Transcription of Sponsored by - dailylivestockreport.com

1 Vol. 12, No. 42 / February 28, 2014 Fed cattle and lean hog futures posted significant increases yesterday on the back of strong cash livestock values and higher wholesale prices. The nearby February live cattle futures closed at an all time high of $ and prices have advanced by almost $11/cwt (+8%) in the last three weeks and 16% higher than the previous year. Packers have been ag-gressively bidding on cattle in recent days as cold weather and extremely currently supplies in feedlots have limited availability. USDA reported that packers paid anywhere between for live steer and for steer on a dressed basis. Heif-er prices were also around 150 live and 240 dressed. The recent spike in cash prices just as the futures contract was nearing expi-ration has driven the recent move in the nearby contract.

2 April and June live cattle futures were up earlier in sympathy but set-tled lower as market participants remain somewhat apprehensive about the state of beef demand going into the spring. Cattle sup-plies are expected to be seasonally higher and weather issues should not be a factor (in a normal year) after April 1. The nearby April lean hog futures contract was up some points yester-day, settling at an all time contract high of $ The rally in lean hog futures was driven in part by the sharp increase in live cattle futures but also wire reports that Russia will commence purchases of US pork on March 10. The entry of Russia, a signifi-cant buyer of US pork, at a time when pork supplies are expected to decline added to the bullish momentum in the hog futures com-plex. Russia is a significant buyer of lower value pork items, es-pecially trimmings.

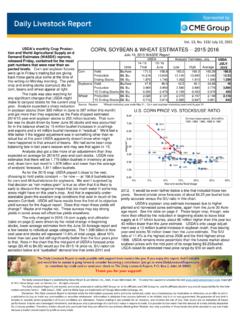

3 Pork trim inventories in storage were down as of January 31 and pork exporters that have the ability/relationships to export to Russia, and can meet the ractopamine-free requirement, have known since February 5 about the possibil-ity of the opening of the Russian market. It appears that staging product in order to ship in March already has started and we think this has contributed to the big increase in pork trim values. The price of 72CL pork trim last night closed above $100/cwt, 65% higher than the same period a year ago. Tight livestock supplies so far appear to have met a somewhat inelastic demand, mostly on the retail end. The charts to the right show the big increases in pork and beef cutout values (cutout is a weighted average of wholesale beef prices).

4 What is interesting, in our view, is the items that account for much of the increase in wholesale prices. In the case of beef, in-creases in the price of round and chuck prices have accounted for about 2/3 of the overall increase in the value of the choice beef cutout. Chucks and rounds are traditionally retail items. Ground beef prices are also sharply higher and all this points to the fact that retail sales, at least in the short term, remain strong. The big questionmark remains what happens when retailers are forced to raise prices. Different from foodservice operators, retailers are able to change prices more quickly, and when they do prices tend to stay up for a while. Maybe consumers, forced to stay at home during long, cold winter nights, were willing to pay up for beef roasts and pork chops (see pork loin primal).

5 Warmer weather and higher prices will eventually ration out the quantity demand-ed. For now, however, packers are forced to pay up and retailers are forced to take the price increases. Sponsored by The Daily Livestock Report is published by Steve Meyer & Len Steiner, Inc., Adel, IA and Merrimack, NH. To subscribe, support or unsubscribe visit Copyright 2013 Steve Meyer and Len Steiner, Inc. All rights reserved. The Daily Livestock Report is not owned, controlled, endorsed or sold by CME Group Inc. or its affiliates and CME Group Inc. and its affiliates disclaim any and all responsibility for the informa on contained herein. CME Group , CME and the Globe logo are trademarks of Chicago Mercan le Exchange, Inc. Disclaimer: The Daily Livestock Report is intended solely for informa on purposes and is not to be construed, under any circumstances, by implica on or otherwise, as an offer to sell or a solicita- on to buy or trade any commodi es or securi es whatsoever.

6 Informa on is obtained from sources believed to be reliable, but is in no way guaranteed. No guarantee of any kind is implied or possible where projec ons of future condi ons are a empted. Futures trading is not suitable for all investors, and involves the risk of loss. Past results are no indica on of future performance. Futures are a leveraged investment, and because only a percentage of a contract s value is require to trade, it is possible to lose more than the amount of money ini ally deposited for a futures posi on. Therefore, traders should only use funds that they can afford to lose without affec ng their lifestyle. And only a por on of those funds should be devoted to any one trade because a trader cannot expect to profit on every trade. The Daily Livestock Report is made possible with support from readers like you.

7 If you enjoy this report, find if valuable and would like to sustain it going forward, consider becoming a contributor. Just go to to contribute by credit card or send your check to The Daily Livestock Report, Box 2, Adel, IA 50003. Thank you for your support! $2$7$10$12$2$1$1$35 - 10 20 30 40 Primal RibPrimal LoinPrimal ChuckPrimal RoundPrimal BrisketShort PlatePri mal Fl an kChoice CutoutFebruary 27, 2014 vs. February 28, 2013$/cwtY/Y Change in CHOICE BEEF Cutout & PrimalValue, $/cwt$1$3$6$3$2$1$5$22 - CutoutY/Y Change in PORK Primal & CutoutValue , $ /CWT $/cwtFe bruary 27, 2014 vs. Fe bruary 28, 2013