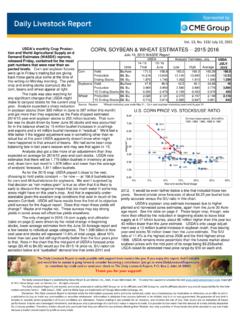

Transcription of Vol. 13, No. 190 / September 30, 2015 - Daily Livestock Report

1 Vol. 13, No. 190 / September 30, 2015 Hog futures rallied on Monday and Tuesday on account of high-er prices paid in the cash market and also higher cutout values. The pork cutout on Tuesday was quoted at $ , about $ higher than a week ago. Cash hog prices also have rallied in the last few days and this has caused market par cipants to feel more confident about demand in the hog market. However, despite the bullish tone in the hog complex at this point, a few cau ous notes are in order. We think it helps no ng the sea-sonality of hog prices in the second half of September . The chart to the right shows the five year seasonal factor for cash hogs (we use the IA/MN base) and compares it to the actual price paid for IA/MN cash hogs this year.

2 Earlier in the year cash hog prices declined much more than the sea-sonal trend would suggest as short term supplies were burdensome. But as the glut of hogs/pork was cleaned up, markets bounced higher in line with the normal seasonal trend. Since summer, it has been quite remarka-ble how closely cash hog prices have followed the seasonal trend. And that includes the last few weeks when, as if on cue, prices have moved higher. Seasonally, however, hog prices dri lower in Q4. Not so much because demand is weak but rather because the significant seasonal increase in pork produc on. Hog slaughter so far has not surpassed million head. And producers have managed to stay current as evidenced in the weight of hogs coming to market.

3 But as we move into October, hog slaughter is expected to ramp up. The inventory of hogs 120 pounds to 179 pounds was reported by USDA up 8% compared to a year ago. This would imply a few weeks in late October and early November at or even slightly above million head. The chart to the right by Steve Meyer illustrates the implied weekly hog slaughter for the remainder of 2015 and through the spring and summer of 2016. The large hog slaughter numbers will come at a me when hog carcass weights also are seasonally higher. Fresh corn and cool weather induces hogs to perform be er during this me of year and it is not a ma er of if but when and hog much hog weights will move up in Oc-tober and November.

4 Currently hog futures for December are priced near $67/cwt, a $7 discount to the October contract. The spread between these two contracts has increased since early September , largely because market par cipants have been surprised by the strength in cash hog markets. The spread also indicates that market par cipants also expect heavy supplies in late October and November to pressure hog values later in the year. Exports remain a key driver for the hog market in 2016. Earlier this year there were reports of strong demand likely developing in China, which would help bolster US exports to that market. So far, however, US exports to China have been higher than the extremely low levels last year but nowhere close to what many in the market expected.

5 Recent reports from China show that their imports are up but the main beneficiary of those higher imports has been the European Union. How slaughter in 2016 is expected to be steady to slightly higher than in 2015 but futures are cur-rently pricing a modest price increase compared to 2016, and we suspect be er export demand is factored in these projec ons. Sponsored by The Daily Livestock Report is published by Steve Meyer & Len Steiner, Inc., Merrimack, NH. To subscribe, support or unsubscribe visit Copyright 2015 Steve Meyer and Len Steiner, Inc. All rights reserved. The Daily Livestock Report is not owned, controlled, endorsed or sold by CME Group Inc. or its affiliates and CME Group Inc.

6 And its affiliates disclaim any and all responsibility for the informa on contained herein. CME Group , CME and the Globe logo are trademarks of Chicago Mercan le Exchange, Inc. Disclaimer: The Daily Livestock Report is intended solely for informa on purposes and is not to be construed, under any circumstances, by implica on or otherwise, as an offer to sell or a solicita- on to buy or trade any commodi es or securi es whatsoever. Informa on is obtained from sources believed to be reliable, but is in no way guaranteed. No guarantee of any kind is implied or possible where projec ons of future condi ons are a empted. Futures trading is not suitable for all investors, and involves the risk of loss.

7 Past results are no indica on of future performance. Futures are a leveraged investment, and because only a percentage of a contract s value is require to trade, it is possible to lose more than the amount of money ini ally deposited for a futures posi on. Therefore, traders should only use funds that they can afford to lose without affec ng their lifestyle. And only a por on of those funds should be devoted to any one trade because a trader cannot expect to profit on every trade. The Daily Livestock Report is made possible with support from readers like you. If you enjoy this Report , find it valuable and would like to sustain it going forward, consider becoming a contributor. Just go to to contribute by credit card or send your check to The Daily Livestock Report , Box 4872, Manchester, NH 03018 Thank you for your support!

8 Source: Steve Meyer, EMI Analytics. Published in National Hog Farmer. Feb Mar Apr May Jun Jul Aug Sep Oct Nov DecHog Carcass Weights, 5-day Moving Average, Producer OwnedBase on Daily MPR Report , LM_HG201. Updated through September 28, 20152014201320122015 Comparing Cash Hog Seasonal to Current Cash Hog SEASONAL FACTORIA/MN Lean Hog Carcass Seasonal (left)IA/MN Lean Hog Carcass 2015 Price (right)