Search results with tag "Tax withheld"

CLGS-32-1 (10-21) TAXPAYER ANNUAL LOCAL EARNED …

keystonecollects.comIncome $ divided by 12 months X (months at this address) = $ Withholding $ divided by 12 months X (months at this address) = $ Current Residence Total Income $ Total Local Tax Withheld $ Put the Total Income on Line 1 and the Tax Withheld on Line 10 of the Local Earned Income Tax Return for your current residence taxing jurisdiction.

Individual Income Tax - Michigan

www.michigan.govImportant: Ifyour income subject to tax (MI-1040, line 14) isless than your personal exemption allowance (line 15) and Michiganincome tax was withheld from your earnings, you mustfile a return to claim a refund of the tax withheld. Who Must File a Joint Return . Ifyou are considered married for federal tax purposes, you must

Individual Taxpayers Earned Income Tax FAQ

www.captax.com(taxable earned income, to include earnings in Philadelphia, at the applicable earned income tax rate) or the Philadelphia wage or net profits tax withheld and paid.

AMENDED FORM Nebraska Reconciliation of Income Tax ...

revenue.nebraska.govto income tax withholding, or if the license was cancelled during the year. When and Where to File. E-file or attach the Nebraska copies of the following federal withholding forms for each employee or payee who had Nebraska income tax withheld: 1. Wage and Tax Statement, Federal Form W-2; 2. Statement for Recipients of Certain Gambling Winnings,

2020 IA 1040 Iowa Individual Income Tax Return

tax.iowa.govFederal tax withheld in 2020, federal estimated tax payments made in 2020, and federal taxes paid in 2020 for 2019 and prior years..... 31. .00 .00 32. Qualified business income deduction. 25.0% (.25) of federal amount. See instructions ..... 32. .00 .00 33.

Heath Quarterly WH Booklet 09 3-up - Heath, Ohio

www.heathohio.govCITY OF HEATH, OHIO, EMPLOYER'S RETURN OF TAX WITHHELD a AMENDED RETURN WITH PAYMENT 2. 3. 6. Taxable Earnings paid all Employees subject to City of HEATH, Ohio, 1.500/0 (.0150) Income Tax

Full-Year Resident Income Tax Return

www.tax.ny.govIT-2 report wages and NYS, NYC, or Yonkers tax withheld (do not submit Form W-2). IT-195 allocate all or a portion of your personal income tax refund to a NYS 529 account. IT-196 claim the New York itemized deduction IT-201-V make a payment by …

2018 Form W-4

www.irs.govLine G. Other credits. You might be able to reduce the tax withheld from your paycheck if you expect to claim other tax credits, such as the earned income tax

2017 Form W-4 - IRS tax forms

www.irs.govto avoid having too little tax withheld. • If. neither . of the above situations applies, stop here . and enter the number from line H on line 5 of Form W-4 below. Separate here and give Form W-4 to your employer. Keep the top part for your records. Form . W-4. Department of the Treasury Internal Revenue Service

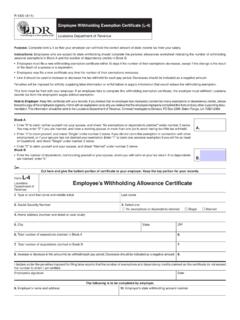

Employee’s Withholding Allowance Certificate

www.revenue.louisiana.gov• Line 8 should be used to increase or decrease the tax withheld for each pay period. Decreases should be indicated as a negative amount. Penalties will be imposed for willfully supplying false information or willful failure to supply information that would reduce the withholding exemption. This form must be filed with your employer.

TAX INFORMATION RELEASE NO. 2010-01 - Hawaii

files.hawaii.govfor a refund for Hawaii income tax withheld), the employer’s duties as it pertains to Hawaii income tax withholding, and other information pertinent to the application of the SCRA to ... source income earned in Hawaii by the servicemember is subject to Hawaii income tax.) IV. MILITARY ASSIGNMENTS Temporary Duty (“TDY”).

Similar queries

TAXPAYER ANNUAL LOCAL EARNED, Income, Tax withheld, Local Earned Income Tax Return, Income tax, Michigan, Withheld, Return, Individual Taxpayers Earned Income Tax, IA 1040 Iowa Individual Income Tax Return, Taxes, Instructions, Ohio, EMPLOYER, PAYMENT, Income Tax Return, Form W-4, 2017 Form W-4, IRS tax forms, Hawaii, Source