State Income Tax

Found 8 free book(s)2017 M1CR, Credit for Income Tax Paid to Another State

www.revenue.state.mn.us2017 Schedule M1CR Instructions a Minnesota resident by filing that state’s income tax return with that state. However, if you paid 2017 income tax to

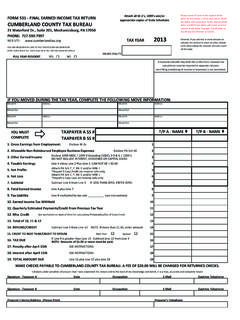

FORM 531 - FINAL EARNED INCOME TAX RETURN …

www.cumberlandtax.orgx % (4) Tax Liability paid to other state or Philadelphia (Philadelphia Credit: Lesser amount should be entered on Line 12) (5) PA Income Tax (Line 1 x PA Income Tax Rate 3.07%)

State Income Tax Withholding QUICK REFERENCE For DLJSC ...

www.netxpro.comTRADITIONAL IRA, SEP, SIMPLE, AND ROTH IRA FEDERAL AND STATE INCOME TAX WITHHOLDING INSTRUCTIONS In most cases, federal and state income tax law requires that we withhold tax from your distribution.

STATE PERSONAL INCOME TAXES ON PENSIONS AND ... - …

www.ncsl.orgNational Conference of State Legislatures April 2015 Prevalence of retirement income exclusions Of the 50 states, seven–Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming–do not levy a personal income tax.

STATE INCOME TAX WITHHOLDING FORMS - WIS …

www.wisintl.comSTATE INCOME TAX WITHHOLDING FORMS Page 1 of 3 Revised March 30, 2015 Please click on either the electronic or paper form link below in order to access the tax withholding form you need.

Ohio Personal Income Tax - mtc.gov

www.mtc.govPIT 2001-01 Personal Income Tax Division PERSONAL INCOME TAX INFORMATION RELEASE – PERSONAL INCOME TAX –NEXUS STAN-DARDS September, 2001 The purpose of this information release is to describe the standards the Department of Taxation

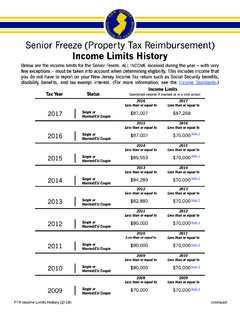

Property Tax Reimbursement Income Limits History

www.state.nj.usSenior Freeze (Property Tax Reimbursement) Income Limits History Below are the income limits for the Senior Freeze. ALL INCOME received during the year – with very few exceptions – must be taken into account when determining eligibility.

NJ-WT Income Tax Withholding New Jersey

www.state.nj.us10-digit New Jersey Corporate Identification Number from the Division of Revenue and Enterprise Services . If you already have a 10-digit ID number but do not remember what it

Similar queries

Income Tax, State, EARNED INCOME TAX RETURN, State Income Tax Withholding QUICK, STATE INCOME TAX WITHHOLDING, State income tax, INCOME, STATE INCOME TAX WITHHOLDING FORMS, Ohio Personal Income Tax, Property Tax Reimbursement Income Limits History, Property Tax Reimbursement) Income Limits History, New Jersey