Search results with tag "Nqdc"

Payroll Tax rePorTing for conTribuTions To nqdc deferred ...

www.lockton.comEECUTIVE BENEFITS PRACTICE L2C.2TN FINANCIAL ADVIS2RS Payroll Tax rePorTing for conTribuTions To nqdc deferred comPensaTion Plans Tax reporting for contributions

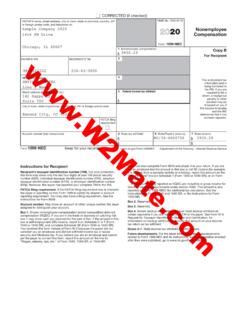

2017 Form 1099-MISC

www.irs.govdeferred compensation (NQDC) plan that is subject to the requirements of section 409A, plus any earnings on current and prior year deferrals. Box 15b. Shows income as a nonemployee under an NQDC plan that does not meet the requirements of section 409A. This amount is also included in box 7 as nonemployee compensation.

W2 Mate – Sample PDF 1099-NEC Form - realtaxtools.com

cdn.realtaxtools.comThe amounts being reported as NQDC are includible in gross income for failure to meet the requirements under section 409A. This amount is also reported on Form 1099-MISC for additional tax calculation. See the Instructions for Forms 1040 and 1040-SR, or the Instructions for Form 1040-NR. Box 2. Reserved. Box 3. Reserved. Box 4. Shows backup ...

2021 Form 1099-MISC - IRS tax forms

www.irs.govShows income as a nonemployee under an NQDC plan that does not meet the requirements of section 409A. Any amount included in box 12 that is currently taxable is also included in this box. Report this amount as income on your tax return. This income is also subject to a substantial additional tax to be reported on Form 1040, 1040-SR, or 1040-NR.

P I T 409A F D C JDand Lee Nunn - aon.com

www.aon.comNONQUALIFIED DEFERRED COMPENSATION REPORTING AND WITHHOLDING / 65 working for the enterprise that is reporting the NQDC.2 An important exception is when the recipient is a beneficiary (e.g., the surviving spouse) or an alternate payee (e.g., a former spouse under a domestic relations order).Reports for these recipients are made using Form 1099-MISC.3 Another

RETIREMENT & BENEFIT PLAN SERVICES Workplace Insights

www.benefitplans.baml.comNONQUALIFIED DEFERRED COMPENSATION PLANS | 4 Employers are in the best position to oversee the timing, amount and tax calculations for NQDC distributions.