Search results with tag "Fax to"

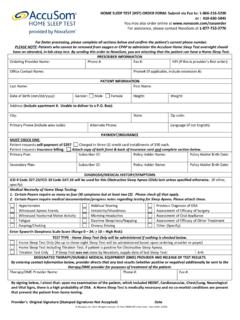

HOME SLEEP TEST (HST) ORDER FORM: Submit via Fax to: 1 …

www.novasom.comBy signing below, I attest that: upon my examination of the patient, which included HEENT, Cardiovascular, Chest/Lung, Neurological and Vital Signs, there is a high probability of OSA.

FAX TO: CUSTOMER APPLICATION

sites.mckesson.comCustomer agrees to pay for all purchases, fees and other charges incurred by Customer or an authorized user on any account of Customer, including service charges on past due amounts at the highest rate permitted by law (including purchases shipped and/or billed to a third-party agent on behalf of Customer).

Tax incentives in India - EY - United States

www.ey.comOverview of tax incentives In order to attract new investments, develop infrastructure and promote export/ industries, India offers various incentives such as tax holidays, investment allowances, tax credits, rebates and so on Prior to expansion/ new investments, companies should evaluate and avail of available incentives to obtain tax synergies.

Web 10-20 North Carolina www.ncdor.gov/enc5q

files.nc.govWithholding Allowance Certificate, Form NC-4, Form NC-4 EZ, or Form NC-4 NRA. To determine the amount of tax to be withheld, select the table in this book which corresponds with the employee’s filing status and your payroll period; i.e., weekly, biweekly, etc.; locate the gross wages in the left-hand column and

Disclaimer - West Bengal

www.wbcomtax.nic.in5 34A. Interest for failure to make payment of tax as referred to in clause (a) of section 118. 35. Exemption from payment of interest. 36.

THE BIHAR GOODS AND SERVICES TAX ACT, 2017 …

www.biharcommercialtax.gov.in[सध ण 8 2017 139 [Bihar Act 12, 2017] THE BIHAR GOODS AND SERVICES TAX ACT, 2017 AN ACT to make a provision for levy and collection of tax …

TAX CERTAINTY - OECD.org

www.oecd.orgThis report explores the nature of tax uncertainty, its main sources and effects on business decisions and outlines a set of concrete and practical approaches to help policymakers and

Position: Tax Manager Key Responsibilities: returns Review ...

www.swiber.comPosition: Tax Manager Key Responsibilities: • Responsible to legally minimise tax liabilities through informed application of tax laws and regulations

GENERAL AUDIT MANUAL - Multistate Tax …

www.mtc.govAUDIT & COMPLIANCE DIVISION Revised February 2009 GENERAL AUDIT MANUAL ADMINISTRATIVE MANUAL EXCERPTS Page 6 OVERVIEW OF TAX AUDITS The General Audit Manual (GAM) provides an overview of the purpose of tax audits and

IRS Transcript Cheat Sheet - American Society of Tax ...

www.astps.orgReturn Transcript (Available for the current tax year and prior 3 years) o Record of most line items from tax return (Not all). o Created when original return is filed and accepted. o Not created when an SFR is filed or an original return is filed after an SFR. o Does not change if return is amended.

TAX AWARENESS AND PERCEPTION OF TAX …

www.ijsrp.orgTax is defined as a compulsory contribution by tax payers irrespective of any corresponding return of services or goods by the government (James & Nobes, 2000).

Allowances, Deductions Tax Rate Table

www.ird.gov.hkYear of Assessment % of Tax Reduction Maximum Per Case ($) Applicable Tax Types

Form 4506 Request for Copy of Tax Return

www.irs.govForm 4506 (July 2017) Department of the Treasury Internal Revenue Service . Request for Copy of Tax Return Do not sign this form unless all …

West Virginia State Tax Department

www.state.wv.usWest Virginia State Tax Department Summary Of Tax Responsibilities of West Virginia Residents This publication is a general summary of taxes imposed by the State of West Virginia on resident individuals.

FORM NO. 49B See sections 203A and ... - Income Tax …

www.incometaxindia.gov.inFORM NO. 49B [See sections 203A and rule 114A] Form of application for allotment of tax deduction and collection account number under section 203A of the Income-tax Act, 1961

TAX DEDUCTION AT SOURCE (TDS) - The International …

www.icnl.orgTax Deduction at source (TDS) Annex-1 Form Income tax-T-D-01-01-0361 MONTHLY STATEMENT OF TAX WITHHELD As per Section 90 of Income Tax Act 2002, the following are the details of the tax withheld and the payment made at the Inland Revenue Office.

Avoidance of Double Taxation Agreements (DTAs)

www.iras.gov.sgAvoidance of Double Taxation Agreements (DTAs) 3 3.7 DTAs (and other forms of tax treaties for the exchange of information) are also vital in facilitating co-operation between tax authorities in the form of exchange

Similar queries

Form, Fax to: 1, FAX TO: CUSTOMER APPLICATION, Customer, Account, Tax incentives in India - EY, Of tax, North Carolina, Certificate, Disclaimer, Report, Position: Tax Manager Key Responsibilities, General Audit Manual, OVERVIEW OF TAX, Overview, Transcript, Return Transcript, Tax return, Return, Tax Rate, Form 4506 Request, Form 4506, Internal Revenue Service, Request, West Virginia State Tax Department, West Virginia, State, Income Tax, Collection, Income-tax, Tax Deduction at source TDS