Pro-rata rule for after-tax money in an IRA

Non-deductible IRA contributions The pro-rata rule also applies to any IRAs where over the years you have made both deductible and non-deductible Traditional IRA contributions or have repaid reservist distributions. The ongoing filing of IRS form 8606, to keep track of the basis, is used to report all non-deductible contributions.

Tags:

Aarts, Contributions, Deductible, Pro rata, Deductible contributions

Information

Domain:

Source:

Link to this page:

Please notify us if you found a problem with this document:

Documents from same domain

Mortgage Assistance Document Submission …

www08.wellsfargomedia.comWells Fargo Owned, Wells Fargo Home Equity Mortgage Assistance Application Form or equivalent document (for example, Homeowners Assistance Form).

Form, Applications, Document, Assistance, Submissions, Mortgage, Assistance form, Mortgage assistance document submission, Mortgage assistance application form

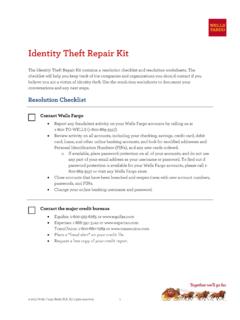

Identity Theft Repair Kit - Wells Fargo

www08.wellsfargomedia.com© 2015 Wells Fargo Bank, N.A. All rights reserved. 1 Identity Theft Repair Kit The Identity Theft Repair Kit contains a resolution checklist and resolution worksheets.

Women and Investing

www08.wellsfargomedia.com4. Five years—the amount of time that . women outlive men, on average. That’s five more years of living expenses that women may need beyond the needs of men.

Wells Fargo has taken a series of steps to address ...

www08.wellsfargomedia.comIn Progress £ Committed to satisfying the requirements of a consent order with the Board of Governors of the Federal Reserve System regarding our board’s ...

Home Wishing Checklist

www08.wellsfargomedia.comHome Wish Checklist Use this checklist to help determine the elements that are important to you as you look for a property. Print the checklist

Wells fargo Payments, Virtual Solutions, and Innovation

www08.wellsfargomedia.comWells Fargo 2017 Investor Day Payments, Virtual Solutions, and Innovation 11 From prospect to making a purchase in 5 minutes Verify new-to-bank customers with

Virtual, Solutions, Innovation, Payments, Well, Fargo, Innovation and, Wells fargo payments, Virtual solutions

Direct Deposit / Automatic Payment Information Form

www08.wellsfargomedia.comDirect Deposit / Automatic Payment Information Form The fastest, most convenient way to manage your everyday financial transactions – and it’s free! ... deposited electronically into your Wells Fargo account. • Fast– You have immediate access to your money on the day of deposit. • Safe– Never worry about checks getting lost, delayed ...

Form, Information, Direct, Payments, Automatic, Deposits, Fargo, Direct deposit automatic payment information form

Wells Fargo Today

www08.wellsfargomedia.comWells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank ailiates of Wells Fargo & Company.

Services, Well, Today, Fargo, Wells fargo, Wells fargo today

Consumer Lending Group - Wells Fargo

www08.wellsfargomedia.comConsumer Lending Group Avid Modjtabai, Senior EVP, Consumer Lending and Operations . ... 18,000 Retail Services merchants Personal Lines and Loans 1.8MM Personal lines & loans ... Dealer Services. 20 years at Wells Fargo. Wells Fargo 2016 Investor Day Consumer Lending Group 4 .

Services, Group, Well, Consumer, Retail, Lending, Fargo, Wells fargo, Retail services, Consumer lending group

Wells Fargo & Company Corporate Social Responsibility ...

www08.wellsfargomedia.comcorporate social responsibility interim report 0426 “We understand the increasing expectations for Wells Fargo to take a leadership role in addressing long-term and complex

Social, Report, Company, Corporate, Responsibility, Corporate social responsibility, Fargo, Fargo amp company corporate social responsibility

Related documents

Voya Funds Individual Retirement Account (IRA)

individuals.voya.comContributions For 2020, the maximum allowable contribution to your individual retirement accounts (deductible, non-deductible, and Roth) is the lesser of (a) $6,000 or (b) 100% of your earned income. If you are submitting a prior year contribution, the limit was set at $6,000. Age 50 or above catch-up contributions – For those who have

Fund, Retirement, Contributions, Deductible, Voya, Voya funds

Automatic Investments - Retirement Plans, Investing ...

www.fidelity.comcontributions beyond their deductible limit. ... retirement plan as part of your workplace benefits program) and you want to automatically invest your HSA payroll contributions, ... • Non-Fidelity funds: Specified fund minimum (see applicable fund prospectus) • IRAs: If investing in a fund you do not already own, $200 monthly or $600 ...

401(k) Plan - Fidelity Investments

workplacecontent.fidelity.com6 In what order are retirement contributions deducted from my check? Contributions are deducted in the following order until your election amounts or allowable limits are reached: (1) 401(k) before-tax, (2) 401(k) Roth, (3) 401(k) after-tax, and (4) Fixed and/or Variable Funds.

Product Disclosure Statement - eXpand

www.myexpand.com.au• Non-concessional contributions (made with after -tax money, eg spouse contributions or non-deductible personal contributions). • Government co-contributions. • Downsizer contributions (made after age 65 from the proceeds of selling your home). • Rollovers/transfers. Generally, it’s compulsory for employers to make contributions to ...

Retirement Annuity Fund Withdrawal Instruction

www.allangray.co.zaTotal excess contributions made by you to a provident fund before 1 March 2016: R Total excess contributions to all retirement funds made before and after 1 March 2016 (excluding the above contributions): R Please note that SARS may require proof of these contributions in the form of a copy of your latest ITA34 (Notice of Assessment) from SARS.

ANNUAL COMPENSATION PLAN for Non-Represented …

slcdocs.comA. Employer-Paid Contributions. Effective July 1, 2021, the city’s contribution toward the total premium for group medical will be 95% for the high-deductible Summit Star Plan. For employees enrolled in the high-deductible Summit Star Plan, the city will also contribute a one-time total of $750 into a qualified health savings account

2021 - Australian Taxation Office

www.ato.gov.auUnder ‘Non-deductible expenses’, list all other expenses or normally allowable deductions that you cannot claim as a deduction (for example, all expenses related to exempt current pension income should be recorded in the ‘Non-deductible expenses’ column).