Retirement plan contribution form

Found 31 free book(s)PENSION PLAN CONTRIBUTION TRANSMITTAL FORM

www.accantors.orgSubject: ACC Retirement Plan Contributions & Annual Contribution Calculation Form Retirement Contributions Contributions to the ACC Retirement Plan for the benefit of cantors, rabbis and GTM members should be made directly to

PPD Retirement Savings Plan Rollover Contribution Form ...

wwwrs.massmutual.comPPD Retirement Savings Plan Rollover Contribution Form Plan ID 990500107 Enclosed are the items needed to make a rollover contribution to the PPD Retirement Savings Plan.

Business for Small Plans Retirement

www.irs.govfined contribution plan is $54,000 for 2017 and increases to $55,000 for 2018. ... To take the credit, use Form 8881, Credit for Small Employer Pension Plan Startup Costs. Retirement savings contributions credit. ... Key Retirement Plan Rules for 2017 Type of

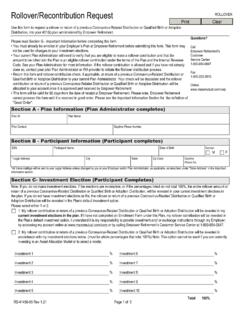

Rollover Contribution Form

retirementsolutions.financialtrans.comRollover Contribution Form. Section C- Investment Election (Participant Completes) Please select either 1 or 2. 1. My rollover contribution will be invested in my . ... or an eligible retirement plan which qualifies this contribution as an eligible rollover; (2) the prior plan or IRA has satisfied such requirements as the Plan may have ...

USE THIS FORM IF YOU ARE TRYING TO RETIREMENT …

ndpers.nd.govemployment of a defined contribution plan member form if you don't have ALL OF THE INFORMATION REQUIRED FOR THE DESIGNATION OF BENEFICIARY FORM. It is more important for NDPERS to get the Retirement Membershi p Application--the Designation

ResCare, Inc. Retirement Savings Plan #610095 Contribution ...

boluicdn.benefits.ml.comContribution Form 2. Rollover Description 1. ... ˇ I have not yet enrolled in the ResCare, Inc. Retirement Savings Plan and have not yet made any investment selections or wish to have my rollover contribution invested differently than the investment selections on file.

EMPLOYEE CONTRIBUTION TO VOLUNTARY RETIREMENT …

www.asusystem.eduEMPLOYEE CONTRIBUTION TO VOLUNTARY RETIREMENT PLAN BY THIS AGREEMENT, made between _____ (the Employee) and Arkansas State ... new election form to Human Resources. With respect to the 403(b) Plan amounts, I can change my contribution at any time. Changes in 457(b) elections must be made prospectively, before the beginning of the pay period.

Employer-Sponsored Retirement Plan Contribution

individual.troweprice.comIf a contribution is included for a new participant, register the participant on Plan Sponsor Web or attach an Employer-Sponsored Retirement Plan Participant Account form.

Rollover Contribution Form Instructions - Crossmark

welcome.crossmark.comRollover Contribution Form Instructions Enclosed are the items needed to make a rollover contribution to the CROSSMARK 401(k) Retirement Plan. • Please carefully review and complete each of the items as described in the procedures below.

Lord & Taylor 401(k) Retirement Rollover Savings Plan ...

boluicdn.benefits.ml.comRollover Contribution Form Continued 2. Rollover Description 1. Check Appropriate Box. All checks must be made payable to the: “ Trustee for Lord & Taylor 401(k) Retirement Savings Plan ,

CWA Savings & Retirement Trust Rollover Contribution Form ...

wwwrs.massmutual.combefore the date your rollover contribution is received by the Plan. However, this requirement can be waived in some hardship circumstances, in accordance with IRS guidance, under a new IRS relief process, and under new federal law, discussed in this form.

Income – Retirement Income; Form 1040, Lines 15-16

apps.irs.gov12-4 Income – Retirement Income; Form 100, ines 15-1 If the taxpayer made all contributions to a plan with after-tax dollars, then the distributions will be partially taxable. The portion of the distribution that is considered a return of the after-tax dollars will not be taxed

2018 Form 8880 - Internal Revenue Service

www.irs.govForm 8880 Department of the Treasury Internal Revenue Service ... The person(s) who made the qualified contribution or elective deferral (a) was born after January 1, 2001; (b) is claimed as a ... qualified retirement plan, as defined in section 4974(c) (including the

Virginia Retirement System Designation of Beneficiary ...

www.bvps.orgNov 12, 2018 · Please be aware that designations made on this form only apply to the defined contribution component of the Hybrid Retirement Plan and do not impact designations you may make for the defined benefit component, which you must do separately.

RETIREMENT PLAN CONTRIBUTION FORM - netxpro.com

www.netxpro.comI. EMPLOYER/PARTICIPANT ACCOUNT NUMBER ACCOUNT NUMBER: II. SELECT PLAN TYPE (For participant IRA contributions to SEP/SARSEP accounts, use the IRA Contribution Form or the Asset Movement Authorization Form) 401(k) PROFIT SHARING PLAN SIMPLE IRA SEP 403(b)(7) MONEY PURCHASE PENSION PLAN/TARGET BENEFIT PLAN SIMPLE 401(k) SARSEP

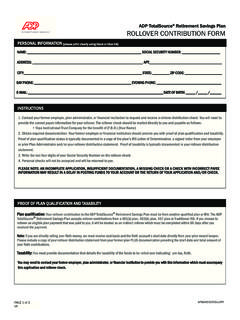

ADP Rollover Contr

adptotalsource.voya.comPlan qualification:Your rollover contribution to the ADP TotalSource ® Retirement Savings Plan must be from another qualified plan or IRA. The ADP The ADP TotalSource ® Retirement Savings Plan accepts rollover contributions from a 401(k) plan, 403(b) plan, 457 plan or Traditional IRA.

401(k) Plan Rollover Contribution Form - Insperity

retirementdocs.insperity.comRollover Contribution Form Please complete this Form to accompany your rollover contribution check into the receiving 401(k) plan listed below (“Plan”). You MUST complete each section before your rollover contribution can be processed.

Employee Contribution Election Form

retirementsolutions.financialtrans.comEmployee Contribution Election Form for Plans with Roth Savings Features Note: This form should be submitted only to your employer. Section 1 Section 2 Employer’s Name: ... contribution to the plan and defer % or deduct $ from each pay check as a Roth contribution to the plan.

Contribution Rate Change Form - Retirement Plan Consultants

retirementplanconsultants.netContribution Rate Change Form Fax this form to 402.379.3818 or mail to RPC LLC, PO Box 1264, Norfolk, NE 68702 or email to admin@retirementplanconsultants.net. Questions?

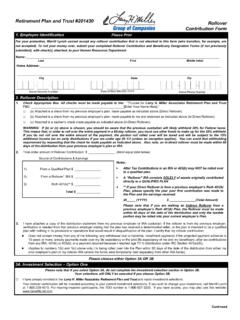

Retirement Plan and Trust #201430 Rollover Contribution Form

docs.lhm.coRollover Contribution Form Continued 2. Rollover Description 1. Check Appropriate Box. All checks must be made payable to the: “ Trustee for Larry H. Miller Associates Retirement Plan and Trust

Fidelity Investment-Only Retirement Account Contribution …

www.fidelity.comContribution Form Use this form to allocate contributions to your Fidelity Investment-Only Retirement Account(s) (also known as the Fidelity Non- Prototype Retirement Account).Type on screen or fill in using CAPITAL letters and black ink.

DISTRIBUTION REQUEST FORM - T. Rowe Price

dsttrac.troweprice.comYou may roll over the payment to either an IRA (an individual retirement account or individual retirement annuity) or an employer plan (a tax- qualified plan, section 403(b) plan, or governmental section 457(b) plan) that will accept the rollover.

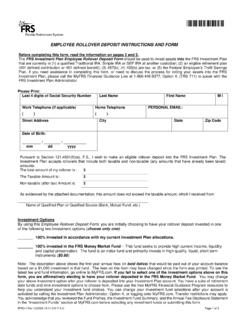

FRS INVESTMENT PLAN CONTRIBUTION ROLLOVER FORM

www.myfrs.complan and can be rolled into the plan, send a copy of the distribution statement/payment confirmation, IRS Form 1099-R, or letter that you received from your prior employer plan or …

Self-Employed 401(k) — Contribution Remittance Form

www.fidelity.comQuestions? Go to Fidelity.comsmallbusiness or call 00-343-34. 1.785683.106 Page 1 of 1 032610101 Self-Employed 401(k) — Contribution Remittance Form Use this form to submit contribution deposits to your Fidelity Self-Employed 401(k) Plan account(s).

Introduction Objectives Topics - Internal Revenue Service

apps.irs.govIncome – Retirement Income; Form 1040, Lines 15-16 ... Introduction Objectives Topics This lesson will help tax preparers identify and report the taxable portion of the taxpayer’s retirement income. Identify how retirement ... A tax-sheltered retirement savings plan set up by the taxpayer.

about tHe desiGnation of beneficiary form

www.state.nj.usdefined contribution retirement proGram (dcrp) instructions for completinG tHe desiGnation of beneficiary form item 1: Indicate Your Contribution Program — Check the appropriate box of the contribution program of which

PAYROLL DEDUCTION AGREEMENT FORM - files.agfinancial.org

files.agfinancial.orgplan contribution types All contributions to the 403(b) plan, whether deferred from taxes or after-tax deposits, will be from qualifying ministry earned income and are subject to legal limits.

2018 Catch-Up Contribution Authorization 401(k) Retirement ...

www.slavic401k.comAs a participant in the 401(k) Retirement Plan, if you will be age 50 or older by 12/31/18 you will be permitted to make an additional salary contribution of up to $6,000 in 2018.

Retirement Plan Acknowledgement Form

workplacecontent.fidelity.comRetirement Plan Acknowledgement Form, front, Jan 2014 . Retirement Plan Acknowledgement Form . As a University of Arkansas employee, you are required by …

CONTRIBUTION AND LOAN REPAYMENT REMITTANCE FORM

abaretirement.comsection 4is for loan repayments.Mailthe original,signed form to the address shown above.For section 2,Contribution Type/Amounts:Enter the contribution dollar amountin the appropriate “Contribution Type” column.Refer to your plan’s Adoption Agreement ifyou are unsure as to which types are allowed under your plan.

CONTRIBUTION FORM FOR ONE EMPLOYEE

files.agfinancial.orgIf all required information is not included on the form, the contribution and coupon will be returned without processing. IRS and MBA Plan rules restrict when amounts contributed to a 403(b) plan …

Similar queries

Plan contribution, Form, Retirement Plan, Contribution, Form Retirement, Retirement Savings Plan Rollover Contribution Form, Retirement Savings Plan Rollover Contribution Form Plan, Retirement, Plan, Contribution plan, CONTRIBUTION FORM, YOU ARE TRYING TO RETIREMENT, ResCare, Inc. Retirement Savings Plan, EMPLOYEE CONTRIBUTION TO VOLUNTARY RETIREMENT, EMPLOYEE CONTRIBUTION TO VOLUNTARY RETIREMENT PLAN, Employer-Sponsored Retirement Plan Contribution, Rollover Contribution Form Instructions, Lord & Taylor 401(k) Retirement, CWA Savings & Retirement Trust, Income – Retirement Income; Form 1040, Lines, Form 8880, Internal Revenue Service, RETIREMENT PLAN CONTRIBUTION FORM, ADP Rollover Contr, 401(k) Plan Rollover Contribution Form, Employee Contribution Election Form, Contribution Rate Change Form, Rollover Contribution Form, Fidelity Investment-Only Retirement Account Contribution, Fidelity Investment-Only Retirement Account, DISTRIBUTION REQUEST FORM, FRS INVESTMENT PLAN CONTRIBUTION, Self-Employed 401(k) — Contribution Remittance Form, Introduction Objectives Topics, Contribution retirement, Retirement Plan Acknowledgement Form