Transcription of Red Meat and Poultry in Cold Storage. USDA

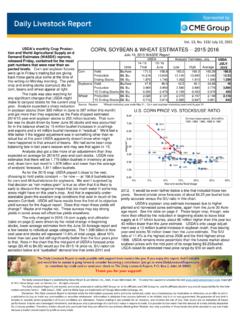

1 Vol. 13, No. 60 / March 24, 2015 usda released on Monday, March 23, the results of its monthly survey of refrigerated warehouses and we think the results have bearish implica ons for beef, pork and chicken. Below are some of this highlights from this report Total supplies of beef, pork, chicken and turkey in cold storage at the end of February were reported at billion pounds, higher than a year ago and higher than the five year average. The normal increase from January to February is about 1-2% but this year it was 6%, which could imply that a slowdown in demand coupled with larger than expected produc on pushed more product into freezers.

2 This supply will be carried forward to future consump on periods. Demand seasonally improves into the spring but the higher produc on levels and larger car-ryout stocks imply ongoing price pressures, especially for pork and chicken, the supply of which is growing at a faster pace than earlier projected. Beef cold storage inventories at the end of February were million pounds, higher than a year ago and higher than the five year average. Higher stocks of boneless beef contributed to the big jump in beef inventories.

3 We don t have detailed info as to what kind of beef this was and usda does not even tell us whether this was imported or domes c beef. Our first inclina on is to a ribute the increase in boneless beef stocks to the sharp rise in imported beef volume and the port conges- on issues in the West Coast, which caused significant disrup ons to the flow of product into commerce. The usda data does imply that this is the case. Stocks of boneless beef in the Middle Atlan c region (port of Phila-delphia is part of this) were reported at million pounds, 29 million pounds (+41%) higher than a year ago.

4 However, the total increase in boneless beef stocks was 85 million pounds and we saw a big jump in stocks in regions where there is li le imported beef (East and West North Central Regions). It appears that stocks of domes c beef trimmings in cold storage are also heavy and the depressed price of 50CL beef is evidence of that. Inventories of pork in cold storage rose 15% from the previous month when normally we see an increase of around 5-7%. Current stocks are 5% higher than a year ago and 14% higher than the five year average.

5 A larger than expected surge in pork produc on and slow exports have con-tributed to the increase in pork freezer stocks. All pork items were higher but some stand out. Pork trim inventories were million pounds, 80% higher than a year ago and higher than the five year average. The price of pork trim is down sharply and this has depressed the en re value of the carcass since you get trim credit from almost all primals. It also has lowered the grinding value for other pork cuts.

6 Belly inventories increased from the previous month and they are also higher than the five year average. Belly prices need to gain trac on into the spring and early sum-mer to give the normal seasonal boost to the pork cutout. So far, that has not been the case. Chicken cold storage stocks are also heavy. Total inventories of all chicken products were 732 million pounds, higher than a year ago and higher than the five year average. The slowdown in exports appears to be taking its toll. Inventories of leg quarters were up high-er than last year and higher than the five year average.

7 Turkey stocks at million pounds were higher than a year ago. Breast meat inventories remain limited, down from a year ago and lower than the five year average, which helps explain why prices for this item remain firm despite a significant increase in turkey produc on. Sponsored by The Daily Livestock Report is published by Steve Meyer & Len Steiner, Inc., Adel, IA and Merrimack, NH. To subscribe, support or unsubscribe visit Copyright 2014 Steve Meyer and Len Steiner, Inc. All rights reserved.

8 The Daily Livestock Report is not owned, controlled, endorsed or sold by CME Group Inc. or its affiliates and CME Group Inc. and its affiliates disclaim any and all responsibility for the informa on contained herein. CME Group , CME and the Globe logo are trademarks of Chicago Mercan le Exchange, Inc. Disclaimer: The Daily Livestock Report is intended solely for informa on purposes and is not to be construed, under any circumstances, by implica on or otherwise, as an offer to sell or a solicita- on to buy or trade any commodi es or securi es whatsoever.

9 Informa on is obtained from sources believed to be reliable, but is in no way guaranteed. No guarantee of any kind is implied or possible where projec ons of future condi ons are a empted. Futures trading is not suitable for all investors, and involves the risk of loss. Past results are no indica on of future performance. Futures are a leveraged investment, and because only a percentage of a contract s value is require to trade, it is possible to lose more than the amount of money ini ally deposited for a futures posi on. Therefore, traders should only use funds that they can afford to lose without affec ng their lifestyle.

10 And only a por on of those funds should be devoted to any one trade because a trader cannot expect to profit on every trade. The Daily Livestock Report is made possible with support from readers like you. If you enjoy this report, find if valuable and would like to sustain it going forward, consider becoming a contributor. Just go to to contribute by credit card or send your check to The Daily Livestock Report, Box 2, Adel, IA 50003. Thank you for your support! , 1,7001,8001,9002,0002,1002,2002,300 JANFEBMARAPRMAYJUNJULAUGSEPOCTNOVDECMILL ION POUNDS5-Year Average 2010 - 201420142015 Red Meat and Poultryin Cold Storage.