Search results with tag "Underpayment"

Refiguring Estimated Tax Overpayment of Estimated Tax

www.irs.govUnderpayment of Estimated Tax A corporation that does not make estimated tax payments when due may be subject to an underpayment penalty for the period of underpayment. Use Form 2220, Underpayment of Estimated Tax by Corporations, to see if the corporation owes a penalty and to figure the amount of the penalty. See Form 2220 and the ...

Instructions for Form 926 (Rev. November 2018)

www.irs.govan underpayment if the taxpayer can demonstrate that the failure to comply was due to reasonable cause with respect to such portion of the underpayment and the taxpayer acted in good faith with respect to such portion of the underpayment. See sections 6662(j) and 6664(c) for additional information. Specific Instructions

2022 Publication OR-ESTIMATE, Oregon Estimated Income …

www.oregon.govUnderpayment interest: The amount of interest charged on your underpayment if required payments aren’t made. Required annual payment: The total amount of all tax pay-ments, including estimated tax payments, withholding, and applied refunds, that you must make by the required due dates in order to avoid being charged underpayment interest.

NEW JERSEY 2017 CBT-100

www.state.nj.usForm CBT-100 Corporation Business Tax Return Form CBT-100-V Payment Voucher Form CBT-160-A Underpayment of Estimated Corporation Tax Form CBT-160-B Underpayment of Estimated Corporation Tax

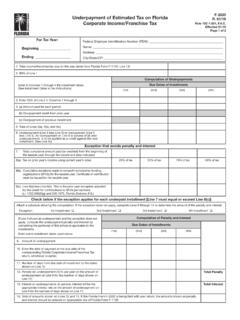

F-2220 Underpayment of Estimated Tax on Florida R. 01/19 ...

floridarevenue.comUnderpayment of Estimated Tax on Florida Corporate Income/Franchise Tax F-2220 R. 01/19 Rule 12C-1.051, F.A.C. Effective 01/19 Page 1 of 2 For Tax Year:

2021 Instructions for Form FTB 3536 - Franchise Tax Board ...

www.ftb.ca.govIf the LLC underpays the estimated fee, a penalty of 10% of the amount of any underpayment will be added to the fee. The underpayment amount will be equal to the difference between the total amount of the fee due for the taxable year less the amount paid by the estimated fee due date. This penalty will not

Form IT-2105.9 Underpayment of Estimated Income Tax By ...

www.tax.ny.govUnderpayment of Estimated Tax By Individuals and Fiduciaries New York State • New York City • Yonkers • MCTMT. 059002210094 IT-2105.9 (2021) (back) Payment due dates A 4/15/21 B6/15/21 C 9/15/21 D1/15/22

Instructions for Form IT-2658 IT-2658-I

www.tax.ny.govUnderpayment of estimated tax – In the case of an underpayment of estimated tax by the partnership or New York S corporation, a penalty as determined under section 685(c) of the Tax Law will be added to the estimated tax required to be paid. In general, the partnership or S corporation may owe a penalty if the

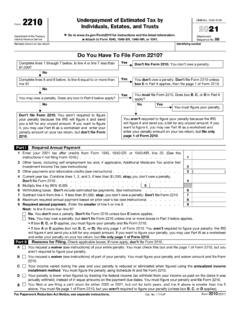

2220 Underpayment of Estimated Tax by Corporations

www.irs.govUnderpayment of Estimated Tax by Corporations ... Enter the tax shown on the corporation’s 2020 income tax return. See instructions. Caution: If the tax is zero or the tax year was for less than 12 months, skip this line and enter the amount from line 3 on line 5 . . . . 4.

Department of Taxation and Finance Instructions for Form ...

www.tax.ny.govestimated tax payments were made (or if no return was filed, the tax for that year), unless one of the exceptions under Exceptions to the underpayment penalty applies. For complete details, see Form CT-222, Underpayment of Estimated Tax by a Corporation. Form CT-1, Supplement to Corporation Tax Instructions See Form CT-1 for the following topics:

2021 Instructions for Estimating PA Fiduciary Income Tax ...

www.revenue.pa.govsubject to estimated underpayment penalty. Estates and trust can calculate the correct amount of the penalty on the REV-1630F, Underpayment of Estimated Tax by Fiduciaries, if there is a disagreement with the amount of the penalty included on the notice. CAUTION: Fiduciaries cannot use the prior year PA-

2020 MICHIGAN Underpayment of Estimated Income Tax …

www.michigan.gov2020 MI-2210, Page 3 . Instructions for Form MI-2210, Underpayment of Estimated Income Tax . Important Notice for Tax Year 2020 . For 2020, taxpayers received an automatic extension of income tax payments otherwise due between April 15, 2020 and July 15, 2020 to July 15, 2020. First and second quarter estimated payments were impacted. These

2021 Instructions for Form 760C - Underpayment of Virginia ...

www.tax.virginia.govTest 2, use Form 760F, Underpayment of Estimated Tax by Farmers, Fishermen and Merchant Seamen, to determine whether you owe an addition to tax. If you do not meet Test 1, use Form 760C. Due Date If the due date falls on a Saturday, Sunday or legal holiday, then the return may be filed and the tax may be paid without penalty or interest on the

Penalty Reference Chart - FTB.ca.gov

www.ftb.ca.govUnderpayment of estimated fee. 10% of the underpayment. Exceptions - Safe harbor-100% of prior year. Tax on Joint Return Exceeds Tax on Separate Returns : 18530 . 6013(b)(5) Tax on a joint return exceeds tax shown on separate returns, due to negligence or intentional disregard of rules, or fraud. In lieu of penalties provided by Section 19164(a ...

General Instructions 21 - IRS tax forms

www.irs.govUnderpayment of Estimated Tax by Corporations Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments affecting Form 2220 and its instructions, such as legislation enacted after

CT-1120 EXT 20170912

www.ct.govForm CT-1120 EXT (Rev. 12/17) Page 3 of 3 Interest and Penalty Interest is assessed at 1% per month or fraction of a month on any underpayment of tax …

2021 Form 990-PF - IRS tax forms

www.irs.gov2021 estimated tax payments and 2020 overpayment credited to 2021 . . 6a: b: ... for underpayment of estimated tax. Check here: if Form 2220 is attached: 8: 9 Tax due. If the total of lines 5 and 8 is more than line 7, enter : amount owed. . . . . . .

21 Internal Revenue Service Department of the Treasury

www.irs.govSee chapter 2 of Pub. 505, Tax Withholding and Estimated Tax, for the definition of gross income from farming and fishing. If you meet test 1 but not test 2, use Form 2210-F, Underpayment of Estimated Tax by Farmers and Fishermen, to see if you owe a penalty. When using Form 2210-F, refer to the Instructions for Form 2210-F,

subsidize Medicare’s underpayment for the costs of ...

www.anco-online.orgCPT copyright 2009 American Medical Association. All rights reserved. E&M Services and Drug Infusion Codes Statement of the Problem Recently, several carriers have denied payment for Evaluation and Management

Draft 2022 Form 760ES, Estimated Income Tax Payment ...

www.tax.virginia.govVIII. UNDERPAYMENT OF ESTIMATED INCOME TAX Generally, an addition to tax is imposed by law if at least 90% (662/ 3% if you are a farmer, fisherman or merchant seaman) of your total tax liability is not paid throughout the year by timely withholding and/or installments of estimated tax. The addition

2020 D-30 District of Columbia (DC) Unincorporated ...

otr.cfo.dc.govD-2220 Underpayment of Estimated Franchise Tax by Businesses 45 Form D-30P Payment Voucher 47 Form FR-130 Extension of Time to File a DC Unincorporated Business Return 49 Form D-30 NOL Net Operating Loss Deduction for Tax Years 2000 to 2017 51 Form D-30 NOL Net Operating Loss ...

Attach to Form 1040, 1040-SR, 1040-NR, or ... - IRS tax forms

www.irs.govUnderpayment of Estimated Tax by ... Estimated tax paid and tax withheld (see the instructions). For column (a) only, also enter the amount from line 11 on line 15, column (a). If line 11 is equal to or more than line 10 for all payment periods, stop here; you don’t owe a penalty. ...

2020 Form OR-20 Oregon Corporation Excise Tax …

www.oregon.govamount of any prior underpayment plus the amount of the current required payment. Example: During the year, Corporation A’s expected net tax increased from $2,000 to $6,000. Corporation A made timely first and second quarter estimated payments of $500 before its expected net tax increased. Corporation A should make four payments of $1,500 each

2019 Form 540 California Resident Income Tax Return

www.ftb.ca.govUnderpayment of estimated tax. 112 111 114 FTB 5805 attached FTB 5805F attached..... 113 Amount You Owe. Pay Online – Go to ftb.ca.gov/pay for more information. Interest and Penalties. Refund and Direct Deposit... 00 00 00 115 REFUND OR NO AMOUNT DUE. Subtract the sum of 110, line 112 and line 113 from line 96. See instructions. 115 116 117 ...

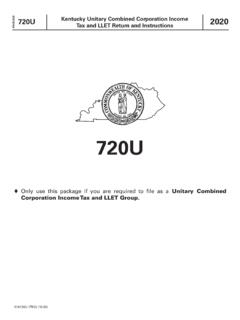

720 KENTUCKY CORPORATION INCOME 2020 TAX AND LLET …

revenue.ky.govForm 2220-K— The instructions were clarified to specify when a taxpayer owes an underpayment of estimated tax penalty and when a taxpayer must include Form 2220-K with their return even if they do not owe the penalty. Schedule RC— The form was updated to reflect changes to the Major Recycling Credit enacted by the Legislature in 2019.

ITE OW-8-ESC Oklahoma Corporate, Fiduciary and Partnership ...

oklahoma.govA corporation or trust with an estimated income tax liability of $500 or more for the year is required to file a declaration and pay esti-mated tax. The corporate income tax rate is 4% of taxable income. The tax rates for trusts are in the Form 513 or 513-NR instructions. ... In general, underpayment of estimated tax interest is due if the

K-40ES Individual Estimated Income Tax Vouchers and ...

ksrevenue.govUse Schedule K-210 to figure any underpayment of estimated tax, to determine if you meet one of the exceptions to the penalty, and figure any penalty due. Schedule K-210 is available from our website at: www.ksrevenue.gov. 2021 KANSAS. INDIVIDUAL ESTIMATED INCOME TAX VOUCHER. K-40ES

Note: The draft you are looking for begins on the next ...

www.irs.govUnderpayment. If line 10 is equal to or more than line 15, subtract line 15 from line 10. Then go to line 12 of the next column. Otherwise, go to line 18 . . . 17 18 Overpayment. If line 15 is more than line 10, subtract line 10 from line 15. Then go to line 12 of the next column . . . . . . . . . . . . 18

720U - revenue.ky.gov

revenue.ky.govForm 2220-K— The instructions were clarified to specify when a taxpayer owes an underpayment of estimated tax penalty and when a taxpayer must include Form 2220-K with their return even if they do not owe the penalty. Schedule RC— The form was updated to reflect changes to the Major Recycling Credit enacted by the Legislature in 2019.

Similar queries

Estimated tax, Of Estimated Tax, Underpayment of estimated tax, Underpayment, ESTIMATED, NEW JERSEY, Corporation, A Underpayment of Estimated Corporation, Underpayment of Estimated Corporation, 2220 Underpayment of Estimated Tax on, 2220, Instructions for Form IT-2658, Underpayment of estimated, Income tax, 2021 Instructions for Estimating PA Fiduciary, Estimated underpayment, 2020 MICHIGAN Underpayment of Estimated Income Tax, 2210, Underpayment of Estimated Income Tax, IRS tax forms, CT-1120 EXT, Form 990-PF, Instructions, Costs, Drug, 2220 Underpayment of Estimated, Oregon Corporation, California, Esti-mated