Search results with tag "Fatu"

ACADEMIC QUALIFICATIONS PENEHURO FATU LEFALE

ilea.co.nzCV_201705_Penehuro Fatu Lefale 3 wAligning with your values, Cultures at Work, New Zealand/MetService, 2012. wLeadership in Management, The Training Practice, New Zealand/MetService, 2011. wSouth-South Cooperation on weather and climate.WMO/Regional

DICTÉES À LA CARTE - CCDMD

www.ccdmd.qc.cadessus en même temps. Il faut dire que la plupart d’entre eux oublient qu’à chaque session, c’est le même stress et la même agitation qui les guettent. L’arrivée du printemps, avec sa chaleur et son beau temps, ne les aide pas non plus. En effet, quoi de plus tentant que de s’étendre au pied d’un arbre pendant que les autres

Dissertation : Faut- - ac-normandie.fr

blogs.ac-normandie.frRambert cherche tout d’abord à quitter la ville. Le médecin Rieux, quant à lui, fait preuve d’une humanité et d’une solidarité sans faille en soignant les hommes. Ces personnages, lâches ou exemplaires, reflètent les différentes facettes de l’âme du lecteur. Conclusion :

Qui est l’intrus ? 10 A Pour chaque carte, il faut ...

www.ecoledecrevette.fr10 4 5 6 5 7 1 9 2 3 10 5 7 8 4 2 6 1 3 5 A1 A2 10 5 7 8 4 2 6 1 3 5 A Pour chaque carte, il faut retrouver une paire de nombre qui permet d’atteindre le

2022 Important Payroll Filing Dates and Information

www.americanpayroll.orgEmployers must file Form 940 to report annual Federal Unemployment Tax Act (FUTA) tax for 2021. If your unde-posited tax is $500 or less, you can either pay it with deposit it. (Employers that deposited all of the tax when due have until February 10 to file Form 940.)

EMPLOYER - Government of New Jersey

nj.gov•Are payments reported on federal forms 1099 exempt for unemployment? • Does a 401(k) pension or section 125 cafeteria plan affect taxable wages? •Federal certification for FUTA taxes (940) •Worker/Employer Refunds •Preparation and filing of quarterly tax reports (UI/DI portion of NJ-927) •Calendar Year Assessments

Corrigé dissertation : faut-il respecter les lois

www.lyceedadultes.fr1 L’OBÉISSANCE À LA LOI EST UNE NÉCESSITÉ PRATIQUE droit de résistance aux lois en vigueur.Reste à savoir au nom de quoi, on pour-rait se permettre de ne pas respecter les lois et en conséquence, de mettre en dan-

2022 Federal and State Payroll Taxes

www.edd.ca.gov2022 Federal and State Payroll Taxes Federal Taxes Federal Unemployment (FUTA) Social Security Tax (FICA) Medicare Tax (FICA) Federal Income Tax (FIT) Employer Pays 0.6% 1 6.2% 1.45% Employee Pays 6.2% 1.45% 2 Use Tables 3 Wage Limit $7,000 $147,000 None None Form 940 941 941 941 State Taxes Unemployment Insurance Employment Training …

Form for 2021: Employer’s Annual Federal Unemployment ...

www.irs.govEmployer’s Annual Federal Unemployment (FUTA) Tax Return Department of the Treasury — Internal Revenue Service. 850113. OMB No. 1545-0028. Employer identification number (EIN) — Name (not your trade name) Trade name (if any) Address

ELECTRONIC FEDERAL TAX PAYMENT SYSTEM PAYMENT …

fiscal.treasury.govand proxy tax under section 6033(e) U.S. Income Tax Return for Estates and Trusts U.S. Information Return Trust Accumulation of Charitable Amounts Annual Withholding Tax Return for U.S. Source Income of Foreign Persons U.S. Return of Partnership Income Monthly Tax Return for Wagers Employer’s Annual Federal Unemployment (FUTA) Tax Return ...

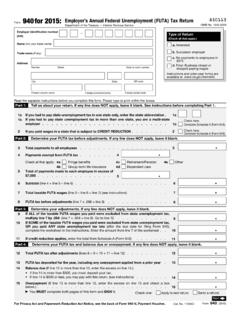

Form for 2015: Employer's Annual Federal Unemployment ...

www.irs.gov23, Federal Unemployment Tax Act, of Subtitle C, Employment Taxes, of the Internal Revenue Code imposes a tax on employers with respect to employees. This form is used to determine the amount of the tax that you owe. Section 6011 requires you to provide the requested information if you are liable for FUTA tax under section 3301.

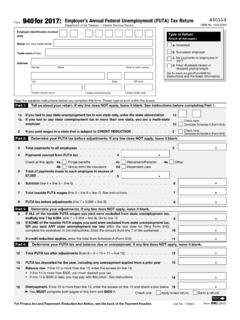

Form for 2017: Employer's Annual Federal Unemployment ...

www.irs.govEmployer's Annual Federal Unemployment (FUTA) Tax Return Department of the Treasury — Internal Revenue Service. 850113. OMB No. 1545-0028. Employer identification number (EIN) — Name (not your trade name) Trade name (if any) Address

Form for 2016: Employer's Annual Federal Unemployment ...

www.irs.govEmployer's Annual Federal Unemployment (FUTA) Tax Return Department of the Treasury — Internal Revenue Service. 850113. OMB No. 1545-0028. Employer identification number (EIN) — Name (not your trade name) Trade name (if any) Address

A. UNIFORM FRAUDULENT TRANSFER ACT (UFTA

www.miamilegalresources.com1 The Role of Fraudulent Conveyances in Collection Matters A. UNIFORM FRAUDULENT TRANSFER ACT (UFTA) Congratulations, you have just won a final judgment for your client. You were sure to have it conclude with the magic words,” for which let execution

Uniform Fraudulent Transfer Act (UFTA) - Fraud Conference

www.fraudconference.comOverview UFTA is a robust and effective legal mechanism. Most often used in creditors’ rights and commercial litigation. May be used to enable the seizure of personal property and real estate of various family members, assistants, and associates of the perpetrator. Not useful in all fraud situations. Most often useful against novice and “lifestyle”

Reporting Sick Pay Paid by Third Parties - IRS tax forms

www.irs.govFederal Unemployment Tax Act (FUTA) tax (collectively, “employment taxes”), or other taxes. This notice also sets forth the rules concerning responsibility for the withholding and payment of employment taxes and for reporting employment taxes and wages with

Similar queries

Penehuro Fatu Lefale, CARTE, Il faut, Chaque, Dissertation : Faut, Rambert, Chaque carte, il faut retrouver une, Annual Federal Unemployment Tax Act, FUTA, Employer, Government of New Jersey, Federal, Unemployment, Corrigé dissertation : faut-il respecter les, Federal Unemployment, S Annual Federal Unemployment, Employer’s Annual Federal Unemployment (FUTA) Tax Return, FEDERAL TAX, Annual, Employer’s Annual Federal Unemployment (FUTA) Tax, Employer's Annual Federal Unemployment, Federal Unemployment Tax Act, Employer's Annual Federal Unemployment (FUTA) Tax, A. UNIFORM FRAUDULENT TRANSFER ACT UFTA, Uniform Fraudulent Transfer Act UFTA, UFTA, Reporting Sick Pay Paid by Third Parties, IRS tax forms