Controller and Director of the Department of Finance, administers the state and federal low-income housing tax credits.

CTC Audit OIG-16-044

www.treasury.govAudit of California Tax Credit Allocation Committee’s Payment Page 3 Under 1602 Program (OIG-16-044) timeframe and was completed as soon as the issue was revealed.

RESIDENTIAL LEASE FOR LOW INCOME HOUSING TAX …

www.nvch.orglimits set for Napa County LIHTC properties by the California Tax Credit Allocation Committee or due to changes in Utility Allowances which are governed by the Housing Authority City of Napa.

Low Income Housing Tax Credits - ahcd.assembly.ca.gov

ahcd.assembly.ca.gov1 Low Income Housing Tax Credits Mark Stivers, Executive Director . California Tax Credit . Allocation Committee (TCAC)

The California Film and Television Incentive (CFTI ...

film.ca.govApril 2016 Guidelines - California Film & Television Tax Credit Program 2.0 For Projects with Credit Allocation Letters on or after July 1, 2016.

CALIFORNIA TAX CREDIT ALLOCATION COMMITTEE ... - …

www.nahma.orgThe Chairperson of the California Tax Credit Allocation Committee. (e) (d) Committee. The California Tax Credit Allocation Committee or its successor. 1/30/02 Page 2 (f) COMMUNITY FOUNDATION. A LOCAL FOUNDATION ORGANIZED AS A PUBLIC CHARITY UNDER SECTION 509(A)(1) OF THE INTERNAL REVENUE CODE.

CALIFORNIA TAX CREDIT ALLOCATION COMMITTEE

www.treasurer.ca.govThe California Tax Credit Allocation Committee (TCAC) received a total of 61 nine percent (9%) federal credit applications and 8 four percent (4%) applications requesting federal and state tax credits in the first round of 2018.

CALIFORNIA TAX CREDIT ALLOCATION COMMITTEE

www.novoco.commemorandum serves as “Agency Approval” from the California Tax Credit Allocation Committee (CTCAC) permitting the Owners of California Low-Income Housing Tax Credit projects to make vacant units available as temporary housing to individuals displ aced by the federally declared Major

California Tax Credit Allocation Committee Regulations ...

www.novoco.compage 1 of 78 california tax credit allocation committee regulations implementing the federal and state low income housing tax credit laws . california code of regulations

CALIFORNIA TAX CREDIT ALLOCATION COMMITTEE

www.treasurer.ca.govMar 26, 2018 · CALIFORNIA TAX CREDIT ALLOCATION COMMITTEE DATE: March 26, 2018 TO: Tax Credit Stakeholders FROM: Mark Stivers, Executive Director SUBJECT: Proposed Emergency Regulation Changes On March 23, 2018, President Trump signed the omnibus appropriations bill which included a change to Section 42 of the Internal Revenue Code allowing ...

California Tax Credit Allocation Committee Update

nonprofithousing.org2017 9% Tax Credit Results Awarded 35 second round projects in September, totaling 1913 units. Total 2017 units to date equal 3815. TCAC is likely to award a few more projects off the waiting list. TCAC will swap out state credits for federal credits in selected projects to reduce state credit over-allocation …

CALIFORNIA TAX CREDIT ALLOCATION COMMITTEE - …

www.spb.ca.govCalifornia Tax Credit Allocation Committee The CRU may also conduct special investigations in response to a specific request or when the SPB obtains information suggesting a …

CALIFORNIA TAX CREDIT ALLOCATION COMMITTEE

spb.ca.govThe CRU conducted a routine compliance review of the California Tax Credit Allocation Committee’s (CTCAC) personnel practices in the areas of examinations, appointments, EEO, and PSC’s from January 1, 2013, through December 31, 2013.

CALIFORNIA TAX CREDIT ALLOCATION COMMITTEE

www.housingonline.comThe Tax Credit Allocation Committee (TCAC) has since 2009 approved the use of the California Utility Allowance Calculator (CUAC) as a means for developers of new Low Income Housing Tax Credit (LIHTC) projects to determine tenants’ utility

CALIFORNIA TAX CREDIT ALLOCATION COMMITTEE …

www.smgov.netCALIFORNIA TAX CREDIT ALLOCATION COMMITTEE INCOME and RENT LIMITS Extremely low income: 0-30% of AMI Very low income: 30% to 50% of AMI Lower income: 50% to 80% of AMI; the term may also be used to mean 0% to 80% of AMI Moderate income: 80% to 120% of AMI 2017 TCAC INCOME LIMITS 2017 TCAC RENT LIMITS 2018 TCAC INCOME LIMITS

California's Low-Income Housing Tax Credit - lao.ca.gov

lao.ca.govCalifornia's Low-IncomeHousing Tax Credit Better Targeting Could Improve Effectiveness Thelow-income housing tax credit is one ofthe state's major housing programs. Currently, there is legislation ... applicants in the absence of a tax credit allocation.Themainfinding ofoursurvey

When is an irrevocable trust’s income taxable in California?

www2.csudh.eduCalifornia’s Other State Tax Credit If a California trust has income from another state, such as rental real estate income that is taxed both to the state where the property is located and to California, the trust may claim a credit against

0959 California Debt Limit Allocation Committee

www.ebudget.ca.govThe California Debt Limit Allocation Committee's ("Committee") mission is to allocate tax-exempt private activity bond authority for the State of California. Private activity bonds may only be used by the private sector for projects and programs

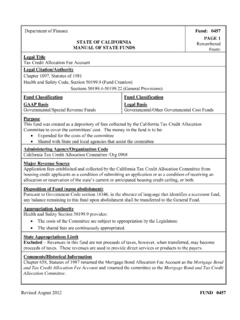

Department of Finance Fund: 0457 PAGE 1 STATE OF ...

www.dof.ca.govthe Tax Credit Allocation Fee Account. Chapter 719, Statutes of 2010 (SB 856) deletes the language that the Tax Credit Allocation Fee Account is in the General Fund.

CALIFORNIA LEGISLATURE - arev.assembly.ca.gov

arev.assembly.ca.govapplicant's estimated tax credit allocation with a minimum of $5,000 and maximum of $12,000, to a local education agency or higher education institution specializing in arts, media, and entertainment career-oriented programs.

California Tax Allocation Committee Update

www.californiacouncil.com2017 9% Tax Credit Results To date, TCAC has funded 63 of 167 applications, a success rate of 38%. 35 project second round and 28 projects first round Likely one more project off the wait list Total 2017 units 3815, 82% of 2016 units New construction equals 84% of units, up from 77% in 2016

Allocations of Tax Credits - Internal Revenue Service

www.irs.govAllocations of Tax Credits Prepared by Dianne Adelberg Internal Revenue Service Overview It is impossible to evaluate whether or ... accounts, the allocation of tax credit 99 percent to the investment partnership partner will be respected. In the above example, the allocation of

California Film Commission PROGRESS REPORT

aart.assembly.ca.govThe California Film & Television Tax Credit Program (Program) was enacted in February 2009 as part of a targeted economic stimulus package to increase film and television production spending, jobs and tax revenues in California.

CALIFORNIA HOUSING FINANCE AGENCY Mortgage Credit ...

www.calhfa.ca.govJun 25, 2018 · credit on their U.S. individual income tax return for the life of their loan. The amount of the CalHFA MCC Tax Credit cannot exceed the amount of a Borrower’s annual federal income

2015-2016 LOW INCOME HOUSING TAX CREDIT PROGRAM …

www.ndhfa.orgHousing Tax Credit (LIHTC) Program for the State of North Dakota. The LIHTC was established by the Tax Reform Act of 1986 for the purpose of encouraging the construction and rehabilitation of …

Similar queries

CALIFORNIA CALIFORNIA TAX CREDIT, CALIFORNIA TAX CREDIT ALLOCATION, CALIFORNIA, Tax Credit, 0968 California Tax Credit Allocation Committee, Credit, Tax Credit Allocation Committee, California Tax Credit Allocation Committee, PROPERTY TAX RULES, State Board of Equalization, Allocation, 2016 3521 - Instructions for Form FTB 3521, ARTISTS VENTURA “WAV” RESIDENT SELECTION CRITERIA, ASSEMBLY BILL No. 35, ASSEMBLY BILL, Low Income Housing Tax Credits, RESIDENTIAL LEASE FOR LOW INCOME HOUSING TAX, California Tax Credit . Allocation, Credit Allocation, California tax credit allocation committee regulations implementing the, California Tax Credit Allocation Committee Update, Tax credit allocation, An irrevocable trust’s income taxable, 0959 California Debt Limit Allocation Committee, California Debt Limit Allocation Committee, California Tax Allocation, Allocations of Tax Credits, Internal Revenue Service, HOUSING TAX CREDIT PROGRAM