Internal Revenue Service Estimated Tax On Unrelated Business Taxable Income

Found 8 free book(s)2019 Instructions for Form 1120 - Internal Revenue Service

www.irs.govThe Internal Revenue Service is a proud partner with the National Center for Missing & Exploited Children® (NCMEC). ... Estimated Tax Payments. Interest and Penalties. Accounting Methods. ... with unrelated trade or business income 990-T Religious or apostolic organization exempt under section 501(d) 1065

2020 Minnesota Corporation Franchise Tax

www.revenue.state.mn.usExempt organizations file Form M4NP, Unrelated Business Income Tax Return. ... If the Internal Revenue Service (IRS) grants an extension of time to file your federal return that is longer than the Minnesota automatic seven- ... If, during the 12 months ending June 30 of the tax year, you paid $10,000 or more in estimated tax payments, you are ...

Form MO-1120 Instructions - Missouri Department of Revenue

dor.mo.govfrom federal income tax. The preceding sentence shall notexempt apply to unrelated business taxable income and other income on which Chapter 1 of the Internal Revenue Code imposes the federal income tax or any other tax measured by income; Note: Any corporation filing a Federal Form 990, 990EZ, 990N, or

CIFT-620 (1/19) Department of Revenue • Page 21 GENERAL ...

revenue.louisiana.govorganization that has income from an unrelated trade or business and files Federal Form 990-T with the Internal Revenue Service is subject to file and report its Louisiana-sourced unrelated business income to Louisiana. Louisiana Administrative Code (LAC) 61:I.1140 and Revenue Information Bulletin 09-009

Forms and Instructions

otr.cfo.dc.govgranted an exemption by the DC Office of Tax and Revenue (OTR). If you are an exempt organization with unrelated business income, as defined in the Internal Revenue Code (IRC) §512, you must file a Form D-20, by the 15th day of the fifth month after the end of your tax year. You are required to pay at least the minimum tax even if

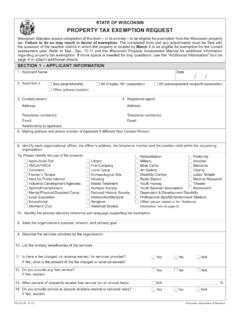

STATE OF WISCONSIN PROPERTY TAX EXEMPTION REQUEST

www.revenue.wi.gov5. Part II of Form 1023 (Application for Recognition of Exemption) filed with the Internal Revenue Service. 6. Form 990 (Return of Organization Exempt from Income Tax). 7. Form 990T (Exempt Organization Business Income Tax Return). 8. Ordination papers for the occupants if the Subject Property is to be considered eligible as housing for pastors and

2021 Publication 225 - Internal Revenue Service

www.irs.govInternal Revenue Service Publication 225 Cat. No. 11049L Farmer's Tax Guide For use in preparing 2021 Returns Acknowledgment: The valuable advice and assistance given us each year by the National Farm Income Tax Extension Committee is gratefully acknowledged. Get forms and other information faster and easier at: •IRS.gov (English)

2016 Form 568 Limited Liability Company Tax Booklet

www.ftb.ca.govPayments and Credits Applied to Use Tax – For taxable years beginning on or after January 1, 2015, if an LLC includes use tax on its income tax return, payments and credits will be applied to use tax irst, then towards franchise or income tax, …

Similar queries

Internal Revenue Service, Estimated tax, Unrelated, Business income, Unrelated Business Income Tax, Missouri, Revenue, Income tax, Unrelated business taxable income, Income, Internal Revenue, Business, Unrelated business income, PROPERTY TAX EXEMPTION REQUEST, Business Income Tax, Farmer's Tax Guide, 568 Limited Liability Company Tax Booklet, Taxable