Search results with tag "Federal tax"

Quick Reference Guide for Understanding FEDERAL TAX …

www.irs.gov1. Federal Tax Deposits (FTDs) are made through the Electronic Federal Tax Payment System (EFTPS). EFTPS is a free service provided by the Department of Treasury. It is a convenient and efficient method of paying all your federal taxes. You may make your tax deposit payments through the Internet at

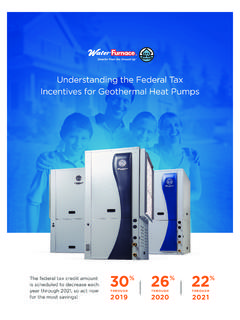

Understanding the Federal Tax Incentives for Geothermal ...

www.waterfurnace.comThe tax credit can be used to offset both regular income taxes and alternative minimum taxes (AMT). If the federal tax credit exceeds tax liability, the excess amount may be carried forward into future years. Spending on geothermal heat pump property adds to your home’s cost basis but also must be reduced by the amount of the tax credit received.

CONSERVATION EASEMENTS AND TAX BENEFITS

www.conservationlaw.orgE. Easements are not interests in real property that can be used in tax-free, like-kind exchanges. IV. Federal Tax Benefits and Qualification: Income Tax Deduction, Estate Tax Reduction, Estate Tax Exclusion A. Qualifying for Income Tax Deduction. (Internal Revenue Code §170(h) (26 USC §170) and Treasury Regulations §1.170A-14 (26 CFR 1.170A ...

ELECTRONIC FEDERAL TAX PAYMENT SYSTEM PAYMENT …

fiscal.treasury.govand proxy tax under section 6033(e) U.S. Income Tax Return for Estates and Trusts U.S. Information Return Trust Accumulation of Charitable Amounts Annual Withholding Tax Return for U.S. Source Income of Foreign Persons U.S. Return of Partnership Income Monthly Tax Return for Wagers Employer’s Annual Federal Unemployment (FUTA) Tax Return ...

2020 Instructions for Form 945 - IRS tax forms

www.irs.govFederal tax deposits must be made by electronic funds transfer (EFT). You must use EFT to make all federal tax deposits. Generally, an EFT is made using the Electronic Federal Tax Payment System (EFTPS). If you don't want to use EFTPS, you can arrange for your tax professional, financial institution, payroll service, or other

Who Must File Form 944? - IRS tax forms

www.irs.govFederal tax deposits must be made by electronic funds transfer (EFT). You must use EFT to make all federal tax deposits. Generally, an EFT is made using the Electronic Federal Tax Payment System (EFTPS). If you don't want to use EFTPS, you can arrange for your tax professional, financial institution, payroll service, or other

A Guide to Kentucky Inheritance and Estate Taxes

revenue.ky.govestate tax is equal to the amount by which the credits for state death taxes allowable under the federal tax law exceeds the inheritance tax, less the discount, if taken by the taxpayer. Since state death taxes are no longer treated as a credit for …

Protecting Federal Tax Information for Government …

www.irs.govSafeguarding federal tax information is critically important. As the employee of a federal, state or local agency who works with federal tax returns and return information, you are responsible for protecting that information. Internal Revenue …

Where Do Our Federal Tax Dollars Go?

www.cbpp.orgWhere Do Our Federal Tax Dollars Go? The federal government collects taxes to finance various public services. As policymakers and citizens weigh key decisions about revenues and expenditures, it is instructive to examine what the government does with the money it collects.

2017 FEDERAL INCOME TAX TABLES - Civica CMI

www.civicacmi.com1 . 2017. FEDERAL INCOME TAX TABLES . Revised 12/27/2016 . There are changes tothe Federal Tax Tables for 7 and the Social Security 201 employee amount withheld.

Circular 230 Best Practices - IRS tax forms

www.irs.gov• Giving any false or misleading information • Use of misleading information with the intent to deceive a client or prospective client • Willful failure to file a required Federal tax return or evading any assessment of tax • Willfully assisting others in the violation of any Federal tax law

Form 941 for 2020: Employer’s QUARTERLY Federal Tax Return

www.cabq.govEmployer’s QUARTERLY Federal Tax Return Department of the Treasury — Internal Revenue Service 950120. OMB No. 1545-0029. Employer identification number ... Don’t use Form 941-V to make federal tax deposits. ...

Oregon Withholding Tax Formulas

www.oregon.govWithholding Tax Formulas 2 150-206-436 (Rev. 12-28-21) Things you need to know Due to changes in federal tax laws, using federal Form W-4 for Oregon withholding calculations may not result in the correct amount of withholding for Oregon tax purposes. We have created Form OR-W-4, Oregon Employee’s

2018-2019 Dependent Verification Worksheet

www.sfa.kent.eduSECTION 2: TAX FILING STATUS AND REQUIRED DOCUMENTATION Select the student federal tax filing status: (All students must complete this section) Select ONE. I did not work in 2016. I did not and will not file a 2016 federal tax return.

Small Business For use in preparing - IRS tax forms

www.irs.govfederal tax laws that apply to you if you are a self-em-ployed person or a statutory employee. This publication has information on business income, expenses, and tax credits that may help you, as a small business owner, file your income tax return. This publication does not cover the topics listed in the following table.

IRS 2016 FEDERAL TAX TRANSCRIPT INFORMATION

www.radford.eduVerification of 2016 Federal Tax Information for Individuals with Unusual Circumstances Individuals Granted a Filing Extension by the IRS If an individual is required to file a 2016 IRS income tax return and has been granted a filing extension by the IRS,

Please review the updated information below. - IRS tax forms

www.irs.govElectronic Funds Tax Payment System (EFTPS) to make federal tax deposits. If you do not wish to use EFTPS, you can make arrangements through your tax professional, financial institution, payroll service, or other trusted third party to make deposits on your behalf. EFTPS is a free service provided by the Department of the Treasury. If you

2021 Form 763, Virginia Nonresident Income Tax Return

www.tax.virginia.gov2021 Virginia Nonresident Income Tax Return 763 Due May 1, 2022 *VA0763121888* Enclose a complete copy of your federal tax return and all other required Virginia enclosures. 1 Adjusted Gross Income from federal return ... No International Deposits Your Name Your SSN

Split-dollar tax and legal guide with specimen documents

www.theworkplace.bizSplit-dollar tax and legal guide with specimen documents F71834-32 Rev 1-2014 Tax Considerations This information is a general discussion of the relevant federal tax laws.

OVERVIEW OF FEDERAL TAX PROVISIONS RELATING TO …

www.jct.gov1 INTRODUCTION AND SUMMARY The Senate Committee on Finance has scheduled a public hearing for July 22, 2008, on selected Federal tax issues relating to …

INTERNAL REVENUE SERVICE Centralized Lien Processing ...

www.pria.usIRS Centralized Lien Processing Guidelines for Recording Offices 6 RELEASING A LIEN The IRS issues a Release of the Notice of Federal Tax Lien within 30 days after the taxpayer satisfies the tax due (including interest and

Form 941 for 2021: Employer’s QUARTERLY Federal Tax Return

www.eitc.irs.govfederal tax liability. If you’re a monthly schedule depositor, complete the deposit schedule below; if you’re a semiweekly schedule depositor, attach Schedule B (Form 941). Go to Part 3. You were a monthly schedule depositor for the entire quarter. Enter …

Form 944-X: Adjusted Employer’s ANNUAL Federal Tax …

www.irs.gov(If you’re currently filing a Form 941 or Form 941-SS, Employer’s QUARTERLY Federal Tax Return, see the instructions.) • If you checked line 2, this is the amount you want refunded or abated. If line 27 is more than zero, this is the amount you owe.

Forms & Instructions California 540 2015 Personal Income ...

www.ftb.ca.govEIC reduces your federal tax obligation, or allows a refund if no federal tax is due . You may qualify if you earned less than $47,747 ($53,267 if married filing jointly) and have qualifying children or you have no qualifying children and you earned less than $14,820 ($20,330 if married filing jointly) . Call the Internal Revenue Service (IRS) at

Form 941 for 2022: Employer’s QUARTERLY Federal Tax …

www.irs.govfederal tax liability. If you’re a monthly schedule depositor, complete the deposit schedule below; if you’re a semiweekly schedule depositor, attach Schedule B (Form 941). Go to Part 3. You were a monthly schedule depositor for the entire quarter. Enter …

Form W-9 (Rev. October 2018) - IRS tax forms

www.irs.govCheck appropriate box for federal tax classification of the person whose name is entered on line 1. Check only . one. of the following seven boxes. Individual/sole proprietor or single-member LLC. C Corporation. S Corporation Partnership. Trust/estateLimited liability company. Enter the tax classification (C=C corporation, S=S corporation,

Levelized Costs of New Generation Resources in the Annual ...

www.eia.govestimates significantly affect LCOE. Incentives, including state or federal tax credits (see text box . AEO2021 representation of tax incentives for renewable generation), also affect the calculation of LCOE. 5. The specific assumptions for each of these factors are provided in the . …

Georgia Rural Hospital Organization Expense Credit ...

www.georgiaheart.orgGeorgia Rural Hospital Organization Expense Credit Contribution Illustrations (Reflecting federal tax laws for 2018 under the 2017 Tax Cuts and Jobs Acts, and Georgia House Bill 769 signed into law on May 2, 2018)

Important Tax Information for Ministers - KNCSB

www.kncsb.org11 Form 941 — Employer's Quarterly Federal Tax Return: This form is used by employers (the church) for reporting to the IRS all wages paid to employees, income

www.sunbiz.org - Frequently Asked Questions

www.lb7.uscourts.govlimited partnerships, limited liability limited partnerships, limited liability companies, federal tax lien registrations, judgment liens, fictitious names, general partnerships, limited liability partnerships, trademarks and service marks from our web site.

Tax Information Security Guidelines For Federal ... - irs.gov

www.irs.govPublication 1075 Tax Information Security Guidelines For Federal, State and Local Agencies Safeguards for Protecting Federal Tax Returns and Return Information

Federal Tax Type Code Table - Huntington Bank

www.huntington.comTAX TYPE PC PHONE PAY-MENT TYPE DESCRIPTION VALID FILING PERIOD MONTHS 11-C 01117 112 N/A Special Tax Return and Application for Registry-Wagering Payment due on a return or an IRS notice only 01-12 706GS(D) 70627 706473 N/A Generation-Skipping Transfer Tax for Distribution Payment due on a return or IRS notice only 12 only 706GS(T)

Federal Tax ID and Group Size Information Sheet …

ghpreporting.com1 Federal Tax ID and Group Size Information Sheet Total Number of Employees Please review the Questions & Answers attached and …

Similar queries

Federal Tax, Federal tax deposits, Federal, Federal Tax Incentives, CONSERVATION EASEMENTS AND TAX BENEFITS, Annual, Employer’s Annual Federal Unemployment (FUTA) Tax, Instructions, IRS tax forms, Electronic, Electronic Federal Tax Payment System EFTPS, EFTPS, Kentucky, Protecting Federal Tax Information for Government, Federal tax information, Information, Protecting, Federal government, Government, 2017 FEDERAL INCOME TAX TABLES, 2017. FEDERAL INCOME TAX TABLES, Withholding Tax, Withholding, 2018-2019 Dependent Verification Worksheet, 2016, 2016 federal tax, Small business, Business, IRS 2016 FEDERAL TAX TRANSCRIPT, Tax Payment System, Deposits, Legal guide with specimen documents, OVERVIEW OF FEDERAL TAX PROVISIONS, INTERNAL REVENUE SERVICE Centralized Lien, Employer, S QUARTERLY Federal Tax, Forms & Instructions California 540 2015 Personal Income, Form 941, Employer’s QUARTERLY Federal Tax, Form, Incentives, Tax incentives, Important Tax Information for Ministers, Reporting, Liability, Huntington Bank, Registry, Group Size Information Sheet, Group Size Information Sheet Total Number