Return preparer fraud or

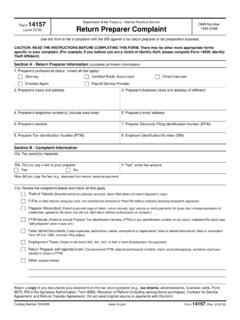

Found 10 free book(s)14157 (June 2018) Return Preparer Complaint

www.irs.govIf a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account, complete Form 14157-A, Tax Return Preparer Fraud or Misconduct Affidavit, in addition to Form 14157. Submit both forms along with

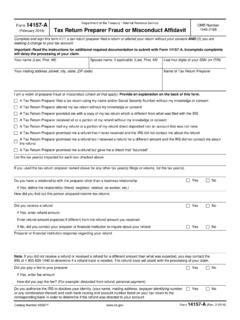

Form 14157-A Tax Return Preparer Fraud or Misconduct …

www.irs.govTax Return Preparer Fraud or Misconduct Affidavit - Complete form in its entirety and sign under penalties of perjury. If your filing status is Married Filing Joint, at least one signature is required. Form 14157, Complaint: Tax Return Preparer - Complete form in its entirety. Information provided on this form will be shared with

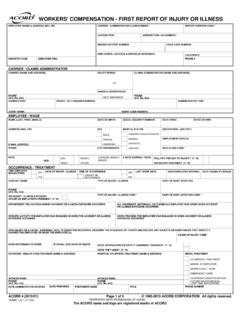

WORKERS' COMPENSATION - FIRST REPORT OF INJURY OR …

www.dii-ins.comDATE PREPARED PREPARER'S NAME TITLE PHONE NUMBER ... DATE RETURN(ED) TO WORK HOSPITAL OR OFFSITE TREATMENT (NAME & ADDRESS) LOST TIME ANTICIPATED ... incomplete or misleading information is subject to prosecution and punishment for insurance fraud, as provided in RSA 638:20. Page 3 of 5. ACORD 4 (2013/01) Page 4 of 5 ...

FP-31 District of Columbia Personal Property Tax Instructions

mytax.dc.gov•A civil fraud penalty of 75% of the underpayment which is attributable to fraud (see DC Code §47-4212). Special Circumstances . Amended Returns . You can correct a previously filed return by filing an amended return. Select the “Amend” option and enter corrected figures. Final Return . If you are not required to continue filing a return ...

Preparer IRS Answer Question

www.eitc.irs.govreturn with a preparer and therefore would have no reason to leave information with that preparer. If the preparer wants to report the taxpayer who he thinks will erroneously claim EITC with another preparer, use the process described in the Fraud section of the Frequently Asked Questions. Consider what due diligence

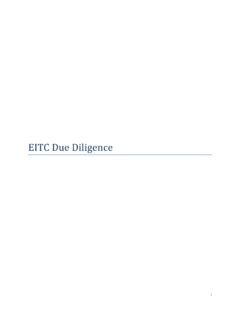

EITC Due Diligence

taxces.com• Identify the tax return preparer’s earned income credit due diligence requirements; and • List the sanctions that may be applied on a tax return preparer and his or her employer for a failure to meet due diligence requirements. 1 SOI Tax Stats-Individual Income Tax …

Tax News December 2021

www.ftb.ca.govcases of tax evasion, tax fraud, refund fraud, and preparer fraud. As part of their investigations, special agents may also uncover other financial crimes such as money laundering, embezzlement, and theft. Through the investigation process, special agents write and execute

Course Introduction - IRS tax forms

apps.irs.govEach return should be identified with the appropriate site identification number (SIDN) to ensure it is readily . identifiable by the IRS. Your site’s SIDN is an 8-digit number preceded by the letter “S” that must appear in the Paid Preparer Use Only section on all returns you prepare, both paper and electronic. Your Site

Individual Income Tax - Idaho

tax.idaho.gov3 If the final federal determination results in an Idaho refund, you must file an amended Idaho income tax return with the written notice. See Amended Returns.

Life’s a little easier with - irs.gov

www.irs.govThe EITC is for working people who earn less than $54,884. This year, the amount of the credit can vary from $2 up to $6,431. The amount of the credit depends on: