Search results with tag "Payroll tax"

ET-1 2021 PAYROLL EXPENSE TAX Employer/Sole Proprietor ...

apps.pittsburghpa.govperforms work or renders service, in whole or in part of the City. The Payroll Tax is on gross payroll of the Employer. The Employers’ portions of federal and state payroll taxes, health insurance premiums, retirement plan contributions, etc., are not part of taxable gross payroll. a. Line 1a. – Enter the taxable payroll expense amount . b ...

Chapter 13 Payroll Accounting, Taxes, and Reports -- The ...

www.fallcreek.k12.wi.usChapter 13 Payroll Accounting, Taxes, and Reports -- The payroll register and employee earnings records provide all the payroll information needed to prepare a payroll and payroll tax reports. Journal entries are made to record the payment of the payroll and the employer payroll …

Chapter 13 Income and Factor Taxes - GTAP

www.gtap.agecon.purdue.eduChapter 13 Income and Factor Taxes Robert A. McDougall and Jan Hagemejer . ... implicitly to record income and factor employment tax payments. Factor employment taxes denotes such taxes as payroll tax, social security levies, and land taxes. ... Table 13.1 shows the regions not covered or only partly covered in the source statistics.

Chapter 13 Payroll Accounting, Taxes and Reports South ...

www.britton.k12.sd.usChapter 13 Payroll Accounting, Taxes and Reports South Dakota CTE Indicator/Standard for Accounting I Indicator #3: Demonstrate the basic principles and procedures of the accounting cycle. ... Prepare selected payroll tax reports. 6. Pay and record withholding and payroll taxes. 2

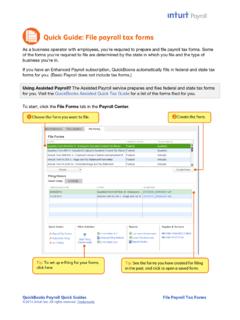

Quick Guide: File payroll tax forms - Intuit

http-download.intuit.comQuickBooks Payroll Quick Guides File Payroll Tax Forms ©2014 Intuit Inc. All rights reserved. Trademarks Quick Guide: File payroll tax forms

Chapter 15: Employees, Payroll, and Account Reconciliation

www.mccc.eduEmployees, Payroll, and Account Reconciliation ... 15-13. W-2 forms, p. 580 An annual report of an employee’s wages subject to FICA and federal income tax that shows the amounts of these taxes ... Remember, Peachtree's payroll tax calculations are for example purposes only. Payroll

Sage100 Payroll 2.18

cdn.na.sage.comChapter 7 — Installing Payroll 13 Preinstallation Tasks13 Installation Process14 Chapter 8 — Upgrading the Payroll Module 16 Install the Payroll Module16 ... Any payroll tax updates available when work on this version of Payroll was completed have been incorporated into the module. These updates may include new

Chapter 14 Employees, Payroll and Account Reconciliation

www.mccc.eduEmployees, Payroll and Account Reconciliation ... Software has a payroll tax update service. To learn more about Peachtree Software’s payroll tax service, visit their website at ... Backing up Chapter 14 data, p. 561 13. Internet activity, p. 561 14. Summary and …

12. Filing Form 941 or Form 944 What's New 27 - IRS tax forms

www.irs.govEmployer's Tax Guide For use in 2022 Get forms and other information faster and easier at: •IRS.gov (English) ... the employer share of social security tax is due by De-cember 31, 2021, and the remainder is due by December ... Payroll tax credit for certain tax-exempt organiza-tions affected by qualified disasters. Section 303(d) of

Sage 100 Payroll User Guide

cdn.na.sage.comChapter 3: Setting Up Payroll Tax Calculations 11 Creating Tax Profiles 12 Assigning Tax Profiles to Employees 13 Configure Multistate Payroll 13 Chapter 4: Working with Earnings Codes 14 Setting Up Automatic Earnings Codes 14 Pay Employees Using Automatic Earnings Codes 15

CHAPTER 13 BUSINESS CASE QUESTIONNAIRE

www.ch13austin.comChapter 13 Business Questionnaire Last Updated: October 6, 2010 Page 3 k. If you have employees, who prepares payroll, payroll tax deposits and payroll tax

2019 Publication 15 - IRS tax forms

www.irs.govBusiness Payroll Tax Credit for Increasing Research Ac-tivities. Form 8974 is used to determine the amount of the credit that can be used in the current quarter. The amount from Form 8974, line 12, is reported on Form 941 or 941-SS, line 11 (or Form 944, line 8). For more informa-tion about the payroll tax credit, see Notice 2017-23,

CHAPTER 13 – PAYROLL TAX Definitions

trimet.orgEvery employer subject to tax pursuant to this Chapter 13 shall pay an amount equal to the product of (i) the Payroll Tax Rate, as set forth in Section 13.09(B), and (ii) the amount of wages paid by such employer with respect to services performed within the District.

Webinar 4: Grouping Provisions - Payroll Tax

www.payrolltax.gov.auPayroll Tax Webinars Webinar One Understanding the basics – what it is, how it works Webinar Two Allowances, FBT, exemptions and rebates Webinar Three Contractors Webinar Four Groupings

CHAPTER 13

occonline.occ.cccd.edu13-1 CHAPTER 13 Current Liabilities and Contingencies ASSIGNMENT CLASSIFICATION TABLE (BY TOPIC) ... *This material is covered in an Appendix to the chapter. 13-2 ASSIGNMENT CLASSIFICATION TABLE (BY LEARNING OBJECTIVE) ... E13-8 Payroll tax entries. Simple 10–15 E13-9 Payroll tax entries. Simple 15–20 E13-10 Warranties. Simple 10–15

Quick Guide: W-2 Filing

http-download.intuit.comQuickBooks Payroll Quick Guides W-2 Filing Quick Guide: W-2 Filing Filing Federal Form W-2 . You create and file your employees’ federal W-2s (and the summary Form W-3) the same way you . create and file any payroll tax form, including . filing electronically, in QuickBooks Payroll. It’s a good idea to

2018 CALIFORNIA EMPLOYER’S GUIDE

www.edd.ca.govImportant Information New Electronic Reporting and Payment Requirement: As of January 1, 2018, employers must electronically submit employment tax returns, wage reports, and payroll tax deposits to the EDD.

Backgrounder - Eliminating Medical Service Plan …

bcbudget.gov.bc.caThis new payroll tax will come into effect Jan. 1, 2019 with the following rate structure: • Businesses with a payroll of more than $1.5 million will pay a rate of 1.95% on their

Chapter 13 Monthly Business Reports

chi13.com• Chapter 13 Summary of Operations • Chapter 13 Monthly Business Reports ... • most recent federal and state payroll tax returns (if applicable) • most recent state sales tax returns (if applicable) • proof of insurance for any business assets.

Webinar 2: Allowances, FBT, Exemptions and ... - …

www.payrolltax.gov.auPayroll Tax Webinars Webinar One Understanding the basics – what it is, how it works Webinar Two Allowances, FBT, exemptions and rebates Webinar Three Contractors Webinar Four Groupings

MINISTRY OF HOME AFFAIRS ... - Government of Bermuda

www.gov.bmpayroll tax, health insurance, social insurance and pension contributions for all employees. In ... permission to work in Bermuda is whether there is a suitably qualified Bermudian, Spouse of a Bermudian or PRC holder who is interested in the job and available to do it.

Payroll Services and Payroll Tax Deposits - Ed Zollars

www.edzollars.comPayment Encore: Liability of Taxpayer for Embezzlement by Payroll Service Podcast for May 18, 2007 Feed address for Podcast subscription: http://feeds.feedburner.com/EdZollarsTaxUpdate

Payroll Tax Act 1995 - Bermuda Laws

www.bermudalaws.bmF A E R N A T F T QU O U BERMUDA PAYROLL TAX ACT 1995 1995 : 16 TABLE OF CONTENTS Short title Interpretation Payroll tax Meaning of “employer” Meaning of “employee”

Similar queries

Payroll, Payroll tax, Contributions, Chapter 13 Payroll, All the payroll information needed to prepare, Chapter 13 Income and Factor Taxes, Chapter 13 Payroll Accounting, Taxes and Reports, CTE Indicator/Standard for Accounting, Quick Guide: File payroll tax forms, Chapter, Employees, Payroll, and Account Reconciliation, Payroll 13, Employees, Payroll and Account Reconciliation, IRS tax forms, Employer's Tax Guide, Employer, Payroll 13 Chapter, CHAPTER 13 BUSINESS CASE QUESTIONNAIRE, Chapter 13, CHAPTER 13 – PAYROLL TAX Definitions, Webinar 4: Grouping Provisions - Payroll Tax, Webinar, Chapter. 13, Quick Guide: W-2 Filing, Payroll Quick, File, GUIDE, Backgrounder, Basics, Allowances, FBT, exemptions and rebates, Bermuda, BERMUDA PAYROLL TAX