Request For Relief From Penalty

Found 9 free book(s)CDTFA-735, Request for Relief from Penalty

www.cdtfa.ca.govI request relief from: PENALTY . The CDTFA may grant relief from penalty charges if it is determined that you failed to timely file or pay, or failed to pay using the correct payment method, due to reasonable cause and circumstances beyond your control. Your request may not be processed until the tax/fee has been paid in full.

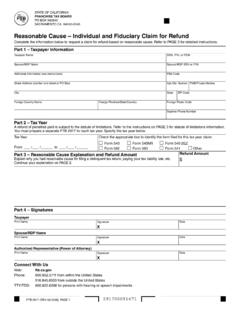

FTB 2917 Reasonable Cause – Individual and Fiduciary …

www.ftb.ca.govTo request this notice by mail, call 800.338.0505 and enter form code . 948. when instructed. FTB 2917 (REV 03-2018) PAGE 3 ... Penalty Reference Chart, lists penalties that can be abated for reasonable cause; go to . ftb.ca.gov. ... California does not conform to federal relief from penalties based upon good filing history or First-Time ...

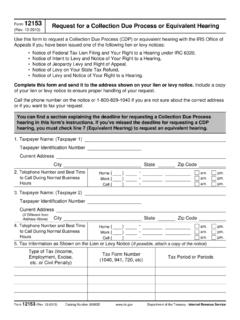

Form 12153 Request for a Collection Due Process or ...

www.irs.govRelief, to your request) Other (for examples, see page 4) Reason ... Penalty and interest will continue to accrue on the unpaid balance. You want action taken about the filing of the tax lien against your property —You can get a Federal Tax Lien released if you pay your taxes in full. You also may request a lien subordination, discharge, or ...

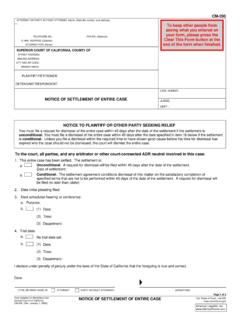

NOTICE OF SETTLEMENT OF ENTIRE CASE ... - Janney & Janney

www.janneyandjanney.comA request for dismissal will be filed within 45 days after the date of the settlement. ... NOTICE TO PLAINTIFF OR OTHER PARTY SEEKING RELIEF You must file a request for dismissal of the entire case within 45 days after the date of the settlement if the settlement is ... I declare under penalty of perjury under the laws of the State of ...

FTB 2924 Reasonable Cause – Business Entity Claim for …

www.ftb.ca.govPenalty Reference Chart, lists penalties that can be abated for reasonable cause; go to . ftb.ca.gov. and search for . FTB 1024. Do not. use FTB 2924 to request a refund of tax. Generally, you can request a refund of tax on an amended tax return. Use the following forms to request abatement: Form Purpose

CIV-110 Request for Dismissal - California

www.courts.ca.govREQUEST FOR DISMISSAL. Page 2 of 2. I declare under penalty of perjury under the laws of the State of California that the information above is true and correct. (TYPE OR PRINT NAME OF (SIGNATURE) COURT'S RECOVERY OF WAIVED COURT FEES AND COSTS . If a party whose court fees and costs were initially waived has recovered or will recover $10,000 or ...

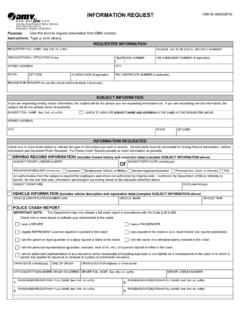

INFORMATION REQUEST - Virginia

www.dmv.virginia.govI agree that the information I obtain in response to my request is considered privileged and confidential. I agree that such information is subject to the restrictions ... civil penalties, criminal penalties or other relief permitted pursuant to Virginia law. If representing a government entity, I agree that the information obtained will not be ...

Interest, Penalties, and Collection Cost Recovery Fee

www.cdtfa.ca.gov• A 10 percent or one-hundred-dollar ($100.00) penalty, whichever is greater, will apply if you do not file your tax return and pay the tax by the due date. This includes returns reporting zero tax due. Cannabis Tax Program: • A 10 percent late payment penalty and a 50 percent failure to pay penalty will apply if you do not file your return or

Injunction by Noticed Motion - saclaw.org

saclaw.orgfacts that the court must consider in deciding whether to grant an injunction. You will sign it under penalty of perjury. Each separate fact should be explained in a numbered paragraph, so that you can easily refer to that fact in other documents. The Declaration is the most important part of the Motion. The judge generally makes a decision on the