Subject New Hire Payroll Forms

Found 10 free book(s)Workers’ Benefit Fund (WBF) Assessment - Oregon

www.oregon.gov– This assessment is a payroll assessment calculated on hours worked in the quarter they are paid by employers. The WBF assessment requires employers to report and pay the Workers’ Benefit Fund (WBF) assessment for all paid employees subject to Oregon’s workers’ compensation law or non-subject employees

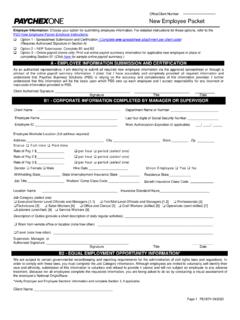

New Employee Packet - Paychex

download.paychex.comNew Employee Packet Employer Information: ... –Option 3 Online payroll clients only: Print out online payroll summary information for applicable new employee in place of ... We are subject to certain governmental recordkeeping and reporting requirements for the administration of civil rights laws and regulations. In order to comply with these ...

CA - NEW HIRE PACKET

www.myhrhelp.comAll forms that require signatures must be completed, signed, and returned within three (3) business days. 1) New Hire Packet Instructions & Acknowledgement Review and sign. 2) New Employee Information Sheet Complete and sign. 3) Form W-4 – Employee Withholding Complete Employee’s Withholding Allowance Certificate and sign.

EMPLOYER'S STATEMENT OF WAGE EARNINGS - New …

www.wcb.ny.govInjured Worker Payroll. section on page 2 of this form.€ If the injured worker has not worked at the same employment for one year or a substantial part of the year, also attach detailed payroll information for an employee of the same class, or complete and submit the . Employee of the Same Class Payroll . section on page 2 of this form. “

Worksheet For Employee Withholding Agreement 2022

www.revenue.wi.gov3.Amount to be withheld each payroll period. (Divide line 1 by the number of. payroll periods entered on line 2.) 2.Remaining number of payroll periods for 2022. (Obtain this figure from. your employer.) First Name and Initial. Social Security Number. Employer's Name. Employer's Address (Number and Street) City, State and Zip Code. Employee's ...

Practical guidance at Lexis Practice Advisor

www.littler.comRefusal to Hire Cases The IRS has stated that claims based on failure or refusal to hire are back pay and thus wages. Rev. Rul. 78-176. A federal district court in the Southern District of New York cited Rev. Rul. 78-176 with approval in Melani v. Board of Higher Ed., 652 F. Supp. 43 (S.D.N.Y. 1986), aff’d, 814 F.2d 653 (2d Cir. 1987).

518, Michigan Business Taxes Registration Book

www.michigan.govforms and more information.--- IMPORTANT INFORMATION ---Use Tax on Rental or Leased Property New Businesses You may elect to pay use tax on receipts from the rental or lease of Employers are required to file tax returns on time and with the the tangible personal property instead of paying the sales or use tax correct payment when required.

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

edd.ca.govCalifornia Employer Payroll Tax Account Number. PURPOSE: This certificate, DE 4, is for California Personal Income Tax (PIT) withholding purposes only. The DE 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. Beginning January 1, 2020,

INSTRUCTIONS & WORKSHEET FOR COMPLETING …

www.marylandtaxes.govIf you have previously filed as “EXEMPT” from federal or state withholding, you must file a new certificate annually by February 15 of each year. Complete the Employee’s Withholding Allowance Certificate as follows: Section 1 - Employee Information-lease check type of Payroll - Regular (RG), Contract (CT), or University of Maryland (UM) P

Withholding Tax Guide - Wisconsin Department of Revenue

www.revenue.wi.govJan 01, 2022 · Withholding Tax . Guide . Effective for Withholding Periods Beginning on or After January 1, 2022 . Publication W-166 (10/21) Printed on Recycled Paper