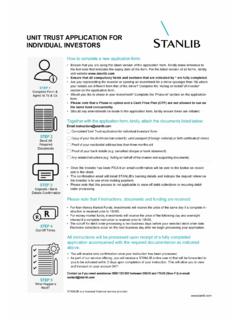

Transcription of Direct Unit Trusts Investment Form - STANLIB

1 E-mail 0867 277 516 Direct unit Trusts : Retirement ProductsNew Investment ApplicationRegistration details: Classic Retirement Annuity Fund Registration number 12/8/34304 (SARS Registration number 18/20/4/41660), Classic Preservation Pension Plan Registration number12/8/34312 (SARS Registration number 18/20/4/39087), Classic Preservation Provident Plan Registration number 12/8/34309 (SARS Registration number 18/20/4/041659)A Daily cut-off time for fully completed instructions received by STANLIB is before 15H30 on any business completed instructions to STANLIB : E-mail: or Fax: +27(0) 867 277 516 PRODUCT TYPE CLASSIC RETIREMENT ANNUITYFUND CLASSIC PRESERVATIONPENSION PLAN CLASSIC PRESERVATIONPROVIDENT PLANINSTRUCTION TYPE CASH Investment TRANSFER FROM ANEMPLOYER FUND TRANSFER FROM ANOTHERRETIREMENT ANNUITY /PRESERVATION FUNDIMPORTANT INFORMATIONAll sections applicable to this Investment must be completed in full and in block letters; all options must be indicated by a cross (X).

2 Failure toprovide clear instructions will delay submit the Instruction together with the following documents:Certified or verified Identity document/ valid passport/ valid asylum seekers permit/ valid work permitDiscretionary FSP client mandate, if applicableFor a unit transfer request, a recent statement from the transferring administratorRelated party annexure, if applicable**Each related party (beneficial owner, controller, signatory, power of attorney holder) to this Investment account must complete a related party annexure available on STALIINV2452018/08/17Z42B62 Page 1 of 9 < - - P a g e B r e a k - - >CLIENT TYPE* INDIVIDUAL FOREIGN INDIVIDUAL INSOLVENT ESTATE REFUGEE ESTATE LATE (DECEASEDESTATE) ASYLUM SEEKER SOLE PROPRIETOR ASSISTED PERSONAL SERVICE PROVIDER DIRECTOR OF A PRIVATECOMPANY/ MEMBER OF A CC*Compulsory fieldsCLIENT DETAILSTITLE*NAME/S*SURNAME*ID/ PASSPORT/ ASYLUM NUMBER*PASSPORT EXPIRY DATE (IFPASSPORT NUMBER IS PROVIDED)*--DDMMYYYY PASSPORT COUNTRY OF ISSUE (IFPASSPORT NUMBER IS PROVIDED)*DATE OF BIRTH*--DDMMYYYY GENDER* FEMALE MALECELLPHONE NUMBER*TELEPHONE NUMBER (H)TELEPHONE NUMBER (W)EMAIL ADDRESS* **TAX REFERENCE NUMBER* COUNTRY OF RESIDENCECOUNTRY OF BIRTH*NATIONALITY** Compulsory fields** Please note that where possible our correspondence to you will be sent by emailINDUSTRYCODE* Please provide the code number which applies as per the list below1.

3 Government, state ownedenterprise, armed forces5. Politics9. Administrative and supportservice 13. Professional, scientific, technicaland education17. Information, technology andcommunication 2. Gambling6. Mining and quarrying10. Agriculture, forestry andfishing14. Electricity, water, gas supply andwaste management18. Manufacturing, wholesale orretail 3. Non-profit / religious organisation7. Motor vehicles, transportation,distribution 11. Arts, entertainment,hospitality15. Financial, Investment and insurance4. Real estate8. Unemployed12. Construction16. Human health and social workactivities* Compulsory fields STALIINV2452018/08/17Z42B62 Page 2 of 9 < - - P a g e B r e a k - - >OCCUPATIONCODE* Please provide the code number which applies as per the list below1.

4 Executive / General 4. Management7. Self employed 10. Clerical support 2. Heads of government / cabinet minister / judges5. Professional8. Unemployed11. Craft and trades worker3. Traditional leader / royal family6. Religious leader9. Technician, Sales or Services12. General Staff* Compulsory fieldsSOURCE OF INCOMECODE* Please provide the code number which applies as per the list below1. Gifts / inheritance / winnings 4. Passive income (Rental, Dividends, Interest) 7. Retirement / insurance pay out 2. Trade / business5. Savings8. Salary / bonus3. Credit6. Child / spousal support refund* Compulsory fieldsPURPOSE OF INVESTMENTCODE* Please provide the code number which applies as per the list below1. Start and expand a business2. Education savings3. Foreign exchange hedging 4. Save for retirement / financial goals**5.

5 Winding up estate* Compulsory fieldsADDRESS DETAILSPHYSICAL ADDRESSCOMPLEX/ unit /NUMBER COMPLEX NAMESTREET NUMBER STREET NAME*SUBURB* CITY*COUNTRY* POSTAL CODE**Compulsory fieldsPOSTAL ADDRESS SAME AS PHYSICAL ADDRESSADDRESS TYPE PO BOX PRIVATE BAG POSTNETSUITE POSTNET SUITE NUMBERNUMBER POST OFFICE NAME POSTALCODEINVESTMENT DETAILSC lassic Retirement Annuity Fund: minimum Investment amount is R25 for a lump sum or per month / R6 per annumfor a recurring Preservation Pension Plan and Classic Preservation Provident Plan: minimum Investment amount is R25 for a lump investments are not RETIREMENT AGERETIREMENT ANNUITY INVESTMENTSINVESTMENT BY LUMP SUM RECURRINGMETHOD OF PAYMENT ELECTRONIC FUND TRANSFER(EFT) ONCE OFF DEBIT CASH TRANSFER* unit TRANSFER* REPURCHASE FROM STANLIBUNIT TRUSTSTANLIB unit TRUSTENTITY NUMBERINVESTMENT AMOUNT* Please complete the transfer details section below.

6 Please note, once off debits will be debited from the specified bank account when we have finished processing this instruction. STALIINV2452018/08/17Z42B62 Page 3 of 9 < - - P a g e B r e a k - - >PRESERVATION PLAN INVESTMENTSMETHOD OF PAYMENT CASH TRANSFER* unit TRANSFER*ESTIMATED TOTAL INVESTMENTAMOUNT* Please complete the transfer details section below. Please note, once off debits will be debited from the specified bank account when we have finished processing this instruction. TRANSFER DETAILS: PRESERVATION PLANS AND RETIREMENT ANNUITY TRANSFERSName of AdministratorAccount NumberProduct TypeEstimated AmountRRRRRETIREMENT ANNUITY: RECURRING INVESTMENTRECURRING AMOUNTRECURRING DEBIT ORDERFREQUENCY MONTHLY ANNUALLY RECURRING DEBIT ORDER DAY 1ST 15 THYou must send us this instruction at least five business days prior to your specified debit date for the instruction to take effect in the current instructions received after this will take effect in the following ORDER START MONTH-MMYYYYANNUAL CONTRIBUTION INCREASEPERCENTAGE 0% 5% 10% 15% 20%PHASE-IN OPTIONWe give you the option to gradually invest some or all of your initial Investment in the Investment portfolios you have chosen over a 3, 6, 9, 12, or24 month period.

7 Where the phase-in option has been selected, the specified initial Investment amount will be held in a Standard Bank call accountand switched into the Investment portfolios over the frequency you would like to make use of this option, please indicate your preferences below, and provide the percentage of your Investment you would liketo phase-in, in the Phase in Call account option in the portfolio list. DO YOU WANT TO PHASE-IN? YESNUMBER OF PHASE-IN MONTHS 3 6 9 12 15 18 24 PHASE-IN DAY 3RD OR 17TH OF THE MONTHFIRST PHASE-IN MONTH-MMYYYYPORTFOLIOSA maximum of 12 portfolios is allowed. Portfolio NameClassLump sumPercentageRecurring Percentage PHASE-IN CALL ACCOUNT% STANLIB Absolute Plus FundB1%% STANLIB Aggressive Income FundB1%% STANLIB Balanced FundB1%% STANLIB Balanced Cautious FundB1%% STANLIB Enhanced Yield Fund A%% STANLIB European Equity Feeder FundB1%% STALIINV2452018/08/17Z42B62 Page 4 of 9 Portfolio NameClassLump sumPercentageRecurring PercentageSTANLIB Extra Income FundR%% STANLIB Flexible Income FundB1%% STANLIB Global Balanced Feeder FundB1%% STANLIB Global Bond Feeder FundB3%% STANLIB Global Equity Feeder FundB1%% STANLIB Global Property Feeder FundB1%% STANLIB Income FundR%% STANLIB Institutional Money Market FundB13%% STANLIB Property Income FundB1%%STANIB Multi-Manager Absolute Income FundB1%% STANLIB Multi-Manager Balanced FundB1%% STANLIB Multi-Manager

8 Defensive Balanced FundB1%% STANLIB Multi-Manager Diversified Equity Fund of FundsB1%% STANLIB Multi-Manager Global Equity Feeder FundB1%% STANLIB Multi-Manager High Equity Fund of FundsB1%% STANLIB Multi-Manager Low Equity Fund of FundsB1%% STANLIB Multi-Manager Medium Equity Fund of FundsB1%% STANLIB Multi-Manager Medium-High Equity Fund of FundsB1%% STANLIB Multi-Manager Real Return FundB1%% STANLIB Multi-Manager Shari'ah Balanced Fund of FundsB1%%TOTAL100%100%PHASE-IN PORTFOLIOSP lease indicate the portfolios into which you would like to phase in belowPortfolio NamePercentage%%%%%%%%TOTAL100%STALIINV2 452018/08/17Z42B62 Page 5 of 9 < - - P a g e B r e a k - - >RETIREMENT ANNUITY: BANK DETAILSD etailsRecurring debit OrderOnce off DebitSAME AS SAME AS RECURRING DEBITORDERBANKBRANCHBRANCH CODEACCOUNT NUMBERACCOUNT TYPEACCOUNT HOLDER'S NAMEACCOUNT HOLDER ID/REGISTRATIONNUMBERThe bank account holder hereby authorises STANLIB to make Direct debits against the bank account providedSIGNATURE OF BANK ACCOUNT HOLDER/AUTHORISED SIGNATORY *Please supply FICA documents for the bank account holder if they are a third party and not the investor.

9 Please refer to the FICA requirements list for details. For a legal entity please alsosupply a bank mandate specifically the authorised signatories on the bank account and the minimum number of signatures NOMINATION FOR FEE DEDUCTIONS Fee accountYou can choose to have your STANLIB annual service charge, financial adviser annual ongoing service charge and model portfolio management fee(as applicable) deducted from one or more Investment portfolio(s) in your account. If you would like to make use of this option, please specify theportfolios you do not specify a fund to deduct fees from, it will be deducted as follows:1. From any money market or call accounts in your Investment If you don t have the above, then money will be deducted proportionately from all the unit trust funds in your Investment (s) Selected For Ongoing Fee DeductionsBENEFICIARY NOMINATIONA nominated beneficiary is a person who you nominate to receive a portion of the death benefit from your account should you pass away.

10 Thisperson does not need to be financially dependent on NumberID/Passport NumberRelationship toInvestorPercentage%%%%TOTAL100% STALIINV2452018/08/17Z42B62 Page 6 of 9 < - - P a g e B r e a k - - >DEPENDANTSA dependant is any person who depends on you for financial support. Please specify these persons below, including your spouse and all yourchildren, who are automatically classified as NumberID/Passport NumberRelationship toInvestorPercentage%%%%TOTAL100%FINANCI AL ADVISER DETAILS DetailsFinancial Adviser 1 Financial Adviser 2 FINANCIAL SERVICE PROVIDER NAMEFINANCIAL ADVISER NAMESTANLIB IDFEE SPLIT*%%*Fee Split: Only available to financial advisers from the same Financial Service Provider. Applies to both initial and ongoing adviser SERVICE PROVIDER CHARGES Where the client has not specified an initial FSP charge for lump sum or recurring investments, and / or an ongoing service charge, a feeof zero percent will apply.