Or more s corporation shareholders

Found 10 free book(s)MEMO FOR 2% OR MORE S CORPORATION …

rmncpas.commemo for 2% or more s corporation shareholders important new irs requirements related to the treatment of health insurance premiums pursuant to irs notice 2008-1:

Section 338(h)(10) S Corporation Checklist - FAU

soa.fau.eduSection 338(h)(10) S Corporation Checklist (Rev. 9/05) PREFACE When the shareholders of an S corporation decide to dispose of their interests in the corporation in a taxable transaction, they have several alternative methods to effectuate

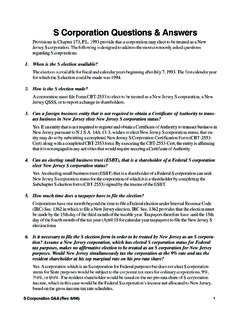

S Corporation Questions & Answers

www.state.nj.usS Corporation Q&A (Rev. 8/06) 2 7. Is it necessary for all shareholders to consent to the S election? Yes. For the election to be valid, the corporation and all present shareholders, referred to as initial

FTB 1017 — Nonresident Withholding S …

www.apu.eduFTB Pub. 1017 (REV 11-2006) Page How do S corporations and partnerships report withholding information to their S corporation shareholders or partners?

LB&I International Practice Service Transaction Unit

www.irs.gov3 . Issue and Transaction Overview . Overview of Subpart F Income for U.S. Individual Shareholders . A foreign corporation is one type of entity through which foreign business operations may be conducted.

Valuation Issues in the C Corporation to S …

www.willamette.comwww.willamette.com INSIGHTS • SPRING 2012 17 Valuation Issues in the C Corporation to . S Corporation Conversion. David M. …

Don't Treat S Corporation Distributions Like …

staleylaw.com15383.DOC 072913:0604 DON’T TREAT S CORPORATION DISTRIBUTIONS LIKE PARTNERSHIP DRAWS William C. Staley, Attorney www.staleylaw.com 818 936-3490 CPA LAW FORUM ...

CBT-2553 New Jersey S Corporation or New Jersey …

www.state.nj.usCBT-2553 - Cert Mail to: (8-05) PO Box 252 Trenton, NJ 08646-0252 (609) 292-9292 State of New Jersey Division of Taxation New Jersey S Corporation Certification

Buyers and Sellers of an S Corporation Should …

www.willamette.comwww.willamette.com INSIGHTS • SPRING 2012 21 Buyers and Sellers of an S Corporation . Should Consider the Section 338 Election. Robert P. Schweihs

Berkshire’s Performance vs. the S&P 500 - Berkshire …

www.berkshirehathaway.comBERKSHIRE HATHAWAY INC. To the Shareholders of Berkshire Hathaway Inc.: Berkshire’s gain in net worth during 2015 was $15.4 …

Similar queries

OR MORE S CORPORATION, Or more s corporation shareholders, H)(10) S Corporation Checklist, Shareholders, S CORPORATION, Corporation, S Corporation Questions & Answers, 1017 — Nonresident Withholding S, S corporation shareholders, Issues in the C Corporation, Issues in the C Corporation to . S Corporation Conversion, 2553 New Jersey S Corporation or New Jersey, New Jersey, New Jersey S Corporation, An S Corporation Should, An S Corporation . Should Consider the Section, Berkshire, Berkshire Hathaway