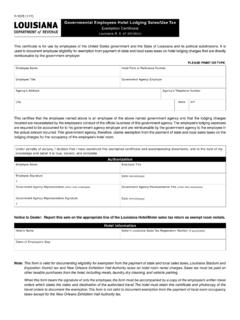

Employees Hotel Lodging Sales Use Tax

Found 8 free book(s)Governmental Employees Hotel Lodging Sales/Use Tax

revenue.louisiana.govThis certificate is for use by employees of the United States government and the State of Louisiana and its political subdivisions. It is used to document employee eligibility for exemption from payment of state and local sales taxes on hotel lodging charges that are directly

What Cities Need to Know to Administer the Local Hotel ...

www.sonoratexas.orgWhat Cities Need to Know to Administer Municipal Hotel Occupancy Taxes 5 Texas Hotel & Lodging Association, 2014 guest is less than the reserved room rate.16 This rule applies both to individual reservations and also to group contracts.17 Exemptions from the Local Tax

2019 HOTEL LISTING - michigan.gov

www.michigan.govState of Michigan Hotel Listing & Lodging Policy Guidelines This listing is provided as a resource and does not expressly authorize, guarantee or warrant the hotels

FORM INDIAN INCOME TAX RETURN Assessment Year ITR …

www.incometaxindia.gov.inPage 6 of 30 ii To others ii iii 24iiiTotal (i + ii) 25 Hotel, boarding and Lodging 25 26 Traveling expenses other than on foreign traveling 26 27 Foreign travelling expenses 27 28 Conveyance expenses 28 29 Telephone expenses 29 30 Guest House expenses 30 31 Club expenses 31 …

TRANSIENT LODGING TAX-GOVERNMENT EXEMPTIONS …

www.clarkcountynv.govTRANSIENT LODGING TAX-GOVERNMENT EXEMPTIONS, 5-5-17 Page2 from, or is to be later reimbursed by, the exempt organization. (d) Rent paid by foreign diplomats properly registered with the United States State

Special Local Taxes 164S - Minnesota Department of …

www.revenue.state.mn.usMinnesota Revenue – Special Local Taxes 3 Beginning July 1, 2013, the city of Marshall will have a 1.5 percent Food and Beverage tax. This tax is in addi-tion to the 6.875 percent state sales tax …

EXPENSE REPORT GUIDELINES & PROCEDURES - Leitz …

www.leitztooling.comEXPENSE REPORT GUIDELINES & PROCEDURES an expense type provided in the dropdown menu. NOTE: Explanations must be given for all miscellaneous costs incurred. Company-paid expenses, including shop purchases are to be recorded using the payment

2019 Publication 15 - Internal Revenue Service

www.irs.govIncome tax. • • Medicare tax. • Internal Revenue Service

Similar queries

Employees Hotel Lodging Sales/Use Tax, Employees, Sales, Hotel lodging, Hotel, Lodging, INDIAN INCOME TAX RETURN Assessment Year, TRANSIENT LODGING TAX-GOVERNMENT EXEMPTIONS, Special Local Taxes, Minnesota Department of, Sales tax, EXPENSE REPORT GUIDELINES & PROCEDURES, Publication 15, Internal Revenue Service