United States Estate And Gift Tax

Found 9 free book(s)United States Estate and Gift Tax - kplaw.com

www.kplaw.comUnited States Estate and Gift Tax An Overview for Foreigners Investing in the United States By John Ledyard Campbell and Ann Seller Kohnen & Patton LLP

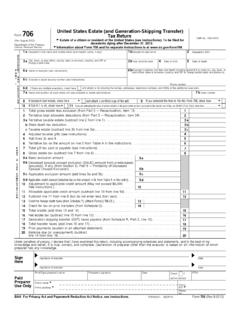

706 United States Estate (and Generation-Skipping Transfer ...

www2.csudh.eduUnited States Estate (and Generation-Skipping Transfer) Form 706 Tax Return GEstate of a citizen or resident of the United States (see instructions).To be filed for OMB No. 1545-0015 (Rev August 2013) decedents dying after December 31, 2012. Department of the Treasury

New Mailing Addresses - irs.gov

www.irs.govUnited States Estate (and Generation- Skipping Transfer) Tax Return Estate of nonresident not a citizen of the United States To be filed for decedents dying after December 31, 2011.

Form 706 (Rev. November 2018) - Internal Revenue Service

www.irs.govForm 706 (Rev. November 2018) Department of the Treasury Internal Revenue Service. United States Estate (and Generation-Skipping Transfer) Tax Return

Income Tax Traps in Estate Planning and Administration

www.willamette.com28 INSIGHTS • AUTUMN 2010 www .willamette .com Income Tax Traps in Estate Planning and . Administration. Andrea C. Chomakos, Esq. Estate Planning Insights . Closely held business owners face challenges in transitioning ownership of the business

International Estate and Inheritance Tax Guide 2013 - EY

www.ey.comPreface The International Estate and Inheritance Tax Guide 2013 (IEITG) is published by Ernst & Young’s Personal Tax Services network, which comprises of professionals hailing from Ernst & Young member firms in over 40 countries around the globe.

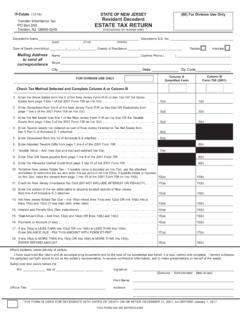

STATE OF NEW JERSEY (68) For Division Use Only Resident ...

www.state.nj.usNEW JERSEY INHERITANCE AND ESTATE TAX: RETURN PROCESSING INSTRUCTIONS Follow these procedures to avoid delays in processing returns, waivers, and

GIFT TAX RETURNS: FINDING AND FIXING PROBLEMS

www.texastaxsection.orgGIFT TAX RETURNS: FINDING AND FIXING PROBLEMS . CELESTE C. LAWTON . Norton Rose Fulbright . 1301 McKinney, Suite 5100 . Houston, Texas 77010 . 713.651.5278

Distinguishing Personal Goodwill from Entity Goodwill in ...

www.willamette.comwww .willamette .com INSIGHTS • WINTER 2016 . 55. transaction, the C corporation assets are valued on . the date of the tax status conversion.

Similar queries

United States Estate and Gift Tax, United States, United States Estate and Generation-Skipping, United States Estate, Estate, Form 706, Internal Revenue Service, In Estate Planning and Administration, In Estate Planning and . Administration, International Estate and Inheritance Tax, Ernst & Young, NEW JERSEY, ESTATE TAX: RETURN, GIFT TAX RETURNS: FINDING AND FIXING PROBLEMS, Distinguishing Personal Goodwill from Entity Goodwill