Search results with tag "Expatriation"

June 2008 Third Dramatic Change in Expatriation Tax Rules ...

www.bryancave.comThird Dramatic Change in Expatriation Tax Rules in Twelve Years: Are We There Yet? ... who give up their “green cards” (or claim Treaty residence in another country). The 1996 changes ... administration of the expatriation regime and the collection of tax therefrom.

Tax Global Employer Services US Expatriation rules

www.taxpublications.deloitte.co.ukresidents” who give up their green cards after 17 June 2008 are subject to the new expatriation rules under the HEART Act if they meet any of the following three tests: Net Income Tax Test – For the five-year period before expatriation, the individual had an average annual US

Transferts internationaux - Expatriation en Thailande

www.expatriation-en-thailande.comTransferts internationaux : SWIFT, IBAN ou les deux ? Nous avons été nom reux à être onfrontés lors dune expatriation en Thaïlande, aux transferts de

Green Cards and Expatriation - ttn-taxation.net

www.ttn-taxation.netGreen Cards and Expatriation Alan Winston Granwell Sharp Partners PA Washington, DC & Zurich This presentation is offered for informational purpose sonly and the

US EXPATRIATION - Frank Hirth

www.frankhirth.comabroad are now increasingly likely to return their cards rather than face the increased tax and immigration requirements facing them. The increasing ... If you are considering giving up your US citizenship or green card, our specialist expatriation team can guide you through the …

Chairman The Honorable Bill Archer Vice Chairman - gao.gov

www.gao.govand (2) a net worth of $500,000 or more on the date of expatriation.1 Expatriates found to have a tax avoidance motive are subject to special rules for U.S. income, estate, and gift taxes for a period of 10 years after the date of their expatriation.

Investing in the US: Tax Considerations for French ...

www.pbwt.comResidence Status and Expatriation • Expatriation and exit Tax: Subject to certain exceptions, the US imposes a mark-to-market exit tax on (i) US citizens who relinquish their citizenship, and (ii) “long-term residents” who give up their green cards.

U.S. Adopts Exit Tax Upon Expatriation*

www.robertsandholland.comto give up their green cards. This act, with its veto-proof name, was designed to provide tax relief for US soldiers. In order to pay for this relief, Congress imposed a new “exit tax” on Americans ... expatriation when they would still be subject to tax upon actual disposition. Other countries,

Ten Facts About Tax Expatriation - 03/23/10

www.woodllp.comPermanent U.S. residents (holding green cards) also pay U.S. tax on their worldwide income. They may find it easier to take the expatriation plunge, particularly if family or …

AKIN GUMP STRAUSS HAUER & FELD LLP Could You Be an ...

www.akingump.comAKIN GUMP STRAUSS HAUER & FELD LLP The United States is unusual among nations in that it imposes income ... individuals with green cards. An “accidental American” is an individual who, in good faith, is ... the tax implications of expatriation and developing proactive strategies around expatriation. Anta Cissé-Green

Frequently asked questions about the changing expatriate ...

www2.deloitte.com“former long-term residents” who give up their green cards after June 17, 2008 are subject to the new expatriation rules under the HEART Act if they meet any of the following three tests: • Net Income Tax Test — For the five-year period before expatriation, the individual had an average

Estate Planning Involving Resident and Non-Resident Aliens

media.straffordpub.comEstate Planning Involving Resident and Non-Resident Aliens Navigating Estate, Gift and GST Tax Rules, and ... expatriation tax would apply if he/she gives up green ... green cards before they become subject to expatriation tax. 19 .

Information retraite DES EXPATRIÉS

www.lassuranceretraite.frL’expatriation L’expatriation : règles générales En principe, c’est le droit social du pays dans lequel vous travaillez qui s’applique. Si vous travaillez en France, vous êtes soumis à la législation française. Lorsque vous travaillez à l’étranger, à moins …

Green Cards and Expatriation - ttn-taxation.net

ttn-taxation.netGreen Cards and Expatriation Alan Winston Granwell Sharp Partners PA Washington, DC & Zurich This presentation is offered for informational purpose sonly and the

2020 Instructions for Form 8854 - IRS

www.irs.govpreceding the date of your expatriation. Exception for dual-citizens and certain minors. Dual-citizens and certain minors (defined next) won't be treated as covered expatriates (and therefore won't be subject to the expatriation tax) solely because one or both of the statements in paragraph (1) or (2) above (under Covered expatriate) applies.

CCH Tax Profile - St. Thomas University

people.stu.cahold U.S. green cards (and are not currently working in the United States) ... Tax Profile 2 The United States has a voluntary disclosure program as well as a special program for foreign investments that ... from the expatriation tax, but are generally taxable in the

E-Treaty Treaty Visas Provide Long Term Immigration ...

www.abil.comE-Treaty Treaty Visas Provide Long Term Immigration Options for Investors and Traders and Promote International Trade and Commerce While Benefiting the US Economy in Creating Jobs and Infusing Capital ... Green cards based on family and employment immigrant visa ... expatriation. This new law makes the green card or United States lawful ...

Estate Planning Involving Resident and Non-Resident Aliens

media.straffordpub.comSep 20, 2012 · U.S. Legal Permanent Resident (Green Card Holder) Married to U.S. Citizen Assume they live in the U.S. Some questions to ask: •How long has LPR had green card (to determine whether expatriation tax would apply if he/she gives up green card)? •Is the LPR a U.S. domiciliary for U.S. estate and gift tax purposes?

Chapter 2: Your Job as an American Citizen Lesson 1 ...

www.stjohns-chs.orgexpatriation green card immigration immunities jurisdiction jus sanguinis jus soli naturalization ... Green Cards. The Green Card does not affect present citizenship. A Green Card holder may ... Chapter 2: Your Job as an American Citizen Lesson 1: Becoming an American Citizen …

A BNA, INC. DAILY TAX REPORT - Wood LLP

www.woodllp.comPermanent U.S. residents (holding green cards) may find it easier than U.S. citizens to take the expatriation plunge, particularly if family or business opportunities

2017 Form 8854 - irs.gov

www.irs.govForm 8854 Department of the Treasury Internal Revenue Service Initial and Annual Expatriation Statement For calendar year 2017 or other tax year beginning, 2017, and ending, 20

Current Issues in U.S. Succession Planning for ...

toclegal.comSimilarly green cards have become a burden for many people who held the card for ... referred to as expatriation. I. Compliance with U.S. Tax Obligations – The New Offshore Voluntary Disclosure Initiative – Compliance Required by 31 August 2011 .

2020 Form 1040-NR - IRS tax forms

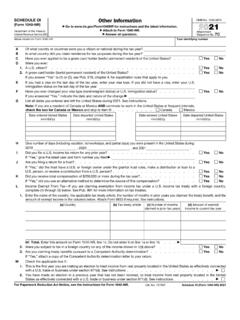

apps.irs.gov2. A green card holder (lawful permanent resident) of the United States? . . . ..... Yes No If you answer “Yes” to (1) or (2), see Pub. 519, chapter 4, for expatriation rules that apply to you. E If you had a visa on the last day of the tax year, enter your visa type. If …

2021 Schedule OI (Form 1040-NR) - IRS tax forms

www.irs.govIf you answer “Yes” to (1) or (2), see Pub. 519, chapter 4, for expatriation rules that apply to you. E If you had a visa on the last day of the tax year, enter your visa type.

Choosing to Renounce U.S. Citizenship or Legal Permanent ...

www.protaxconsulting.comyears with a green card while you are present in the U.S. or a non treaty country count towards the 8/ 15 tax year rule. If you meet the above requirements 1) or 2), the expatriation …

Tax and Succession Planning for Immigration to the United ...

www.ttn-taxation.netGreen card holders are free to live and work in the US ... “Long-term”Green Card Holders are subject to “expatriation” ... Holders of Green Cards more likely considered “domiciled”in US, despite intention to retire elsewhere. 21. Planning for Client Considering US Move

US estate and gift tax rules for resident and nonresident ...

www2.deloitte.comthe green card (even if you are living outside the US), and it is one factor considered when determining whether you are a US domiciliary. An individual who is considered domiciled in the US ... expatriation tax or “exit tax.” ...

CHAPITRE 7 - Histoire et mémoires des conflits

geopolitique.nathan.frde quitter le territoire, ce qui est vécu comme une expatriation forcée. B. La difficile articulation entre histoire et mémoires . L’histoire des décolonisations a commencé à s’écrire rapidement. En Afrique du Nord, l’historien français Charles -André Julien commence par exemple à le faire pendant la décolonisation elle- même.

ENGLISH LANGUAGE COMMUNICATION SKILLS LABORATORY

www.iare.ac.inheavy expatriation of software Engineers to different countries like U.S.A., Australia, etc…there is a need for these professionals to use effective communication skills. It is said that in the year 2002, 30,000 software engineers went to the U.S.A from the state of Andhra Pradesh.

The Nestlé Human Resources Policy

www.nestle.comExpatriation Policy Talent, development and performance management. Th estl uma esource olicy 5 Since its founding, Nestlé has built a culture based on values of trust, mutual respect and dialogue. Nestlé management and employees all over the world work daily to create and maintain

INTERNATIONAL HUMAN RESOURCE MANAGEMENT - DDCE, …

ddceutkal.ac.in5.4 Factors that Affect International Compensation 5.5 Components/Structure of International Compensation Package 5.6 Approaches to International Compensation Management 5.7 Expatriation and Repatriation Process 5.8 Summary 5.9 Key Terms 5.10 Review Questions

Our US tax service offering - msustax.com

www.msustax.comtheir green cards may be subject to the US exit tax on expatriation. We advise individuals on exit tax mitigation and their future US tax implications as non-resident aliens. We also prepare Form 8854, which is required for citizens and long-term green card holders who expatriate.

Expatriation Renouncing Your US Citizenship or Green Card

www.smtaxcpa.comExpatriation Renouncing Your US Citizenship or Green Card ... we see often are persons that obtained US Green Cards but have moved back to their ... maintained a US Green Card for less than eight years may find the expatriation process a bit easier to accomplish.

EXPATRIATION THE TRANSATLANTIC WAY: OVERVIEW OF …

publications.ruchelaw.comexpatriation date is the date on which they cease to be green card holders. Several exceptions exist for the Income Tax Liability Test and the Net Worth Test. Under one of the exceptions, neither test is met if, at birth, the Expatriate was a

Expatriation: Challenges and Success Factors of an ...

llufb.llu.lvRURAL ENVIRONMENT. EDUCATION. PERSONALITY. ISSN 2255-808X Jelgava, 12-13 May, 2017. 453 the main unit of an international company. It is noteworthy that in order to implement the expatriation

Similar queries

Third Dramatic Change in Expatriation Tax, Green Cards, Expatriation, Global Employer Services US Expatriation rules, Cards, Green, And Expatriation, Ten Facts About Tax Expatriation - 03, AKIN GUMP STRAUSS HAUER & FELD LLP, Estate Planning Involving Resident and Non, And ... expatriation, Information, Green Cards and Expatriation - ttn-taxation.net, Green Cards and Expatriation, Instructions, Form 8854, CCH Tax Profile, Tax Profile, Provide Long Term Immigration Options for Investors, Job as an American Citizen, Expatriation green, An American Citizen, IRS tax forms, Green card, Nestlé Human Resources Policy, Nestlé, Factors, Expatriation: Challenges and Success Factors