Search results with tag "Foreign earned income"

2021 Form 2555 - IRS tax forms

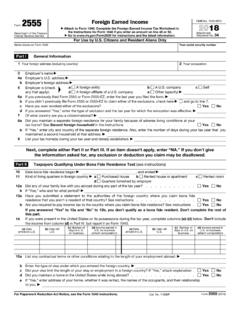

www.irs.govEnter on lines 19 through 23 all income, including noncash income, you earned and actually or constructively received during your 2021 tax year for services you performed in a foreign country. If any of the foreign earned income received this tax year was

2021 Instructions for Form 2555 - IRS tax forms

www.irs.govincome tax withheld from Form(s) W-2 or 1099, respectively), any taxes an employer withheld from your pay that was paid to the foreign country's tax authority instead of the U.S. Treasury. Purpose of Form If you qualify, you can use Form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction.

MAGI INCOME AND DEDUCTION TYPES - California

www.dhcs.ca.govForeign Earned Income (taxable and non-taxable) Form 2555 Count Gross . Count Gross : Foster care, maintaining a space in your home . Count Taxable Portion : Count Taxable : Portion : Foster care or other Title IV-E payments and transitional housing Not Counted : Not Counted :

www.irs.gov/Form673 for the latest information

www.irs.govon Foreign Earned Income Eligible for the Exclusion(s) ... determination by the Internal Revenue Service that any amount paid to me for any services performed during the tax year is excludable from gross income under the provisions of Code section 911(a). Your Signature Date .

Income – Other Income - IRS tax forms

apps.irs.govvalue of the foreign currency. This lesson will cover the foreign earned income exclusion reported on Form 2555, Foreign Earned Income. Income – Other Income Objectives At the end of this lesson, using your resource materials, you will be able to determine: • Other types of income and how to report other sources of income

Foreign Tax Credit - IRS tax forms

apps.irs.govThe foreign earned income exclusion differs from the foreign tax credit; try both methods for taxpayers and choose the approach that results in the lowest tax. • The exclusion allows a portion of the foreign earned income to be excluded from taxable income.