Or more s corporation

Found 10 free book(s)MEMO FOR 2% OR MORE S CORPORATION SHAREHOLDERS …

rmncpas.commemo for 2% or more s corporation shareholders important new irs requirements related to the treatment of health insurance premiums pursuant to irs notice 2008-1:

Buyers and Sellers of an S Corporation Should Consider the ...

www.willamette.comwww.willamette.com INSIGHTS • SPRING 2012 . 23. 1. The target company has been an S corpora-tion since its inception (more than 10 years

Valuation Issues in the C Corporation to S Corporation ...

www.willamette.comwww.willamette.com INSIGHTS • SPRING 2012 17 Valuation Issues in the C Corporation to . S Corporation Conversion. David M. Chiang. Income Tax Valuation Insights

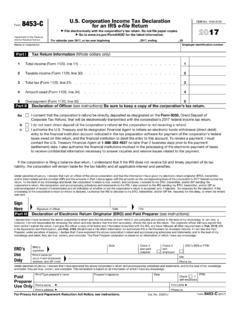

8453-C U.S. Corporation Income Tax Declaration

www.irs.govForm 8453-C Department of the Treasury Internal Revenue Service U.S. Corporation Income Tax Declaration for an IRS e-file Return File electronically with the corporation's tax return.

Choice of Entity for a New Subsidiary of an S Corporation

staleylaw.comBUSINESS LAW U P D A T E 3 sidiaries: the existing corporation and a new subsidiary. The existing corporation would transfer its valu-able asset to the new subsidiary.

1120S, S Corporation Tax Return Checklist, Mini Form

www.albertcpa.comMINI-CHECKLIST S CORPORATION INCOME TAX RETURN 2013 – FORM 1120S Page 2 of 3 2013 AICPA, Inc. Page Completed Done N/A 8. Limit meals and entertainment to allowable percentage.

Documenting S Corporation Shareholder Basis

www.irs.govDocumenting S Corporation Shareholder Basis As Protection Against an IRS Audit American Institute of Certified Public Accountants Washington, DC

2016 S Corporation Return Form M8 Instructions

www.revenue.state.mn.us1 It’s important to include your Minnesota tax ID on your return so that any payments you make are properly credited to your account. If you don’t have a Minnesota tax ID, apply

Medical Expenses and the S Corporation - Ed Zollars

edzollars.comExtra, Extra, Read All About Medical Plans Podcast of June 10, 2006 Feed address for Podcast subscription: http://feeds.feedburner.com/EdZollarsTaxUpdate

CORPORATION Innovative Environmental Products and ...

www.eljen.comCORPORATION Innovative Environmental Products and Solutions Since 1970. Septic System Owner’s Manual. How your septic system works. and how to keep it working

Similar queries

Or more s corporation shareholders, An S Corporation Should Consider, S corpora-tion, More, Issues in the C Corporation, S CORPORATION, Issues in the C Corporation to . S Corporation Conversion, Corporation Income Tax Declaration, Internal Revenue Service, Corporation, Entity for a New Subsidiary of, S Corporation Tax Return Checklist, Mini, Documenting S Corporation Shareholder Basis, S Corporation Return Form M8 Instructions, Medical Expenses and the S Corporation, CORPORATION Innovative Environmental