Example: barber

Tax Return Preparer Ethical Issues

Found 2 free book(s)Third-Party Verification Letters: Questions and Answers

www.aicpa.orgadditional challenges. See questions .02 and .07 .10, which address many of the tax issues involved. ... Section 301.7216-3 actually makes it a crime for a tax preparer to disclose client tax return information to a third party without ... an ethical violation. Providing assurance on solvency is not a decision about risk—it’s an ethics ...

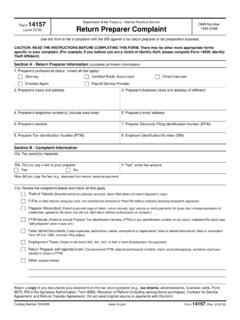

14157 (June 2018) Return Preparer Complaint

www.irs.govUse Form 14157 to file a complaint against a tax return preparer or tax preparation business. Tax professionals can use this form to report events that impact their PTIN or business. Individuals who are paid to prepare federal tax returns must follow ethical standards and guidelines as established in Treasury Department Circular 230.