Search results with tag "Affordable care act"

Health Care Reform (HCR), Affordable Care Act (ACA ...

www.nafhealthplans.com1 Health Care Reform (HCR), Affordable Care Act (ACA), Mandates, Regulations, and Penalties What does all this mean to you in 2017? Many health care reform changes have been initiated as part of the Affordable Care Act (ACA)

Lactation Room Requirements - National Institutes of Health

orf.od.nih.govWith the passage of The Patient Protection and Affordable Care Act (Affordable Care Act) in 2010 the provision of lactation rooms in workplaces and reasonable break time for employees to express breast milk has become a federal requirement. Section 4201 of the Affordable Care Act requires provision of ‘a place, other than a

March 2011 The Affordable Care Act: A Brief Summary

www.ncsl.orgNational Conference of State Legislatures The Affordable Care Act: A Brief Summary March 2011 Overview The federal Patient Protection and Affordable Care Act (P.L. 111-148), signed March 23, 2010, as amended by the Health Care and

FAQs about Affordable Care Act Implementation Part 51, …

www.dol.govJan 10, 2022 · First Coronavirus Response Act (FFCRA), the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), and the Affordable Care Act. These FAQs have been prepared jointly by the Departments of Labor, Health and Human Services (HHS), and the Treasury (collectively, the Departments). Like previously issued FAQs (available at

DEPARTMENT OF HEALTH AND HUMAN SERVICES 45 CFR …

public-inspection.federalregister.gov1 The Patient Protection and Affordable Care Act (Pub. L. 111-148) was enacted on March 23, 2010. The Healthcare and Education Reconciliation Act of 2010 (Pub. L. 111-152), which amended and revised several provisions of the Patient Protection and Affordable Care Act, was enacted on March 30, 2010. In this rulemaking, the two statutes are

A Framework for Patient-Centered Health Risk Assessments

www.cdc.govThe Patient Protection and Affordable Care Act . of 2010 (Affordable Care Act) included several provisions intended to improve the health of Americans and prevent the onset of prevent-able chronic conditions.(16) Section 4103 of the Affordable Care Act, the Medicare Coverage of Annual Wellness Visit Providing a Personalized Prevention Plan ...

RE: Affordable Care Act - EPK Benefits

www.epkbenefits.comRE: Affordable Care Act Changes to Probationary Period The Affordable Care Act (ACA) now includes a provision (SEC 2708) that eliminates employee

CMS Manual System - Centers for Medicare & Medicaid …

www.cms.govthe Medicare regulations at 42 C.F.R. §424.44, specify the time limits for filing Medicare fee-for-service (Part A and Part B) claims. Prior to the passage of the Patient Protection and Affordable Care Act (the Affordable Care Act), on March 23, 2010, a provider or supplier had from 15 to 27 months, depending on the date of

Medicare Claims Processing Manual - Centers for Medicare ...

www.cms.govSection 10501(i)(3)(A) of the Affordable Care Act (Pub. L. 111-148 and Pub. L. 111-152) added section 1834(o) of the Social Security Act to establish a Medicare PPS for FQHC services. FQHCs transition to the Medicare PPS beginning on October 1, 2014, based on their cost-reporting period. All FQHCs are expected to be transitioned to the

Patient Protection - HHS.gov

www.hhs.gov3 tient Protection and Affordable Care Act’’. 4 (b) TABLE OF CONTENTS.—The table of contents of this 5 Act is as follows: Sec. 1. Short title; table of contents. TITLE I—QUALITY, AFFORDABLE HEALTH CARE FOR ALL AMERICANS Subtitle A—Immediate Improvements in Health Care Coverage for All Americans Sec. 1001.

Publication 5223 (Rev. November 2021) - IRS tax forms

www.irs.govFurther information can be found in Pub. 5164, Test Package for Electronic Filers of Affordable Care Act (ACA) Information Returns (AIR), and Pub. 5165, Guide for Electronically Filing Affordable Care Act (ACA) Information Returns for Software Developers and Transmitters. Note. Further information impacting Pub. 5223, such as issues arising ...

The Patient Protection and Affordable Care Act Detailed ...

www.dpc.senate.govAffordable Care Act is fully paid for, will provide coverage to more than 94% of Americans while staying under the $900 billion limit that President Obama established, bending the health care cost curve, and reducing the deficit over the next ten years and beyond.

Florida Medicaid Fee Schedule Overview

ahca.myflorida.com• The Affordable Care Act of 2010 required CMS to notify states by September 1, 2010 of the NCCI methodologies that were compatible with Medicaid. • State Medicaid Director Letter #10-017 notified states that all five Medicare NCCI methodologies were compatible with Medicaid. • The Affordable Care Act required state Medicaid programs to

Health Insurance Coverage for Americans with Pre-Existing ...

aspe.hhs.govThe Impact of the Affordable Care Act January 5, 2017 The Affordable Care Act (ACA) put in place a range of nationwide protections for Americans with pre-existing health conditions. Under the ACA, insurance companies cannot deny coverage or charge higher premiums based on a person’s medical history or health status. In addition,

CalPERS Health Program Guide

www.calpers.ca.gov*The Affordable Care Act has provisions which expand eligibility criteria for certain variable-hour employees. For additional . information, please contact your employer. CalPERS cannot advise on the timekeeping and documentation requirements of . variable-hour employees under the Affordable Care Act. my.calpers.ca.gov . my.calpers.ca.gov

Seasonal Employees and the Affordable Care Act (ACA)

www.gbac.comThe ebenefit Private Benefits Marketplace will have Affordable Care Act tools and safeguards to protect employers and their employees from non-compliance. The policy and management of the seasonal employees in addition to your full-time employees will be managed within the platform and alleviate the administrative burden for all employees that

Hospitals and the Affordable Care Act (ACA) - jhsph.edu

www.jhsph.eduThe Details • Free Preventive Care: All new plans must cover certain preventive services such as colonoscopies and mammograms without charging a co-pay, deductible or coinsurance • Rebuilding the Primary Care Workforce: There are new incentives in the law to expand the number of primary care

THE PATIENT PROTECTION AND AFFORDABLE CARE ACT P.L. …

www.aacr.orgthe patient protection and affordable care act . p.l. 111-148. selected health insurance provisions incorporating . changes in the manager”s amendment and the

Public Law 111–148 111th Congress An Act

www.congress.govPUBLIC LAW 111–148—MAR. 23, 2010 124 STAT. 119 Public Law 111–148 111th Congress An Act Entitled The Patient Protection and Affordable Care Act. Be it enacted by the Senate and House of Representatives of

Publication 5164 (Rev. 10-2021) - IRS tax forms

www.irs.govAffordable Care Act (ACA) Information Returns for Software Developers and Transmitters, and . Publication 5258, Affordable Care Act (ACA) Information Returns (AIR) Submission Composition and Reference Guide. Note: When resubmitting a rejected transmission, make sure a new UTID is generated for the resubmission.

The Affordable Care Act of 2010: A Brief Summary

www.unmc.edury aspect of the US health care system:1,2 1. “Quality, Affordable Health Care for All Ameri-cans” deals with expanded private health in-surance coverage and regulation of the pri-vate health insurance market. 2. “Role of Public Programs” expands and re-forms public coverage in Medicaid and the Children’s Health Insurance Program. 3.

NCSL Fact Sheets on Health Reform

www.ncsl.org3 Tax Treatment of Health Care Benefits Provided with Respect to Children Under Age 27 • IRS Notice 2010‐38 provides guidance on the Affordable Care Act’s (the Act) amendment of Section 105(b) of the

Note: The draft you are looking for begins on the next ...

www.irs.govThe IRS will provide any further updates as soon as they are available at IRS.gov/Coronavirus. See also Notice 2020-29, 2020-22 I.R.B. 864, and ... cation of the Affordable Care Act (ACA) to FSAs and Health Reimbursement Arrangements (HRAs). For more information on the ACA, go to IRS.gov/ Affordable-Care-Act.

The Department of Health and Human Services (HHS), Office of

www.oig.hhs.govThe Administration for Community Living (ACL) serves as the ... Act, Title II of the Americans with Disabilities Act, and Section 1557 of the Affordable Care Act. Group Home Beneficiaries Are at Risk of Serious Harm ... and provide access to Medicaid claims data.

SUPREME COURT OF THE UNITED STATES

www.supremecourt.govAffordable Care Act required most Americans to obtain minimum essential health insurance coverage. The Act also imposed a monetary penalty, scaled according to in-come, upon individuals who failed to do so. In 2017, Con-gress effectively nullified the penalty by setting its amount at $0. See Tax Cuts and Jobs Act of 2017, Pub. L. 115–97,

Medicare Prescription Drug Benefit Manual

www.cms.govSep 17, 2018 · ACA Affordable Care Act . ADAP AIDS Drug Assistance Program . AI/AN American Indian/Alaskan Native . ATBT Automated TrOOP balance transfer . BAA Business Associate Agreement . BCRC CMS Contracted Benefits Coordination & Recovery Center. BIN Bank Identification Number . BL Black Lung . BSQ Benefit Stage Qualifier

Coverage and Reimbursement of COVID-19 Vaccines, …

www.medicaid.govstates opting to implement section 1905(a)(13)(B) of the Act (section 4106 of the Patient Protection and Affordable Care Act), and coverage under Alternative Benefit Plans (ABP). This section also provides guidance on what actions states and territories need to take, if any;

CMS Voluntary Self-Referral Disclosure Protocol

www.hollandhart.comOMB CONTROL NUMBER: 0938-1106 1 CMS Voluntary Self-Referral Disclosure Protocol. I. Introduction. The Affordable Care Act (ACA), enacted on March 23, 2010, provides for the establishment of a

ACA Definition of Full-Time Employee - SHRM

www.shrm.orgBackground: Under the Affordable Care Act (ACA), employers with more than 50 full-time employees are required to provide affordable group health insurance coverage to …

Employer Reporting Requirements (Forms 1095-C and …

www.americaninsuranceid.comEmployer Reporting Requirements (Forms 1095-C and 1094-C) Quick Facts: The Affordable Care Act (ACA) added two employer reporting requirements to the Internal Revenue

The HHS-HCC Risk Adjustment Model for Individual and Small …

www.cms.govAffordable Care Act (ACA) provides for a program of risk adjustment in the individual and small group markets in 2014 as Marketplaces are implemented and new market reforms take effect. The purpose of risk adjustment is to lessen or eliminate the influence of risk selection on the premiums that plans charge.

The ACA and Tax Filing for Married, Separated, and ...

coveraz.orgThe ACA and Tax Filing for Married, Separated, and Abandoned Spouses In the Loop is a joint project of The Affordable Care Act (ACA) requires married couples to file

Coding reference tobacco use prevention and cessation ...

www.aafp.orgIn 2014, the Patient Protection and Affordable Care Act (ACA) began requiring insurance plans to cover many clinical preventive services. Two of the covered

State of Maryland Policy for Identifying Full-Time ...

dbm.maryland.govOct 15, 2014 · who meet the Affordable Care Act (ACA) definition of full-time employee. Employee. ... hours per week, and who are not seasonal employees, must be treated as new full-time employees. o New full-time employees will be immediately eligible for an offer of subsidized coverage. New coverage becomes effective either the first or the 16th of the

Publication 5165 (Rev. 11-2021) - IRS tax forms

www.irs.govAug 31, 2021 · Affordable Care Act Information Returns (AIR) page. 1.1 Purpose . The purpose of this publication is to provide the specifications to electronically file the ACA Information Returns (Forms 1094/1095-B and 1094/1095-C) with IRS.

If you’re an eligible employee: Affordable Care Act’s

www.benefitoptions.az.govCONTENT AREA Health Insurance Marketplace Notice ANNOUNCEMENT ADOA Human Resources Division - Benefit Services will be sending an email to employees on

New Health Insurance Marketplace Coverage Options and …

www.dol.govAffordable Care Act, you may be eligible for a tax credit. 1. Note: If you purchase a health plan through the Marketplace instead of accepting health coverage offered by your employer, then you may lose the employer contribution (if any) to the employer -offered coverage. Also, this employer

Affordable Care Act (ACA) Information Returns (AIR)

www.irs.govGeneral AIR Information AIR Publication Resource List • Publication 5164, Test Package for Electronic Filers of Affordable Care Act (ACA) Information Returns (AIR) • Publication 5165, Guide for Electronically Filing Affordable Care Act (ACA) Information Returns for …

Affordable Care Act (ACA) Information Returns (AIR)

www.irs.govAffordable Care Act (ACA) Information Returns (AIR) Working Group ... • Corrections & Other Non-Technical ... Guide for Electronically Filing Affordable Care Act (ACA)

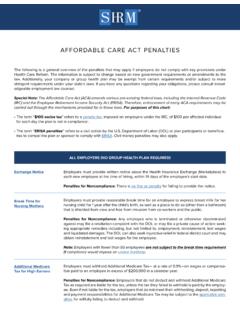

AFFORDABLE CARE ACT PENALTIES - SHRM

www.shrm.orgAFFORDABLE CARE ACT PENALTIES ... information returns and employee statements may apply—ranging from $50-$270 per return, with a maximum penalty …

Affordable Care Act: What Employers Need to Know

www.irs.govThe Affordable Care Act contains tax provisions that affect employers. The number of employees an employer has during the current year determines whether it is an applicable large employer for the following year. An employer's size determines which parts of the law apply to which employers.

Similar queries

Care, Affordable Care Act, Patient Protection and Affordable Care Act, Section, National Conference of State Legislatures, Patient, RE: Affordable Care Act, Probationary Period, Centers for Medicare & Medicaid, Medicare, The Affordable Care Act, Claims Processing Manual, Protection, IRS tax forms, Information, Information returns, Florida Medicaid Fee Schedule Overview, CalPERS Health Program Guide, Employees, Calpers, Seasonal Employees and the Affordable Care Act, Seasonal employees, Health, Publication 5164, Affordable, NCSL Fact Sheets on Health Reform, Updates, Administration, Claims, SUPREME COURT OF THE UNITED STATES, Medicare Prescription Drug Benefit Manual, Coverage and Reimbursement of COVID, CMS Voluntary Self-Referral Disclosure Protocol, Employer Reporting Requirements Forms 1095, Filing for Married, Separated, and, Filing for Married, Separated, and Abandoned Spouses, Tobacco use prevention and cessation, Affordable Care Act ACA, Publication 5165, Affordable Care Act (ACA) Information Returns, Filing Affordable Care Act (ACA) Information Returns, Affordable Care Act (ACA) Information Returns AIR, Corrections, What Employers Need to Know