Transcription of Sponsored by PORK PACKERS' EST'D GROSS MARGIN

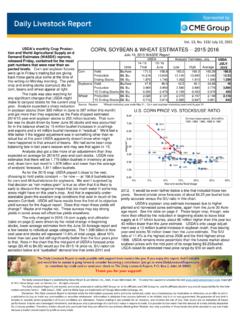

1 Sponsored by Vol. 13, No. 81 / April 24, 2015 Cheaper and many would argue downright cheap hogs PORK packers ' EST'D GROSS MARGIN . have been of li le solace to pork packers this spring. While the cost of the $/Head primary produc on input for a packing plant has been less than half the 2014. amount of one year ago in recent days, packer margins are s ll struggling. 2013. As with virtually anything in the pork sector, any comparison to one year ago 2015. pales but packers ' GROSS margins have been well below the 5 year average Avg. '10-'14. for the past two months and, given the con nued struggles of the MARGIN components, are showing li le sign of improvement. The one solace is that rela vely large hog numbers have kept unit costs low the complete oppo site of one year ago when very low throughput drove unit costs higher. Those $50 per head GROSS margins were certainly profitable but not nearly as profitable as one might think a er plant and labor costs were spread over so few animals.

2 A primary culprit this year, though, has been the huge reduc on in the value of by products. These items are, generally, those parts and piec . es of the pig that are not sold (or not sold in very large quan es) in tradi onal American meat counters. They include most organ meats such as J F M A M J J A S O N D. livers, hearts, kidneys, stomachs, chi erlings, etc., head products, lard (both edible and inedible), meat and bone meal and blood products. Meat and PORK PACKER MARGIN COMPONENTS. bone meal is used in animal and pet diets but has fallen into some disfavor $/Head as both livestock producers and pet owners have moved toward more vegetarian diets. We s ll aren't convinced of the concept of vegetarian By-Product Value, $/hd. dogs and cats but we suppose they eat what their owners put in front of Meat MARGIN , $/Hd them, right? Porcine blood plasma has for many years been a key compo.

3 Nent in weaned pig diets but it fell into some disfavor last year due to suspi . cions that it was a vector for spreading PEDv. Many of these by products especially the organ meats and head products such as snouts and masks are very dependent on export markets with China and Mexico being by far the largest. Thus, it is no sur . prise that the drop in the by product value from nearly $30 per head last summer to just $ per head last week corresponds to the sharp rise in the value of the dollar. Add that factor to larger supplies and di cul es in ge ng product o our West Coast ports and you have a decidedly unsavory recipe for total value. The reduc on would account for about $6/cwt. carcass of the decline in hog value. 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15. As can be seen at right, the meat MARGIN held up reasonably well into February but actually went nega ve early March and has improved only hams, picnics and trimmings.

4 Those prices are 30 to 50% lower than their slightly since then. The larger freezer inventories we discussed yesterday respec ve 5 year averages, crea ng a huge drag on hog carcass values. will keep those margins under some pressure in the short term. Further, the Charts of these other cuts see page 2 have shown some signs of seasonal decline in hog numbers is hardly ever conducive to packer margins. bo oming in recent weeks but the bo oming is at very low values. The The degree to which that happens this year is in some ques on but even price of 42% CL (chem lean) pork trimmings (not shown on page 2) dipped though numbers will be much larger than last year, they will s ll decline below $ per pound two weeks ago and has been, amazingly, below me . seasonally, likely keeping meat margins very ght. chanically deboned chicken. The cure for low prices is low prices and these A good solu on to all of these woes would be a rally in wholesale depressed values are finally, it seems, a rac ng some a en on.

5 A DLR pork cut values. Most pork cut prices are sharply lower than last year but reader posed the per nent observa on last week: The market is saying values of retail pork cuts (ie. loins, bu s and ribs that are sold fresh in consumers should eat more pork but I'm not sure consumers are ge ng retail stores) are holding near their 5 year averages with ribs almost as high that message in the form or lower retail prices yet. We'll see if the mes . as one year ago. The challenge lies in processing cuts such as bellies, sage gets sent and how long it takes to send! The Daily Livestock Report is made possible with support from readers like you. If you enjoy this report, find if valuable and would like to sustain it going forward, consider becoming a contributor. Just go to to contribute by credit card or send your check to The Daily Livestock Report, Box 2, Adel, IA 50003. Thank you for your support!

6 The Daily Livestock Report is published by Steve Meyer & Len Steiner, Inc., Adel, IA and Merrimack, NH. To subscribe, support or unsubscribe visit Copyright 2014 Steve Meyer and Len Steiner, Inc. All rights reserved. The Daily Livestock Report is not owned, controlled, endorsed or sold by CME Group Inc. or its a liates and CME Group Inc. and its a liates disclaim any and all responsibility for the infor . ma on contained herein. CME Group , CME and the Globe logo are trademarks of Chicago Mercan le Exchange, Inc. Disclaimer: The Daily Livestock Report is intended solely for informa on purposes and is not to be construed, under any circumstances, by implica on or otherwise, as an o er to sell or a solicita on to buy or trade any commodi es or securi es whatsoever. Informa on is obtained from sources believed to be reliable, but is in no way guaranteed. No guarantee of any kind is implied or possible where projec ons of future condi ons are a empted.

7 Futures trading is not suitable for all investors, and involves the risk of loss. Past results are no indica on of future performance. Futures are a leveraged investment, and because only a percentage of a contract's value is require to trade, it is possible to lose more than the amount of money ini ally deposited for a futures posi on. Therefore, traders should only use funds that they can a ord to lose without a ec ng their lifestyle. And only a por on of those funds should be devoted to any one trade because a trader cannot expect to profit on every trade. Sponsored by Vol. 13, No. 81 / April 24, 2015 1/4" TRIMMED LOIN VAC BUTT, 1/4" TRIM, COMBO. $/cwt Avg. '09-13 2014 2015 $/cwt Avg. '09-13 2014 2015. 200 200. 180 180. 160. 160. 140. 140. y 120. 120. 100. 100 80. 80 60. J F M A M J J A S O N D J F M A M J J A S O N D. SPARERIB, TRIMMED, MED HAM, BONE-IN, 23-27#. $/cwt Avg. '09-13 2014 2015 $/cwt Avg.

8 '09-13 2014 2015. 220 150. 200 130. 180 110. 160 90. 140 70. 120 50. 100 30. J F M A M J J A S O N D J F M A M J J A S O N D. BELLY, SKIN-ON, 14-16# PORK TRIM 72% LEAN. $/cwt Avg. '09-13 2014 2015 $/cwt Avg. '09-13 2014 2015. 220 170. 200 150. 180. 130. 160. 110. 140. 90. 120. 100 70. 80 50. 60 30. J F M A M J J A S O N D J F M A M J J A S O N D. PICNIC, SMOKER-TRIM, PAPER/POLY. $/cwt Avg. '09-13 2014 2015. 150. 130. 110. 90. 70. 50. J F M A M J J A S O N D.