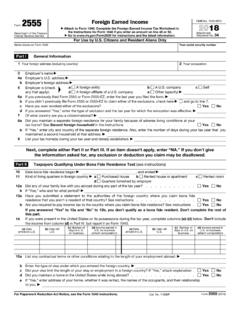

Foreign Earned Income

Found 6 free book(s)2021 Form 2555 - IRS tax forms

www.irs.govIf any of the foreign earned income received this tax year was earned in a prior tax year, or will be earned in a later tax year (such as a bonus), see the instructions. Don’t ; include income from line 14, column (d), or line 18, column (f). Report amounts in U.S. dollars, using the exchange rates in effect when you actually or

2021 Instructions for Form 2555 - IRS tax forms

www.irs.govincome tax withheld from Form(s) W-2 or 1099, respectively), any taxes an employer withheld from your pay that was paid to the foreign country's tax authority instead of the U.S. Treasury. Purpose of Form If you qualify, you can use Form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction.

MAGI INCOME AND DEDUCTION TYPES - California

www.dhcs.ca.govForeign Earned Income (taxable and non-taxable) Form 2555 Count Gross . Count Gross : Foster care, maintaining a space in your home . Count Taxable Portion : Count Taxable : Portion : Foster care or other Title IV-E payments and transitional housing Not Counted : Not Counted :

Income – Other Income - IRS tax forms

apps.irs.govvalue of the foreign currency. This lesson will cover the foreign earned income exclusion reported on Form 2555, Foreign Earned Income. Income – Other Income Objectives At the end of this lesson, using your resource materials, you will be able to determine: • Other types of income and how to report other sources of income

Foreign Tax Credit - IRS tax forms

apps.irs.govThe foreign earned income exclusion differs from the foreign tax credit; try both methods for taxpayers and choose the approach that results in the lowest tax. • The exclusion allows a portion of the foreign earned income to be excluded from taxable income.

About EY Almanac

www.ey.comAbout EY EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the …